How to Plan a Simple Credit Card Miles Strategy for 2019 – I Only Used 3 Credit Cards Last Year and Still Got 12+ Nearly Free Flights!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Now that the new year has arrived, this is the best time to reconsider your miles and points strategy. All of your hotel and airline elite status quotas have reset, meaning you have a full year ahead for you to work toward earning elite status.

If nothing else, a fresh year is just a great time to review your credit card miles and points tactics to see how you can improve.

In the points and miles hobby, it is important to have a strategy for how you will use and earn your miles. This way you don’t need to think about how you do things on a daily basis. You can take some time to come up with a plan now, and stick to that plan in the year ahead to maximize your point-earning potential.

My strategy in 2018 was to use these 3 cards most frequently:

- Chase Sapphire Reserve®

- Chase Freedom Unlimited®

- Alaska Airlines Visa Signature® credit card

And in 2019 I’m looking to add these cards:

It’s simple and it works for me. Here is how I developed my strategy and how you can do the same.

Let me walk you through my simple strategy for points earning in 2019. Why I carried so few credit cards last year, what I want to change this year, and how I will be choosing which card to use for each purchase.

Here is How I Came Up With My Credit Card Miles Earning Strategy for 2019

Step 1: Choosing an Airline and Hotel to Focus On

Some folks might disagree with me on this, but I like to focus most of my rewards earning efforts toward a single airline and hotel chain so I can try to achieve elite status at each of these.

The best rewards in travel generally come after earning elite status. It is also effective at multiplying and speeding up points and miles earning since most elite status comes with additional bonuses. This helps you reach free travel even quicker!

Earning elite status isn’t easy. It generally requires you traveling a fair amount. Spreading your travel across too many hotels or airlines can sometimes mean not reaching status with any of them. It also means that your points are scattered across different reward programs, making it harder to actually redeem them.

Which Airlines and Hotels Am I Focused on?

Last year I flew exclusively on Alaska Airlines for all of my domestic travel. I was able to earn elite status because of this. I flew a ton last year, both paid and free travel. In fact, I wrote about how I flew 11 flights last year for free with Alaska Airlines miles, and on most of those flights I received free First Class upgrades.

I also took 3 international trips last year, which were all on either United Airlines or with their Star Alliance partners. Unfortunately, my Alaska Airlines status did me no good on my international travel. I also didn’t fly enough with United Airlines to earn elite status with them. But my Chase Ultimate Rewards points did help because I could transfer them to United Airlines.

Looking forward into 2019, I actually truly debated whether I wanted to stick with Alaska Airlines again this year or switch my allegiance to Delta.

My thought process went like this:

- Both Delta and Alaska Airlines fly my most common routes (from Salt Lake City to Seattle, Boise, Los Angeles, San Francisco)

- Both offer competitive (nearly identical) pricing on these routes

- Both offer similar flight selections, with a slight edge to Alaska Airlines, especially when flying to Seattle or San Francisco

- Alaska Airlines miles are easier to earn. They award miles off distance flown, whereas Delta miles are based off ticket price

- Alaska Airlines miles are worth more. I can fly for free to any of my common destinations for just 5,000 Alaska Airlines miles one-way. These same routes cost 10,000 – 12,000+ Delta miles.

- Alaska Airlines elite status is easier to earn, I just need 30 flight segments or 20,000 eligible miles earned with Alaska Airlines. Delta is a bit harder with 30 flight segments or 25,000 MQMs (Medallion Qualifying Miles) but the real problem is that they also require $3,000 Medallion Qualifying Dollars (MQDs) to be spent

- The MQDs requirement with Delta isn’t a deal breaker. Because this requirement is waived if you have an AMEX Delta SkyMiles credit card and spend $25,000 in a calendar year on it, which I would do if I decided to shoot for Delta status.

- Delta miles can be used internationally with Delta or their SkyTeam Partners. Alaska Airlines has no international flights and fewer international partners.

For those keeping score, I decided that Alaska Airlines was a better fit again for me in 2019. In many ways they are very close, but I find Alaska Airlines miles to be easier to redeem (I love the 5,000-mile one-way flights). However, fair warning to any Alaska Airlines management reading this, I am hoping we see some changes for international travel coming up in 2019.

If another year goes by with no international options for my elite status and miles, then in 2020 I will almost certainly switch to becoming a Delta elite status member. Delta also offers amazing lounges, the same can not be said about Alaska Airlines (although they promise to improve them this year). A switch to Delta would also mean ditching my Alaska Airlines credit cards in favor of Delta credit cards.

If you are wondering why I am only considering these two airlines, it is simply because of availability. For the routes that I frequently fly, from my home airport, these are the only 2 airlines that make sense. I think that Southwest, American, and United are great airlines too, but their presence on the West Coast isn’t as strong as Delta and Alaska Airlines. So for me, they don’t make sense.

As for hotels, I plan on focusing most of my loyalty this year with Marriott hotels. In 2018, I split a lot of my time between Marriott, Hilton, and Hyatt. I’ve lost a bit of faith in Hyatt recently due to some recent loyalty program changes and some local management changes that happened at the Hyatt I often stay at.

I still think Hyatt is a great transfer option for my Chase Ultimate Rewards points, but I probably won’t put much effort into staying there beyond any free nights I get with Chase Ultimate Rewards point transfers. Marriott now includes all Starwood brands, for a total of 29 brands ranging from basic quality up to absolute luxury. I have had an overall good experience with Marriott hotels in the past and will focus efforts this year toward their hotels.

Go through the same thought exercise yourself, to determine which airline and hotels make the most sense for you. I am not trying to convince you that Alaska Airlines is a better airline, just that it makes more sense for me. If you live on the East Coast or in the Mid-west then I can guarantee you that another airline is almost certainly a better option. Each of us has different needs and circumstances, so make sure to make the best choice for yourself.

Step 2: Choose Credit Cards

Now that you know what kind of points and miles you plan on earning in 2019, it is a great time to look at which credit cards are best for earning those points.

In general, virtually all the airlines and hotels offer their own co-branded cards, which make it easy to earn points from everyday purchases. But don’t forget that some of the best deals in travel come from flexible rewards programs. I would put a slight preference toward flexible reward programs over co-branded cards because your points can be transferred to multiple hotels and airlines, meaning you only need to focus on earning a single type of points.

Examples of these flexible reward programs are Chase Ultimate Rewards, AMEX Membership Rewards, and Citi ThankYou points.

There is still a lot of value with co-branded cards though, because they often come with brand-specific perks. This could be bonus miles after hitting annual spending amounts, free checked bags, automatic elite status, or free hotel stays on your cardholder anniversary. Often these perks alone can offset the annual fee for a card.

Which Credit Cards I Already Have, And What Will Change in 2019

Alright, so now that I know which hotel and airline reward programs I wish to stay involved in, I can take an inventory of my credit cards to see which changes I might want to make.

Remember, I plan to focus my efforts on Alaska Airlines, some United Airlines flying for international travel, and Marriott as my primary hotel.

I currently have:

- Alaska Airlines Visa Signature Card: This is still really the only way to earn Alaska Airlines miles from everyday spending. Unfortunately, Alaska Airlines isn’t part of any flexible rewards program other than Marriott, which transfer at a 3:1 ratio to Alaska Airlines. I personally don’t think this card is all that great, but it earns me Alaska Airlines miles, which is what I need.

- Chase Sapphire Reserve: Right now I think that Chase Ultimate Rewards is the best flexible rewards program, so I use this card a lot. It also has a $300 travel credit each account anniversary year, Global Entry or TSA PreCheck fee credit once every 4 years (Up to $100), and a Priority Pass membership. Making it a great option for those that travel frequently.

- Chase Freedom Unlimited: It has no annual fee and earns a flat 1.5 Chase Ultimate Rewards points on every purchase. And because I have the Chase Sapphire Reserve, I can pool my points on my Sapphire Reserve card and then transfer them to Chase’s travel partners.

- Capital One® Quicksilver® Cash Rewards Credit Card: I don’t really ever use this card. But it has no annual fee, so I have kept it open from a very long time ago when I thought cash-back was cool. I’ve since figured out that travel rewards are far better.

- Chase Debit Card: It is still smart to hold onto a debit card because I do occasionally run into places that don’t take credit cards, or I can use it to pull out cash. But this is only used as a last resort because I earn absolutely no rewards for using this card.

That’s it! With as much travel as I do, many people think I have a slew of other cards, but I don’t. I really just focus on using the top 3 cards listed above.

For 2019, I have been considering a couple new cards to add to my collection like the Marriott Rewards® Premier Plus Credit Card, and Ink Business Preferred℠ Credit Card.

Marriott Rewards® Premier Plus Credit Card

Apply here for the

I like this card because if I stay at Marriott, I could use it to earn 6 Marriott points per $1 spend, on top of my base points. Plus I get automatic Silver elite status just for keeping the card open (which means 10% more bonus points on paid stays). And starting in 2019 you can get 15 elite night credits each calendar year toward elite status, which makes Gold Elite status easily attainable for me.

Folks also get a free night award (worth up to 35,000 Marriott points) every year on your account anniversary. This free night each year more than justifies the $95 annual fee. This makes it a no-brainer to keep on hand, even though I would probably only use it for booking Marriott stays.

Currently, the welcome bonus on this card is 75,000 Marriott points after spending $3,000 on purchases within the first 3 months of account opening. This is a decent bonus, but nothing crazy. I might hang tight to see if a better bonus offer comes along before applying for this card.

Chase Ink Business Preferred

I currently have no business credit cards and that is something I plan to change in 2019. I do software consulting and speaking as my primary job, and am therefore self-employed. I am in the terrible habit of using my personal credit cards for my business expenses (but I do separate the business purchases later using QuickBooks). This is something I really should change and with the awesome business cards offered by Chase, there is no reason to postpone this any longer.

Right now you can earn a welcome bonus of 80,000 Chase Ultimate Rewards points after spending $5,000 on purchases in the first 3 months of account opening. If I transfer these points to my Chase Sapphire Reserve they will be worth 1.5 cents each toward travel booked through the Chase Travel Portal and would be worth at least $1,200 (80,000 Ultimate Rewards points x 1.5 cents each = $1,200 value)! That translates into a very fun vacation for me in 2019.

I really like that this card offers 3X Chase points per $1 on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year). This represents the majority of what I would end up using this card for.

As I mentioned earlier, I can pool my Chase Ultimate Rewards points onto my Chase Sapphire Reserve card for some very lucrative redemptions, or I can transfer them to any of Chase’s travel partners.

Step 3: Plan My Bonus Category Spending

Probably the most important step when planning out your credit card strategy is committing your bonus category spending to memory. When you walk up to the cash register at a grocery store, you should immediately know which card you plan to use. The same with dining out or going to the movies.

Taking the time now to plan out your purchasing strategy can save you a lot of second-guessing later. Here’s an easy way to do it.

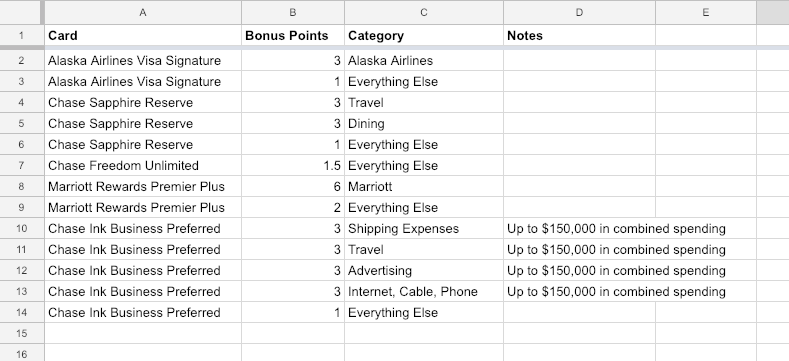

Start by creating a spreadsheet. List each bonus category in a row for each card. Have columns for the card, the bonus rate, and other details like any limits that card might have.

This is what my spreadsheet looks like so far. I left out my debit card and Capital One Quicksilver, since I don’t incorporate those into my everyday spending. They are only used for emergencies.

Now you can sort the list by the bonus points column. This will list everything from the highest bonus to the smallest.

Of course, you can do the same exercise with pen and paper. But this gives you an idea for how I figured this out. So my end result is that I should order my spending like this:

- Marriott Purchases: Use the Marriott Rewards Premier Plus

- Alaska Airlines Purchases: Use the Alaska Airlines Visa Signature

- Travel: Use Chase Sapphire Reserve

- Dining: Use Chase Sapphire Reserve

- Shipping Expenses: Use Chase Ink Business Preferred

- Advertising Expenses: Use Chase Ink Business Preferred

- Internet, Cable, Phone Bills: Use Chase Ink Business Preferred

- Everything Else: Use Chase Freedom Unlimited (or maybe Alaska Airlines Visa Signature or Marriott Rewards card)

So now for each category, I have predetermined which card to use. No more trying to remember bonus categories at the checkout.

A few notes. First of all, I want to use Chase Sapphire Reserve for all travel purchases instead of Chase Ink Business Preferred even though they both earn the same 3x bonus. Because by using the Chase Ink Business Preferred I am eating into the $150,000 a year limit in other categories, which could ultimately limit my bonus potential. And not all of my travel is business related.

Also even though I can earn 2x Marriott points on all purchases, I largely ignored that bonus. Because I would rather use the Alaska Airlines card or the Chase Freedom Unlimited because both of those points are far more valuable than 2 Marriott points. I basically only want to use the Marriott card on Marriott purchases. I tend to favor Alaska Airlines card for my other purchases because I usually get ~3 to ~5 cents of value from each Alaska Airlines mile.

I only use the Chase Sapphire Reserve card for its bonus categories. If I am ever making a purchase that falls outside any of the bonus categories for the card, then I am better off using the Chase Freedom Unlimited card, because it will earn 1.5 Chase Ultimate Rewards points instead of just 1. That’s 50% more points, and the points I earn on the Chase Freedom Unlimited can still be transferred to the Chase Sapphire Reserve just as if they were earned on that card. So on a $500 purchase, I earn 750 points with the Chase Freedom Unlimited instead of just 500 with the Chase Sapphire Reserve. That is significant, especially since it is the same type of points!

Bottom Line

With the start of a new year, now is a great time to sit down and plan out your miles & points strategy for 2019. It is also a great time to start working toward new elite status because you have the maximum earning time ahead of you.

When planning your points strategy follow these 3 easy steps:

- Choose an airline(s) or hotel(s) to focus on

- Select cards that earn points toward your focused rewards programs

- Plan out your bonus categories for maximum earning potential

Everyone’s strategy is going to be different because we all have different travel plans, circumstances, and schedules. I shared with you my plan for 2019. What changes do you plan to make in 2019?

Ready to make that dream trip a reality in 2019? Then subscribe to our newsletter and we’ll send you all the guides, tips, tricks, and deals you need to make it happen.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!