Delta Gold Business Card review – Huge 70,000 mile offer for a limited time

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Delta SkyMiles® Gold Business American Express Card is a great way to stock up on Delta miles — up to 70,000 of them to be exact — after meeting minimum spending requirements — while keeping your costs low.

It won’t cost you anything to try out, because the $99 annual fee is waived the first year (See rates & fees).

If you frequently fly with Delta, it’s a good card to consider because it offers a first checked bag free, priority boarding and a 20% rebate for inflight purchases on Delta flights. Even if you don’t, it can be great choice because Delta’s SkyTeam partners can help you fly to many destinations all over the world, or you can redeem these miles during one of Delta’s award sales to get even more bang for your buck.

You can apply for the Delta SkyMiles Gold Business Credit Card here.

Here’s our Delta SkyMiles Gold Business Card review.

Who is this card for?

As long as you haven’t had this specific credit card in the past, you’re eligible if for this card. American Express only lets you earn the welcome bonus on each card once per lifetime.

Note that this is a small business card, so you’ll need a for-profit venture to be eligible. You don’t need to be running a big corporation or full-time business to qualify — even side hustles like reselling on eBay or running an Airbnb could qualify you. Here’s a guide to filling out an Amex business card application.

However, unofficially you can only get two Amex credit cards every 90 days, so if you recently applied for other Amex cards you might have to wait.

Current bonus

With the Delta SkyMiles® Gold Business American Express Card, you’ll earn up to 70,000 bonus miles (terms apply):

- 60,000 bonus miles after you spend $2,000 on purchases in the first three months of account opening

- 10,000 additional bonus miles after you first cardmember anniversary

That’s enough miles for a one-way coach flight to Europe or multiple short hops around the U.S., but we’ve also seen Delta selling flights as far away as Australia for only 44,000 miles round-trip with its flash award sales. If you’re able to save your miles for one of these deals, you’ll end up with a much better value for your Delta miles.

At minimum, this welcome bonus is worth $700 in Delta flights when you book using Pay With Miles. Amex Delta card holders have this option to book paid flights using their miles at a rate of 1 cent each with no blackout dates, so it’s worth considering if you aren’t flexible with your travel dates or can’t find award seats.

Benefits and perks

The Delta SkyMiles Gold Business Card has a $99 annual fee that’s waived for the first year. In exchange for that, you get a number of elite-like perks with Delta that will make your travel much more enjoyable. The good news is that most of these benefits are linked to your SkyMiles account, so you don’t need to use your card when purchasing airfare to get these perks.

First checked bag free

You and up to eight companions traveling on the same reservation will enjoy a first checked bag free, a savings of $30 per bag.

Priority boarding

You’ll receive Zone 1 priority boarding for you and up to eight companions traveling on the same reservation.

$100 Delta flight credit

When you spend $10,000 on purchases with your card in a calendar year, you’ll receive an up to $100 Delta Flight Credit.

20% inflight savings

Receive 20% back in the form of a statement credit when you use your Delta SkyMiles Gold Business Card for inflight purchases on Delta (not including Wi-Fi).

Car rental loss and damage insurance

When you use your Delta SkyMiles Gold Business Card to pay for a car rental, you’ll get secondary car rental insurance coverage up to $50,000 if your car is damaged or stolen. Here are important details and restrictions.

Travel Accident Insurance

If tragedy strikes on the road, you could be covered for losses resulting from accidental death or dismemberment. Your immediate family (spouse, dependent children under 23, etc.) are also covered on an eligible trip.

To be eligible for this insurance you’ll need to pay for your entire travel fare (cruise, ticket, etc.) with your Delta SkyMiles Gold Business Card. You can read the full terms of this card’s travel accident coverage here.

Amex Offers

Amex Offers are targeted deals offering statement credits or bonus points for everyday purchases. Some examples of deals might be $10 off a $50 purchase at a specific merchant, or receive 5,000 bonus points for purchasing something from a website.

Jasmin loves using Amex Offers to stock up on household products and snacks for her kids, especially whenever the offers for Boxed.com appear. Meghan has also been able to take advantage of some of these discounts, even turning some of them into a profit.

How to redeem miles

The Delta SkyMiles Gold Business Card earns miles at the following rates:

- 2 Delta miles per dollar on eligible Delta purchases

- 2 Delta miles per dollar on U.S. shipping and U.S. advertising

- 2 Delta miles per dollar at restaurants

- 1 Delta mile per dollar everywhere else

- Terms Apply

Still, you can often receive a higher return with a card like the Chase Sapphire Reserve or The Platinum Card® from American Express. Although the Delta SkyMiles Gold Business Card offers a great welcome bonus, it may not be a card you’ll want to keep in your wallet for day-to-day spending. However, if your main focus is to earn Delta SkyMiles and you don’t have other cards that earn a bonus in certain categories, it’s a great pick.

Delta was the leader in the nefarious trend of dynamic pricing, with United and American Airlines following suit. Delta doesn’t publish an award chart. Instead, the price for award flights varies day to day just like the price for cash tickets.

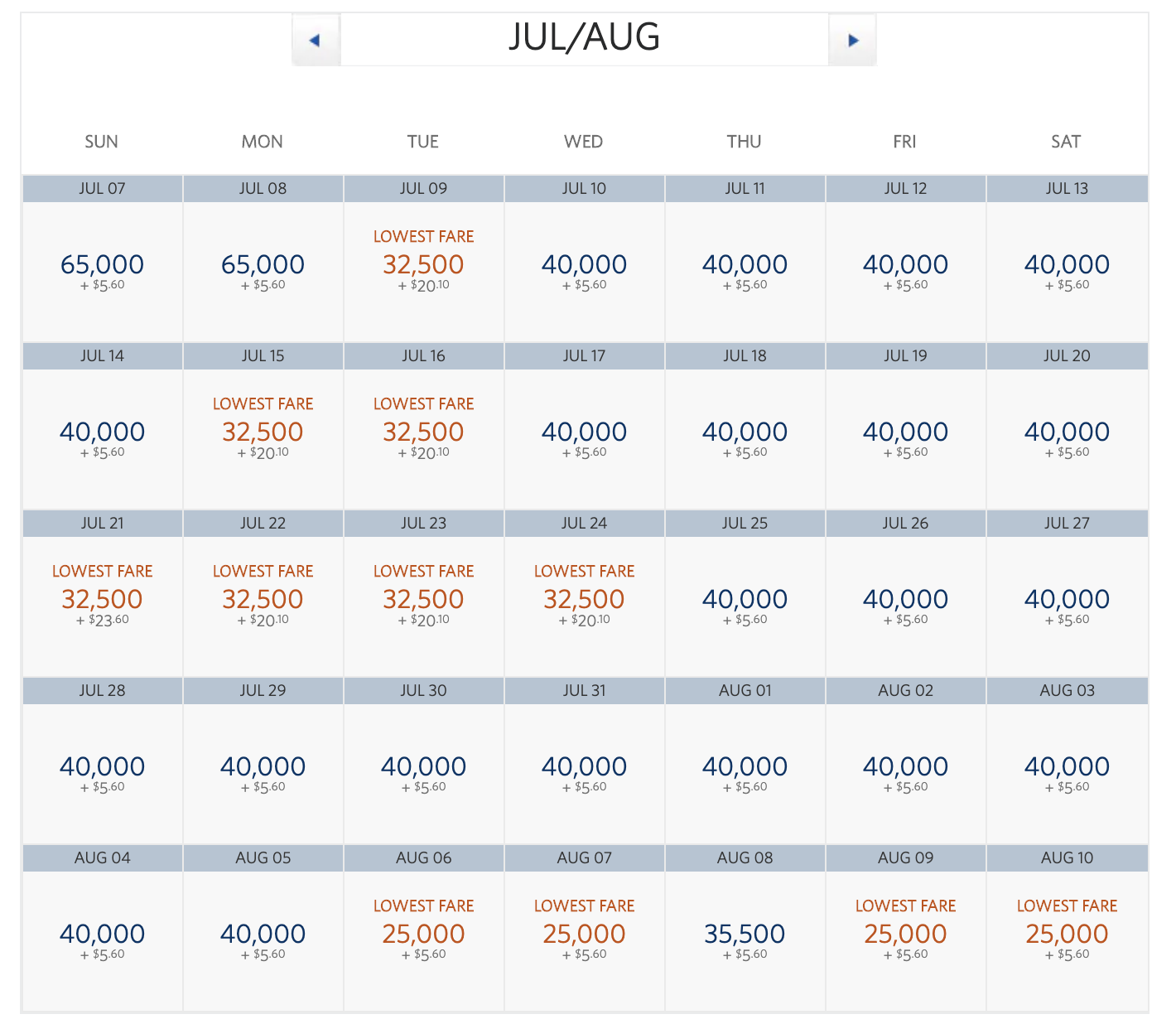

This makes it hard to talk about how to use Delta miles in detail, and instead, we have to focus on pricing trends. A good way to see this variability for yourself is to look at the five-week calendar view when searching Delta awards. Take this example of one-way economy flights from New York (JFK) to London (LHR). Some days, the flights are as low as 25,000 miles, whereas other days, they’re more than 2.5 times more expensive at 65,000 miles each way.

If you want to see this at its most extreme, look at some of Delta’s ultra-long-haul flights like Atlanta (ATL) to Johannesburg (JNB). Here, one-way business-class awards cost 465,000 miles, which is more than you would earn if you opened every single Delta credit card right now.

Your best bet for stretching the value of your SkyMiles is to watch for Delta SkyMiles deals. My personal favorite was a U.S. to Australia sale for only 44,000 miles round-trip in economy. Delta has really stepped up the pace of these sales, and we’re now seeing one or two domestic and international sales each month.

Keep in mind, Delta miles do not expire, so even if you don’t have plans for an immediate award trip, your miles are safe sitting in your account until you’re ready.

Is the annual fee worth it?

This card is a no-brainer for the first year, with a strong welcome bonus. However, in subsequent years it gets a little tougher. You won’t get a great return by spending on this card, so the value comes in the form of the perks.

If you frequently fly Delta, the free checked bag alone can be enough to justify the annual fee. Use it four times a year and you’ve already saved more than $99 annual fee. However, if you’re not a regular Delta flyer you might not want to pay that amount every year.

Insider secrets

Because Amex only allows you to earn the bonus on each card once per lifetime, you need to wait until there’s an exceptionally high offer on each card to open it. It’s your one shot at its bonus! This 70,000 mile offer is the perfect opportunity.

Plus, personal and small business cards are considered separate products, so even if you’ve had the personal Delta SkyMiles® Gold American Express Card in the past, you can still apply for the business version.

Bottom line

It’s hard to peg an exact value to this bonus because Delta miles value varies depending on how you redeem them — but flexible travelers who can wait for an award sale are sure to get a great deal here. At very least, the bonus is worth $300 in Delta flights when you book using Pay With Miles.

If you’re a small-business owner (even folks with a side gig or freelancers could qualify) looking to build up your mileage stash or a frequent Delta flyer, this is a great card for you to consider.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

For the rates and fees of the Gold Delta SkyMiles Business Credit Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!