Why I Renewed My AARP Membership Even Though I’m Nowhere Near Retirement Age (Hint: It Saves a TON of Money and Stacks With Credit Card Rewards!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Like many folks in the miles and points hobby, the hunt for a good deal extends to aspects of my life unrelated to travel. And being a single parent on a budget means getting discounts and saving money is even more important for my family.

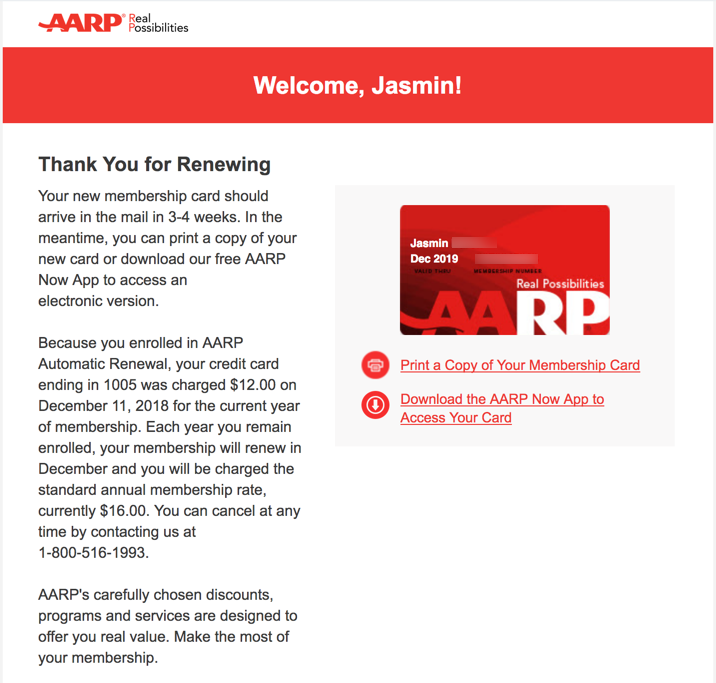

That’s why I joined AARP a few years ago, and just renewed my AARP membership again this week. Many folks don’t know you don’t need to be retirement age to join – anybody of any age can! For $16 per year ($12 for the first year if you enroll in auto-renewal), you’ll get access to dining, travel, and retail discounts that are worth far more than the cost of membership.

Better yet, you can stack these savings with rewards earned from the best travel credit cards, including the next card I have my eye on, the Capital One® Savor® Cash Rewards Credit Card (which earns unlimited 4% cash back on dining and entertainment).

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

I’ll share how much you could save by having an AARP membership, and why I keep renewing mine year after year.

Sign-Up for (or Renew) an AARP Membership for Big Savings

While yes, technically, AARP stands for the American Association of Retired Persons, you don’t need to be retired (or of a certain age) to join. I’m in my mid-40s (ok – I’m no spring chicken) but have had a membership for a few years now. Occasionally I’ll get an odd look when I produce my card at a restaurant to get a discount, but nobody’s ever given me a hard time.

Membership costs $16 per year (or $12 for the first year if you select auto-renew, which you can cancel later). And if you have a spouse or partner, they can piggyback on your membership for free.

This is why I keep my AARP membership: I get way more than $12 to $16 worth of value by using the card for discounts at restaurants and saving on my cell phone bill.

Here’s where you could save, too.

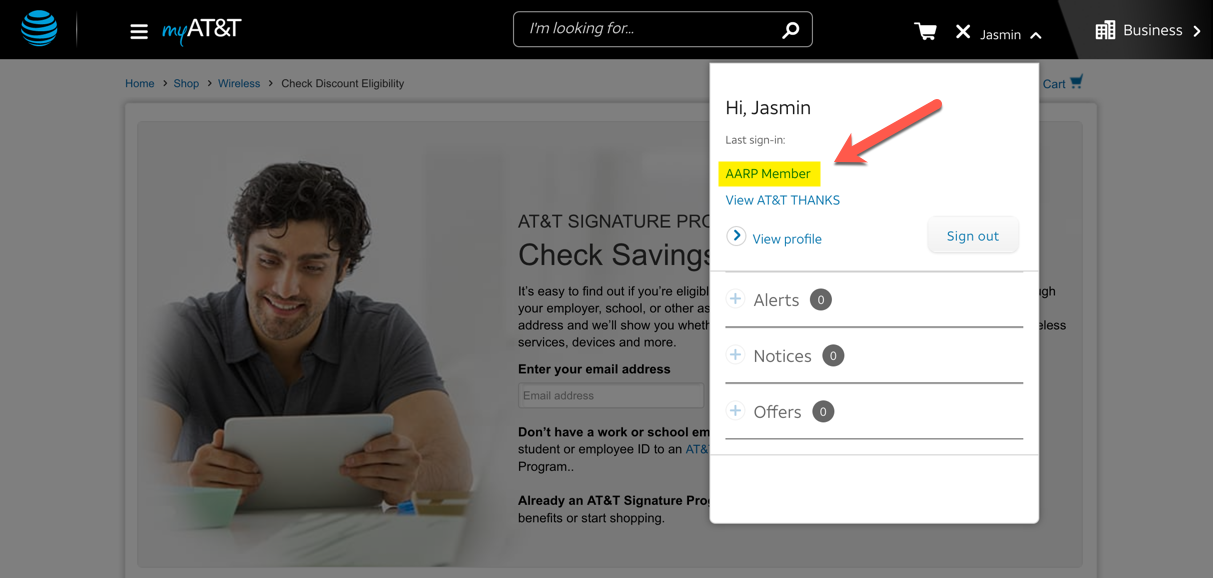

10% off Your AT&T Bill

Folks who have AT&T as their cell phone provider can save 10% on eligible plans as an AARP member. If your base plan costs $50 per month, that’s $5 per month or $60 per year in easy savings!

And I stack this discount with the bonus 3X Chase Ultimate Rewards points and savings from automatic cell phone insurance I get by paying my bill with the Ink Business Preferred Credit Card (here’s our review of the Ink Business Preferred).

Restaurant Discounts of up to 15%

I save a nice chunk of cash each year by dining at restaurants with an AARP discount (usually 10% to 15%). Recently my dad came for a visit, and we had a special family dinner at Outback Steakhouse to celebrate (he’s nearly 82 and laughed when I busted out my AARP card – until he saw the discount). I saved 10% just by showing my AARP card!

Of course I paid with my trusty Chase Sapphire Preferred Card to earn 2X Chase Ultimate Rewards points on our dinner. But like I mentioned earlier, I’m seriously considering picking up the Capital One Savor to stack discounts on meals like this, because it earns unlimited 4% cash back on dining and entertainment. Plus, it’s got a substantial $300 welcome bonus after spending $3,000 on purchases in the first 3 months of account opening, with a $95 annual fee. It’s a really tempting deal!

Other restaurants that offer AARP discounts include Denny’s (combine with kids eat free night for the win!), Bonefish Grill, Carabbas Italian Grill, and Corner Bakery Cafe. Here’s the full list of participating restaurants.

Travel Discounts

Confession – I first got an AARP membership because I was writing an article about stacking the British Airways AARP discounts (you can save $65 to $200 on a round-trip flights from the US to Europe) with other offers. But the British Airways deal isn’t the only way to save on travel with an AARP membership.

You can save on car rentals from companies like Avis, Budget, and Payless (30% or more). And some hotel chains, including Hilton, Choice, and Wyndham, offer discounts to AARP members similar to what you’d get as a AAA member. That said, compare prices and shop around because you’ll often save more with other discounts.

Using these discounts is as simple as selecting the AARP rate when you make your hotel booking. But be prepared to show your card at check-in to confirm you’re a member.

Discounts on Retail, Insurance, and More

Admittedly I probably haven’t made the most of my AARP membership by digging through every single possible discount, like a free coupon book to Tanger Outlets or discounts on life or medical insurance. There are more savings to unlock when you take the time to pick through the website.

Here’s a list of all the available discounts you’ll get with an AARP membership.

Let me know if you spot any really good deals, especially discounts you can combine with rewards from travel credit cards.

Do you keep an AARP membership active to save money and stack discounts? How much have you saved and what’s your favorite deal?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!