A cringe worthy mistake: I missed out on $1,615 in travel because I forgot one simple rule

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

There are a lot of details to remember in our hobby. Even if you’re far from an “expert,” you can earn thousands and thousands of dollars in free travel with surprisingly little effort from the best travel credit cards. But paying attention to the fine print minutiae is how you can take your savings to the next level.

A few weeks ago, I violated a rule that would make even relatively new miles and points hobbyists shake their head in disappointment — and it cost me over $1,600 in travel. I’ll have the opportunity to recoup most of that money at a later date — but the gutted feeling stems more from the simplicity of the mistake.

I’ll help you avoid the same mistake.

[ Subscribe to our newsletter for more tips on how to avoid mistakes like this ]

Missing out on 95,000 Chase Ultimate Rewards points

The Chase Sapphire Preferred® Card recently came with a bonus of 80,000 points — the best bonus we’ve ever seen for that card. It now comes with 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Still amazing, but several hundred dollars less valuable than the previous bonus, in our estimation.

See, we find that Chase points value averages at 1.7 cents each. That means an 80,000 point bonus is worth $1,360. You can fly in lie-flat business class seats or stay several nights in a five-star hotel with that amount of points! Read our post on the best ways to use Chase points for more details. You can even cash those points out for straight cash back or to cover grocery, dining and home improvement expenses through Chase’s Pay Yourself Back tool.

My thinking — you can re-earn a Chase Sapphire bonus if it’s been 48 months since opening the card!

Chase has some pretty strict rules when it comes to their best travel cards. For example, if you’ve opened five or more cards in the past 24 months, you won’t be approved for cards like the Chase Sapphire Preferred. Also, if you’ve opened a Chase Sapphire Preferred® Card or a Chase Sapphire Reserve® in the past 48 months, you won’t be able to earn the bonus.

My wife opened her Chase Sapphire Preferred about 50 months ago. I sagely advised her to downgrade her card to a Chase Freedom Flex℠ (it’s better for everyday spending, anyway), so she could reapply for the Chase Sapphire Preferred and earn the giant bonus.

In addition to the 80,000 bonus points she’d get, I sent her a referral link (I’ve had my Chase Sapphire Preferred for years). The two of us would earn a total of 95,000 bonus Chase points this way! That’s an estimated total of $1,615 in value — though I’d have probably squeezed double that amount from them by transferring them to Hyatt for three nights at the Park Hyatt Beaver Creek in Colorado this winter.

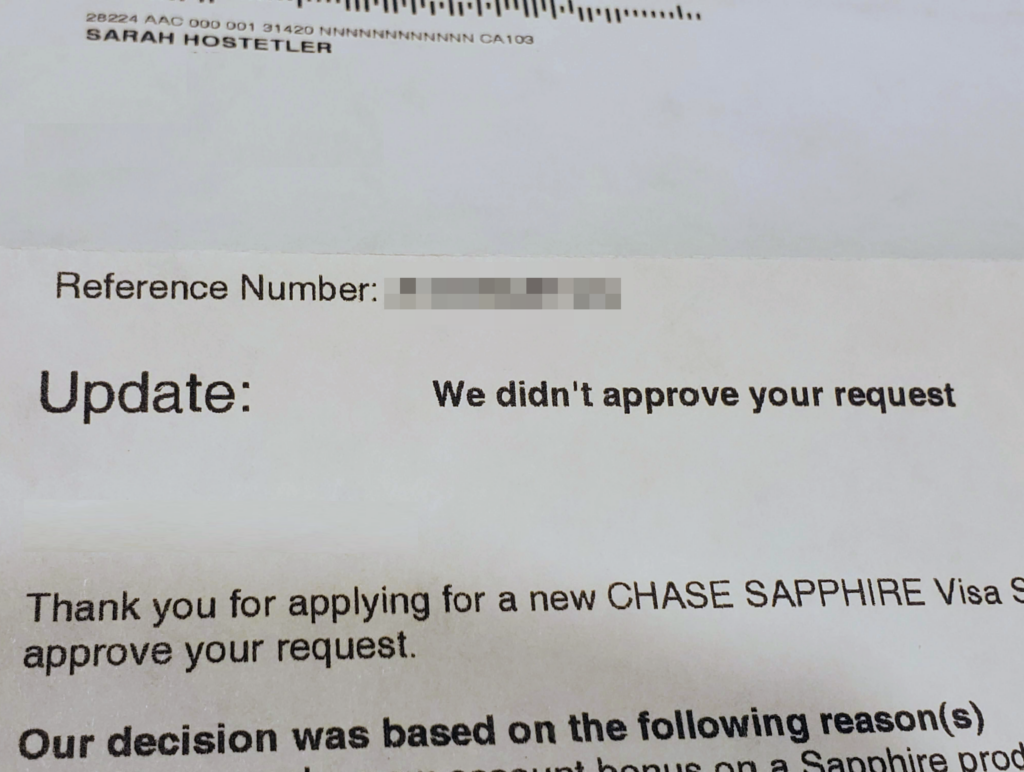

Imagine my surprise when my wife, with an excellent credit score and low number of hard inquiries on her credit report, was instantly declined after submitting her online application to Chase. When Chase mailed us the reason, I was mortified.

The actual Chase Sapphire rule

True, you won’t be eligible for a Chase Sapphire card if you’ve opened one in the past 48 months. But the actual Chase Sapphire rule is that you won’t be approved unless it’s been 48 months since you earned your card bonus. Because my wife was denied, she must have earned her bonus in the third month of her cardmembership, meaning we had reapplied 47 months after the bonus posted.

I totally forgot to check that — I was only worried about when she opened the card.

There was a bit of good news in this tragedy, however. I didn’t realize Chase would deny you if you weren’t eligible for the Sapphire welcome bonus. This is fantastic, as I’d much prefer that over my wife being approved for a card on which she’s ineligible to earn the bonus.

Sure enough, on the Chase Sapphire Preferred application page, it says:

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.

Because Chase denied her, she can now apply for the card again in six months and she shouldn’t have a problem being approved.

When you apply for a credit card and are denied, it’s a good idea to wait about six months before applying again. I’m not aware of any hard fast rules about this, but data points show that your best bet for approval is to wait at least six months. Chase will not be amused if you apply for the same card a month after they told you to get lost.

Bottom line

If you’re in the market to earn another Chase Sapphire bonus, pay no mind to when you opened the card — it’s all about when you earned the bonus. If you don’t know when you earned it, best to reapply at least 52 months after account opening. Or. you can call Chase and they can likely figure out when the last time you earned the bonus.

My wife and I will still get a total of 75,000 points (after I send her another referral code), but we’ll have to wait a while. An unbelievable rookie mistake from me.

Let me know your credit card shame story — and subscribe to our newsletter for more credit cards tips, tricks, and painful reminders like this delivered to your inbox once per day.

Featured image by Mirjana Seba / EyeEm / Getty Images.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!