Is the Marriott Bonvoy Boundless worth it? You bet!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The key to making the most of the best travel credit cards is always weighing the benefits of the card versus the annual fee. Most rewards credit cards are worth the annual fee for at least the first year, because they generally come with a hefty sign-up bonus.

For a limited time, the Marriott Bonvoy Boundless™ Credit Card is offering 5 free nights after spending $5,000 in the first three months of account opening. And although it does have a $95 annual fee, the welcome bonus and Marriott Bonvoy Boundless benefits and perks can save you a ton of money and give you peace of mind when you travel.

Is the Chase Marriott Bonvoy Boundless card annual fee worth it?

The Marriott Bonvoy Boundless comes with 5 free nights after spending $5,000 in the first three months of account opening. That’s the equivalent of up to 250,000 Bonvoy Boundless points and can be redeemed for up to 50,000 per night (which includes up to Category 5 properties, as well as Standard redemption for Category 6, and off-peak redemption for Category 7.

It’s a really incredible bonus. But what about after you’ve used your free nights?

Marriott elite status perks

First, you will earn automatic Silver Marriott Bonvoy Elite Status just for having the card. This includes the following perks:

- 10% bonus base points at Marriott hotels

- Free premium Wi-Fi

- Late checkout (based on availability)

- Elite reservations telephone line

The Marriott Bonvoy Boundless also comes with 15 Elite Night Credits each calendar year so you can achieve higher elite status faster. And if you spend $35,000 or more on the card in a cardmember year you’ll earn Marriott Gold status.

Anniversary free-night award

Every year on your cardmember anniversary, you’ll earn a free-night award. This is a certificate that allows you to stay at participating hotels costing 35,000 points or less each year you renew your card.

This is the key benefit. If you stay at a Marriott hotel once per year, the card is likely worth the annual fee. That’s because Marriott hotels costing 35,000 points can be way more expensive than $95.

Other perks from the Chase Marriott Bonvoy Boundless card

- No foreign transaction fees (that’s likely to save you 3% abroad over a card that charges foreign transaction fees)

- Baggage delay insurance – This will reimburse you for essential purchases like toiletries and clothing if your bag is delayed for more than six hours. You’ll receive up to $100 per day for five days

- Lost luggage reimbursement – You and immediate family members receive up to $3,000 if the airline loses or damages your bag

With the Marriott Bonvoy Boundless Credit Card you’ll earn:

- 6x Marriott points at participating Marriott hotels

- 2x Marriott points on all other purchases

However, if you want to use this card for daily spending, I wouldn’t recommend it. There are much better hotel credit cards that earn points for daily expenses.

Should you keep the Marriott Bonvoy Boundless card long term?

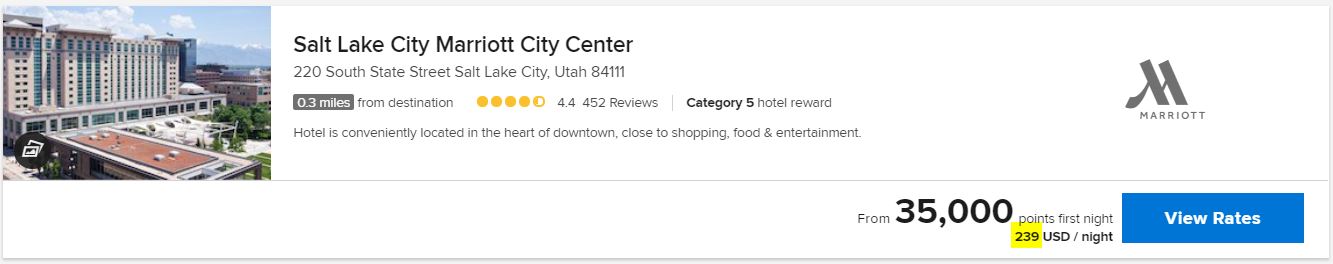

Absolutely, if you can make use of the perks. The card is worth the annual fee just for the anniversary free-night award. As another example, here is a one-night stay at the Salt Lake City Marriott City Center.

Instead of paying around $250 for a room, you could be paying only $95. Everything else you earn is simply gravy.

Bottom line

Many people look at annual fees for credit cards and make the decision on the spot if they are going to apply or not. In nearly every case, the annual fee can be recouped by maximizing the perks of the card. And that’s certainly the case given the Marriott Bonvoy Boundless’ increased intro offer.

Always do the math – that’s a golden rule in the miles and points hobby. It may seem absurd to shell out money just for owning a credit card, but the benefits often justify the fee. Just make sure you actually use them.

The Bonvoy Boundless’ annual free night perk alone is all it takes to convince me to pay the annual fee each year. Several of us on the team have this card and don’t plan to cancel any time soon.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!