How to book luxury all-inclusive resorts for two-star prices in one of the only countries open to U.S. travelers

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Mexico is one of the few places fully open to U.S. travelers right now. It also happens to be one of the most popular tourist destinations in the world, with powdery-white beaches ad nauseam, rich culture and tons of all-inclusive resorts.

If you’re a fan of all-inclusives, the time to book is now. Prices are so low that you can easily receive double the value of what you pay for the room in food and alcohol. If you use points or miles you’ve accrued from the best travel credit cards (like the Chase Sapphire Preferred® Card or Capital One Venture Rewards Credit Card) to pay for your room, you’ve got the “freest” vacation you could possibly book.

Super cheap all-inclusive resorts in Mexico

There have always been some all-inclusive steals in Mexico. Low rates are not uncommon, but at this time when Mexico is trying to recoup some of its lost tourism revenue, deals are everywhere you turn.

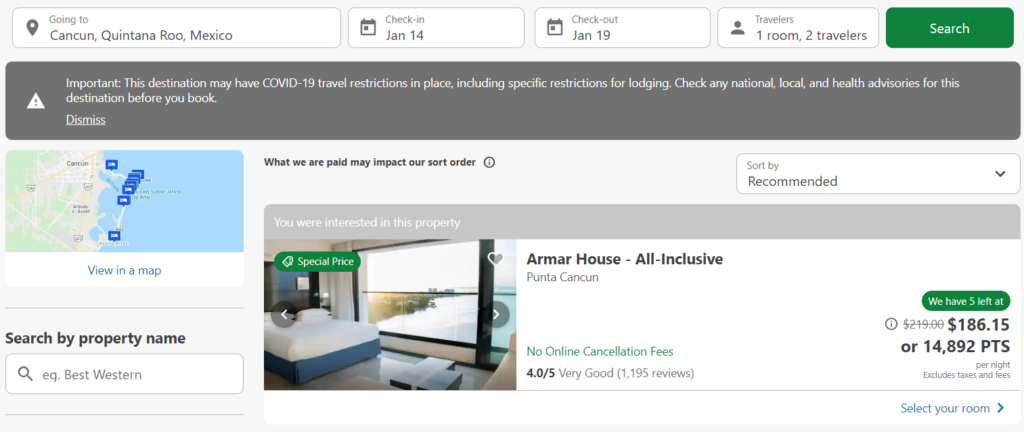

For example, there’s this four-star resort in Cancun named Armar House, All-Inclusive. It’s new to the Marriott portfolio, and apparently, it’s under the W hotel brand. Marriott has been renovating it for months — the property is scheduled to reopen on Dec. 11, 2020 — but it looks quite beautiful, and the prices are rock-bottom.

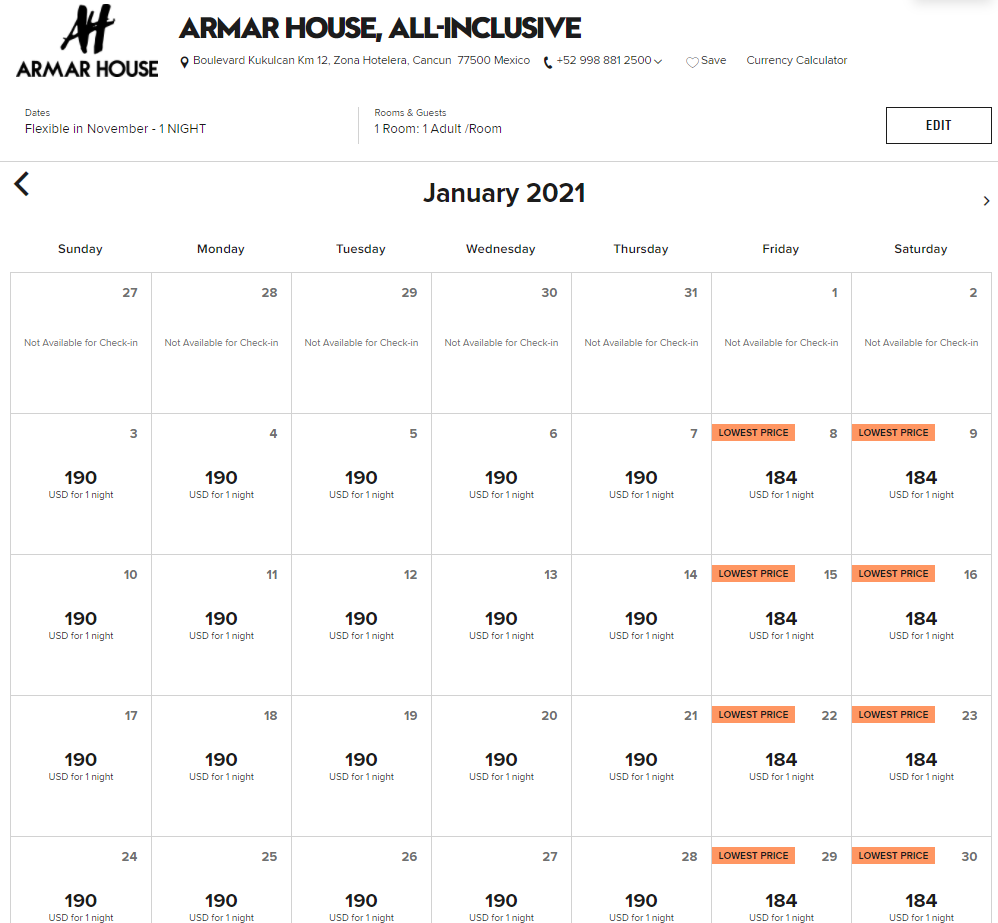

This hotel is a bit of a mystery, as nobody has stayed here since the new management. Here are what the prices look like for double occupancy from late December to early June:

- Sunday through Thursday, $190

- Friday and Saturday, $184

Note that these are the figures for prepaid, nonrefundable rates. Booking a refundable rate costs closer to $210 per night.

$190 all-in for a beachfront hotel and unlimited food and alcohol? That’s too cheap.

My wife and I have stayed at a few all-inclusive resorts in Mexico, and we paid many times that price. Here’s an estimation based on those previous trips of what I reckon a high-end, all-inclusive resort is worth in sustenance for two people, per day:

- Food – $380

- Coffee – $28

- Alcohol – $120

From my past experience, an all-inclusive gives me about $528 in value for food and drink alone. That doesn’t even account for the hotel room and facilities. Extra inexpensive resorts like the Armar House, All-Inclusive are offering, in my arbitrary estimation, $730+ in value for $185 per night.

That doesn’t mean you’re SAVING $550 by booking these rooms. After all, you can lock down a truly amazing all-inclusive (like the Beloved Playa Mujeres) for ~$500 per night. Because of this, I estimate a savings of $315 per night by booking Armar House. And if you leave the resort area and venture into town, you can probably eat like a king for $40 a day. But if your goal is to lounge and just hang by the beach (that’s probably why you’re booking an all-inclusive), then staying at an all-inclusive vs. paying à la carte for food and drink can save you a ton of cash.

Again there are a lot of options. Here are some other cheap finds from a few hasty searches using Google Hotels:

- Samba Vallarta, Nuevo Vallarta – $174 per night

- Solmar Resort, Cabo San Lucas – $192 per night

- Hotel Villa Varadero, Puerto Vallarta – $127 per night

All-inclusives are the key to a free vacation

I’m not quite sure why people say there’s no such thing as a free lunch. The best travel credit cards can give you a lot of free lunches.

For example, the Chase Sapphire Preferred® Card comes with 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That’s worth:

- $1,000 in cash

- $1,250 in travel (including hotels) when redeemed through Chase Ultimate Rewards

- $1,250 in groceries, dining or at home improvement stores with Chase’s Pay Yourself Back feature

- Potentially much more if you know the best ways to use Chase points

To stick with our example, this welcome bonus could give you five free days at Armar House when booking through the Chase Travel Portal. That’s free food, free alcohol, free facilities and a free room! Depending on how much you consume, you might see a value of $3,000+ from that stay! If you can fly to Mexico on points too, food, shelter, and transportation will all be taken care of for free.

Bottom line

Mexico is on sale right now — big time. Browse their all-inclusive rates to see what I mean. If you’ve got any desire to travel right now, I highly recommend an all-inclusive resort in Mexico. It’s perhaps the cheapest vacation you’ll ever take.

To get free flights to Mexico, read our post on the best airline credit cards. Mexico takes surprisingly few airline miles to reach!

Subscribe to our newsletter for more deal alerts like this delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!