Changes to This Flexible Points Program – What You Need to Know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Heads-up for folks who collect US Bank FlexPerks points!

Frequent Miler has confirmed starting December 31, 2017, US Bank FlexPoints will be worth 1.5 cents each when you redeem them for airfare, hotels, and car rentals.Currently, US Bank uses a tiered redemption chart for flights, hotels, and car rentals. Right now, you can get up to 2 cents per point in value when you redeem for flights, up to 1.5 cents per point for hotels, and up to 1.25 cents per point for car rentals.

So this change makes redeeming points more straightforward. But folks who made the most of their FlexPoints redeeming for flights might not be happy with this new policy!

I’ll explain what’s coming up for folks who collect US Bank FlexPoints!

US Bank FlexPerks Changes

Link: US Bank FlexPerks

Link: Can You Transfer US Bank FlexPoints to Other Loyalty Programs?

Link: Trick for Big Travel on Southwest Using US Bank FlexPerks Cards

US Bank says starting December 31, 2017, it’s simplifying its rewards program. From that date, you’ll be able to redeem US Bank FlexPoints at a flat rate of 1.5 cents per point for airfare, hotels, or car rentals.

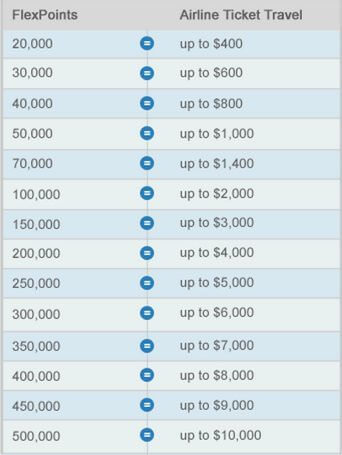

Currently, US Bank works on a tiered system. For example, when you redeem FlexPoints for airfare, you’ll pay according to the following chart:

Right now, you’ll get the most value for your FlexPoints when you book a flight priced as close to the top of a tier as possible. I shared how to get the most travel on Southwest using US Bank FlexPoints.

From December 31, 2017, it will be easier to make the most of your FlexPoints when you’re booking cheaper flights. For example, under the current system, you’ll pay 20,000 FlexPoints regardless of whether your flight costs $100 or $400.

If your flight only costs $100, you’re getting a value of 0.5 cents per point ($100 cash price / 20,000 FlexPoints). That’s not a good deal.

But a $400 flight gets you a value of 2 cents per point ($400 cash price / 20,000 FlexPoints). Which is better than what you’ll get after the end of the year.

Under the tiered system, you can currently get a maximum of 1.5 cents per point for hotel bookings, and 1.25 cents per point for car rentals. So with the new rules, folks will almost always do better when they redeem FlexPoints for hotels and car rentals.

Why Consider US Bank FlexPoints?

Link: US Bank FlexPerks® Gold American Express® Card

Link: US Bank FlexPerks® Travel Rewards Visa Signature® Card

Link: US Bank FlexPerks® Select+ American Express® Card

The US Bank FlexPerks cards are good for folks who want flexibility in booking travel.

FlexPoints are similar to miles you earn with cards like the Capital One® Venture® Rewards Credit Card and Barclaycard Arrival Plus World Elite Mastercard.You do NOT have to search for award seats or worry about blackout dates. But you’ll have to book your travel through the US Bank portal. It’s always best to compare prices to be sure you’re getting the best deal.

And keep in mind, you likely won’t earn hotel points or stay credits when you book hotels with US Bank FlexPoints. Because it’s considered a 3rd-party booking.

If you’re new to miles and points, the US Bank FlexPerks cards are NOT a good place to start. That’s because there are far more valuable cards with better sign-up bonuses. And I always recommend applying for the Chase cards you want first because of their tighter application rules.

We don’t earn a commission for the US Bank FlexPerks cards, but we’ll always share updates with our readers!

Earning Changes

US Bank is also changing the bonus for charitable donations with the FlexPerks cards. Currently, you’ll earn 3X FlexPoints per $1 on charitable donations. But after December 31, 2017, you’ll only earn 2X FlexPoints per $1.

Bottom Line

Starting December 31, 2017, US Bank FlexPoints will be worth a flat 1.5 cents each when you redeem them for travel (airfare, hotels, and car rentals).

This is a simpler way to redeem points. Because currently, redemptions work on a tiered system that can be confusing and not always a good deal.

That said, folks who were able to redeem US Bank FlexPoints for airfare at 2 cents per point by making the most of the current rules might be disappointed with this change.

What do you think of the US Bank FlexPerks updates?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!