These Southwest Chase Credit Cards Are Incredibly Popular With Readers (Offers End February 11, 2019)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

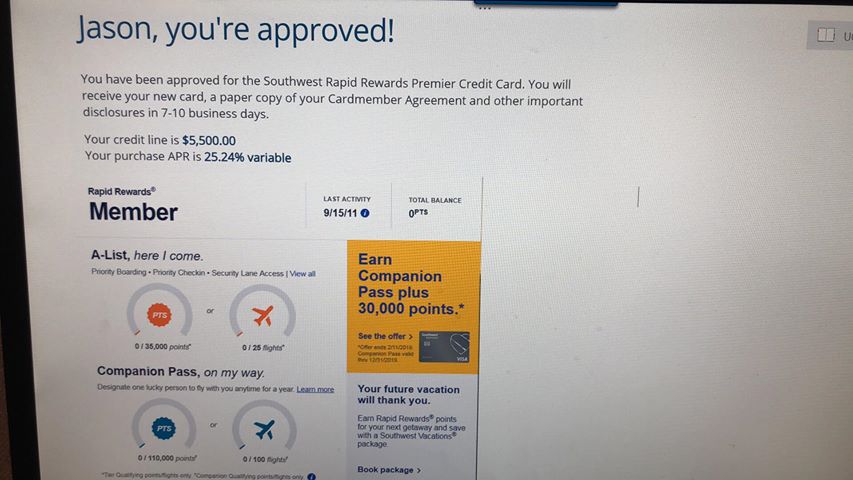

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.By now, you’ve probably heard about the incredible Chase credit card offers to earn the Southwest Companion Pass AND 30,000 Southwest points by opening ONE card and spending $4,000 on purchases in the first 3 months of account opening.

It’s a crazy good deal because you can bring a companion with you for just the cost of taxes and fees (only ~$6 each way domestically) on an unlimited number of flights for the rest of 2019. It works with both paid and award flights. And it’s only available through February 11, 2019. The sooner you earn it, the faster you can start using it!

You can get the deal with any of the 3 personal Southwest cards:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

Many MMS readers have jumped all over it! And you don’t need a perfect credit score – I found approval rates for folks with scores between 607 and 700+.

I’ll share approval tips!

Southwest Chase Credit Cards for Unlimited Flights With a Partner & $450 in Travel

Apply Here: Southwest Rapid Rewards® Plus Credit Card

Apply Here: Southwest Rapid Rewards® Premier Credit Card

Apply Here: Southwest Rapid Rewards® Priority Credit Card

When you sign-up for any of the Chase Southwest personal cards, you’ll earn the Companion Pass and 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening.

The Companion Pass lets you designate someone to fly with you for free on an unlimited number of flights, as long as you pay the taxes and fees. The pass you’ll earn with these card offers is valid through December 31, 2019.

And, you’ll get 30,000 Southwest points! Each point is worth ~1.5 cents toward Southwest flights. So that’s enough for $450 worth of travel (30,000 X 1.5). And you can bring your companion with you! Just pay their taxes and fees and you’re good to go.

The real value of this offer is up to you! The more you fly with a companion, the more you’ll save on the cost of their flights. If you have lots of travel coming up, you could save a lot of cash (or points!) with this deal.

Here’s more about each card to help you decide which is best for you.MMS Readers Are Loving These Southwest Cards

And we love how excited y’all are about these cards. Many of our friends and relatives are jumping on this deal, too.

Keith’s wife signed-up on the first day of the offer. And my one of my friends was instantly approved this week.

You guys have been telling us about your successes opening these cards, too!

MMS readers Adriene, Tammy, and Brenda have their cards – and Companion Passes – on the way. Congrats!

Give Yourself the Best Approval Odds

The Southwest cards are all subject to the Chase 5/24 rule. If you’ve opened 5+ credit cards from any bank (with the exception of certain business cards) in the past 24 months, you won’t be approved. Here’s a step-by-step guide to using myBankrate to count your recent cards.

Another important note – it’s no longer possible to have more than one personal Southwest card at the same time.

If either of these apply to you, I wouldn’t recommend trying.

So don’t worry if your score isn’t perfect. While higher is typically better, you may have a stronger chance than you realize.

The one caveat is if you have missed payments on your credit history. Chase doesn’t like to see missed payments – in that case, use your best judgment, especially if you think any negative information was reported in error.

And if you aren’t instantly approved, call Chase and see what’s going on. Sometimes they want to ask a couple of simple questions, and it only takes a few minutes for them to push approval through. Other times, you might need to move credit lines from other Chase cards to accommodate a new one.

If you run into any hitches, definitely pick up the phone and call Chase reconsideration at 888-270-2127.

Timing Is Everything to Earn the Sign-Up Bonus

Because you’ll earn the sign-up bonus when you complete the minimum spending, you’ll want to do it as quickly as you can.

Be sure to check our guide of 40+ ways to meet spending requirements. The fastest way to get the Companion Pass and bonus points is to spend $4,000+ on purchases and make sure they post before your statement closes. Keep in mind, it can take a couple of days for a purchase to go from pending to posted.

To see when your closing date is on the Chase website, click “Account Details” after you select the card you want to check. It’ll tell you in the first section, under “Account Information.”

You can always call the number on your card to ask, too.

If you miss the first statement closing, you’ll have to wait an extra month until the next one. Considering the Companion Pass is valid through the end of 2019, that’s a month you might not want to wait before you can start using it. It’s helpful if you can plan your purchases while you wait for your card to arrive. Then you can line ’em up and knock it out!

Bottom Line

We’re glad y’all are picking up Chase Southwest cards to earn a Companion Pass and ~$450 worth of flights. It’s a heck of a good deal if you have a lot of travel planned in 2019, and if you qualify.

You can earn the Companion Pass and 30,000 Southwest points when you apply for one the below cards before February 11, 2019 and spend $4,000 on purchases within the first 3 months of account opening:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

It’s NOT a card for those over 5/24, and you can only have one personal Southwest card at a time. But don’t count yourself out if your credit score isn’t perfect! Folks report approval with scores in the 600 to 700 range.

Finally, try to complete the minimum spending as soon as you can if you’re eager to get your Companion Pass. The sooner you get it done, the longer it be valid. And that means more free flights with your travel buddy! ✈️

Let us know if you’re planning to get in on this deal before it ends on February 11, 2019!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!