No-Annual-Fee Wyndham Card Bonus Increases by $50

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Via Doctor of Credit, you can now earn 15,000 Wyndham points (worth 1 free night at any Wyndham hotel) and a $25 statement credit with the no-annual-fee Wyndham card.

That’s a decent deal, but I’d rather pay for the annual fee version of this same card, because its sign-up bonus is worth 3 free nights at any Wyndham hotel.

We don’t earn a commission for any of the Wyndham cards, but we’ll always tell you about the best offers!

I’ll show you how to get the better offer for the no-annual-fee Barclaycard Wyndham card. And explain why I prefer the annual fee version.

Better Offer for the No-Annual-Fee Wyndham Card

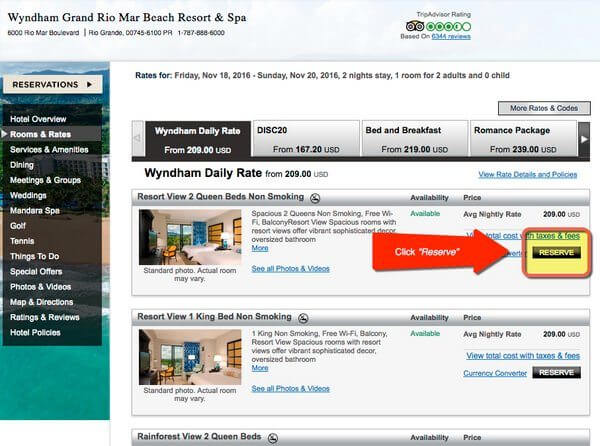

When you make a test booking on Wyndham’s website, you’ll see an offer for 15,000 Wyndham points and a $25 statement credit for the no-annual-fee version of the Barclaycard Wyndham Rewards card.

To earn the sign-up bonus, you’ll have to spend $1,000 in the first 90 days of opening your account. But you’ll earn the $25 statement credit after your first purchase.

You’ll also get:

- 3X Wyndham points per $1 you spend at Wyndham hotels

- 2X Wyndham points per $1 you spend on everything else

To find the offer, go to the Wyndham website and search for a hotel.

Then select any room type from the list.

From there, you’ll be directed to the booking screen. The better offer for the no-annual-fee Wyndham card will be towards the bottom of the page.

Is This a Good Deal for the Wyndham Card?

Link: Barclaycard Wyndham Rewards Card Annual Fee Version

15,000 Wyndham points is enough for 1 free night at any Wyndham hotel, and a $50 statement credit is a nice perk.

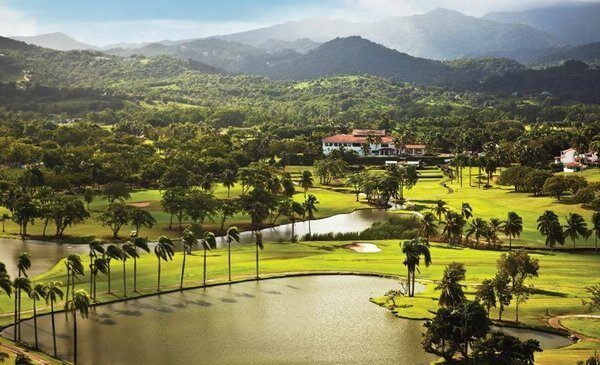

But I’d rather pay the $69 annual fee for Wyndham card with the 45,000 Wyndham point sign-up bonus. Because that’s enough for 3 free nights at ANY Wyndham hotel. This includes luxury hotels like the Wyndham Grand Chicago Riverfront, which costs ~$243 per night!

Check out my post about how to save over $1,000 on Big Travel with the Barclaycard Wyndham Rewards cards. And how to get 3 free nights with the annual fee version of the card.

And don’t forget, most folks can do better with other cards, especially if you’re new to miles and points. I always recommend folks new to our hobby apply for Chase cards first because of their stricter application rules.

Plus, Barclaycard typically only approves folks for 1 to 2 cards per year. So other Barclaycards, like the Barclaycard Arrival Plus World Elite Mastercard, might be better suited to your travel style.

Bottom Line on the No-Annual-Fee Wyndham Card

If you make a test booking on the Wyndham website, you’ll see an offer for 15,000 Wyndham points and a $25 statement credit with the no-annual-fee Wyndham card.

That’s better than the normal offer for the no-annual-fee version of this card.

But I’d rather get the Barclaycard Wyndham card with the $69 annual fee. Because you can earn 45,000 Wyndham points after meeting minimum spending requirements, worth 3 free nights at Wyndham’s top hotels and all-inclusive resorts!

I always suggest getting any Chase cards you want first because of their stricter approval rules. So the Barclaycard Wyndham cards are NOT the best for folks new to this hobby.

Emily and I don’t earn a commission for the Barclaycard Wyndham Rewards cards, but we’ll always let you know about the best deals!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!