Even Hotel Employees Are Confused Following the Marriott-Starwood Loyalty Program Merger

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I recently had my first Marriott stay following the merger of the Marriott and Starwood loyalty programs. My wife and I spent a few nights in Portland at The Nines, a Luxury Collection Hotel. We used points for 2 nights and booked the 3rd night through AMEX Fine Hotels & Resorts.

As many folks have already noted, the technical glitches during the Marriott-Starwood integration were annoying. But I figured once we got past the IT upgrades, things would be back to normal and I could continue enjoying my free award stays and Platinum status perks.

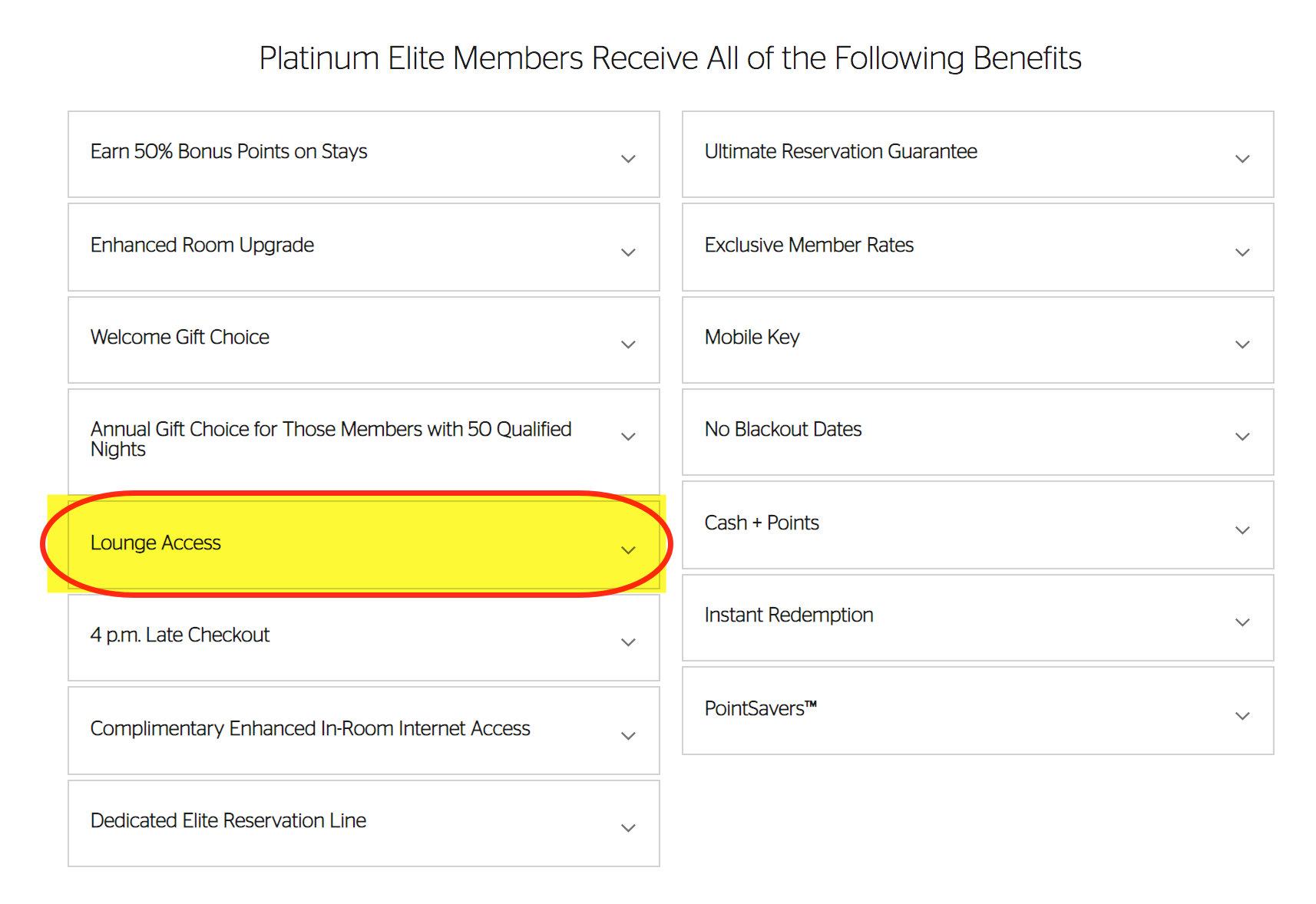

Unfortunately, I think the merger of the loyalty programs has created confusion for hotel employees as it relates to what perks elite status guests can enjoy. Specifically, I’m referring to lounge access.

As a guest with Platinum status, one of the benefits I enjoyed most in the past was access to hotel lounges. Instead of eating outside of the hotel, it was nice to enjoy a free hot breakfast in the lounge. So I was somewhat surprised to learn I couldn’t use the lounge at The Nines.

During check-in, I was advised by the front desk associate that following the loyalty program merger, lounge access was reserved exclusively for Platinum guests staying on the same floor as the lounge. And because no lounge floor rooms were available during our stay, we’d have to miss out on the benefit.

I certainly realize missing out on a croissant and cappuccino in the lounge is not the end of the world. But what frustrates me is that the changes to the newly integrated loyalty program do not appear to be properly communicated to hotel employees. For example, the Marriott webpage dedicated to summarizing Platinum status perks clearly states lounge access is a benefit. And the fine print doesn’t have exclusions about which floor you’re staying on.

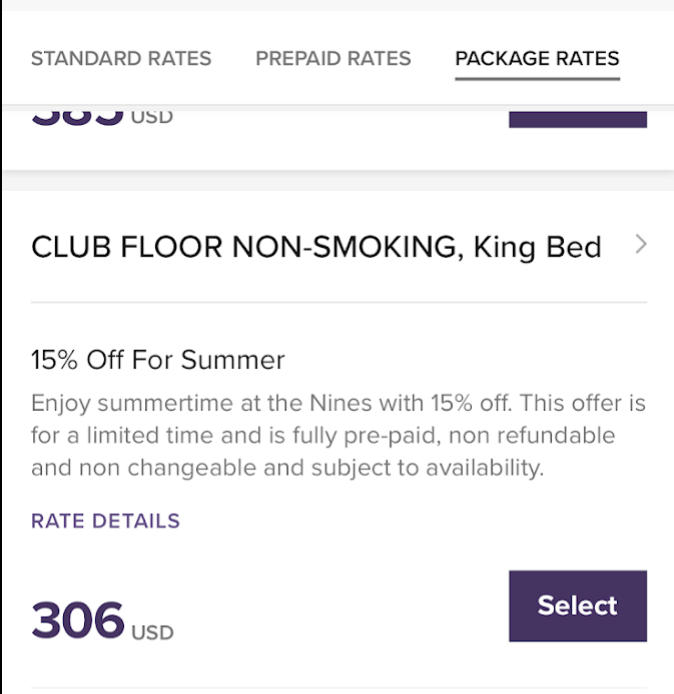

Even more irritating was the fact the hotel did actually have available rooms on the lounge floor during our stay as the below screenshot shows. If I wanted, I’m sure I could have made my case to the hotel manager. But my wife and I didn’t plan on spending much time in the hotel anyway. To me, it was more about the principle.

I’ve reached out to Marriott for clarification regarding the lounge access benefit. Perhaps I still have a bit to learn about the lack of benefits for guests with status.

In any event, I’m definitely rethinking my hotel elite status strategy moving forward. As my colleague, Joseph, recently wrote, switching to Hilton certainly seems compelling.

Have you had any negative experiences after the Marriott-Starwood integration? Let me know in the comments below.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!