Airlines’ frequent flyer programs are worth billions, and they’re helping them survive the pandemic

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

If you’re reading MMS, there’s no doubt that you’re a points and miles enthusiast — or are at least working your way toward mastering the hobby. Whether you’re a beginner or a travel rewards addict, you’re probably focused on how to earn and use your rewards. And rightly so! That’s the most exciting part of it all.

But have you ever considered the value of your favorite loyalty program as a whole? These programs are huge businesses in and of themselves, sometimes worth even more than the rest of an airline’s operations. And they’ve become a vital part of many airlines’ strategies to survive the COVID-19 pandemic and the impact it has had on the travel industry.

What are frequent flyer programs worth?

Historically, airlines have been very nontransparent when it comes to the valuations of their travel rewards programs. But in an effort to boost liquidity amid the pandemic, some airlines have planned to borrow against their frequent flyer programs, using these programs as collateral. This, in turn, has allowed consumers an unprecedented look into the intricacies of these programs.

For example, United Airlines recently posted a detailed presentation about the MileagePlus program on their investor relations site. In it, United valued its loyalty program at around $20 billion in the hopes it can raise $5 billion by borrowing against it.

Similarly, American Airlines wants to leverage its AAdvantage program as collateral against a $4.75 billion loan from the U.S. government. And they have noted that appraisals from third-parties have valued its frequent flyer program between about $19.5 and $31.5 billion.

Throughout the years, some analysts have maintained that loyalty programs could be worth more than the traditional travel side of these businesses, as Inc. reported back in late 2018. And given this new information from United, they seem to have been right all along.

How frequent flyer programs make money

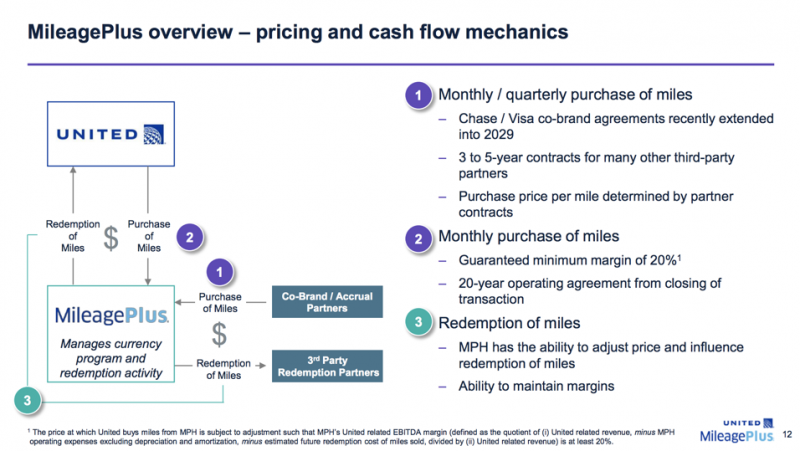

In its recent filing, United laid out the ins and outs of the MileagePlus program by providing a flowchart of cash flows to and from the program. While this information is specific to United, it’s likely more or less how many of the other frequent flyer programs operate.

As you can see, the loyalty program makes money from both the airline itself and third parties.

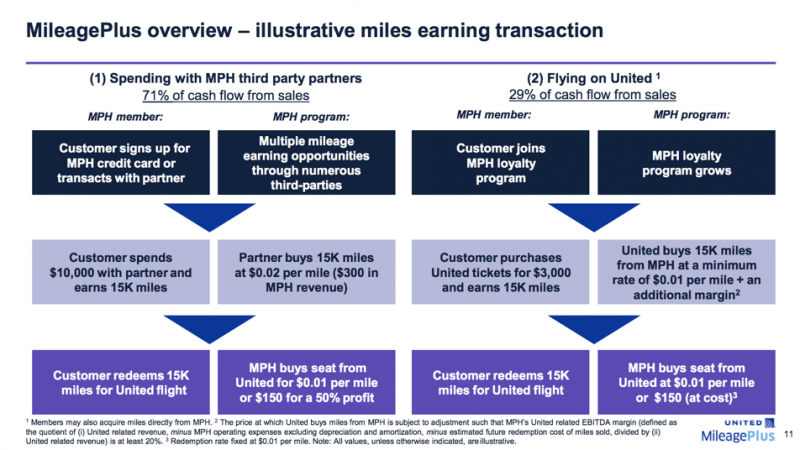

One way the program makes money is by collecting revenue through tickets. An example included in the filling was that if a customer pays $3,000 for a ticket and earns 1,500 United miles, United then pays MileagePlus “a minimum rate of $0.01 per mile,” which would translate to $150 in revenue.

Secondly, loyalty programs generate revenue by selling miles to third parties. United offered the following example in their recent filing:

A customer spends $10,000 with a third-party partner and earns 15,000 miles from spending. The partner buys those 15,000 miles, which generates $300 in revenue for MileagePlus. Then, when the customer redeems these 15,000 miles, MileagePlus pays United $150 and keeps $150 as profit.

Lastly, the primary way in which frequent flyer programs make the bulk of their revenue is through selling miles to banks. These partnerships generate billions and are mutually beneficial — the program makes money on the sales, and the banks use the miles & points as a way to entice consumers to use their rewards and travel cards.

The airlines are usually very vague when reporting these numbers. Still, we’ve been able to glean a little insight into this revenue stream since both Delta and United have recently renegotiated their contracts with American Express and Chase, respectively.

In a press release from early 2019, when Delta extended its partnership with American Express, Delta said it “expects its benefit from the relationship to double to nearly $7 billion annually by 2023, up from $3.4 billion in 2018.” And when United extended its contract with Chase earlier this year, the company stated it would “increase the annual cash contribution to the Company by approximately $400 million in 2020.”

Again, this doesn’t offer a crystal clear explanation of the market capitalization of these loyalty programs, but it’s undeniable that they’re a big business. In fact, one could even argue that the airlines and their loyalty programs should be considered two entirely different businesses.

Bottom line

If you thought the idea of a frequent flyer program only had to do with promoting customer loyalty, you’d be mistaken. Frequent flyer programs are a massive part of airlines’ revenue streams. And due to the gigantic valuations of frequent flyer programs, several airlines are now depending on these programs to see them through the coronavirus pandemic, one of the biggest crises the travel industry has ever seen.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!