“The Less Frequented Places Are Where You Can Really Experience Culture and Get Out of Your Comfort Zone”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Welcome to the next installment of our interview series where folks share their thoughts about Big Travel with Small Money!Miles & Points Interview: Johnny Africa

John writes Johnny Africa to inspire readers to travel indefinitely. You can follow him on Facebook and Instagram, too!

How and when did you start collecting miles and points?

I started collecting miles 2 years ago. I always knew the benefits credit cards had, but I had a few negative marks on my credit report due to some irresponsible spending habits in college that left me in the dust. Once those things disappeared from my credit report, it was on!I knew I liked to travel and save money, which are 2 givens for anyone collecting points. I started small and cautious with the Chase Sapphire Preferred and worked my way up to more cards from there.

Why did you start your blog? What’s special about it?

I started my blog when I moved to South Africa (from New York City) as a way to document my experiences as an expat, and my travels through Africa. It started off as something for myself to capture my experiences in a more descriptive way than just Facebook and Instagram. I prefer to travel to lesser known places that others may never consider.

Everyone’s been to Thailand, Rome, or Paris. It’s the less frequented places where tourists are not regularly seen where you can really experience the culture and get out of your comfort zone.

What’s the one single thing people can do to get more miles?

Well I’m not sure if this is much of a secret, but opening new cards and pocketing the sign-up bonus is how someone really obtains meaningful amounts of rewards.

There are 2 types of credit card rewards people out there; the ones that have a business, and the ones that do not. If you have a legitimate business or travel for work and do NOT have to use a company credit card, then you are better off than most and are able to rack up rewards quickly. This is definitely not a recommendation for people to start their own businesses purely to rack up points however!

For the rest of us, it’s not as simple. Even if you manage to optimize which credit card to use on which type of expense, you just aren’t spending enough to rack up any meaningful points.

Take for example the Chase Sapphire Reserve. Earlier this year, it offered 100,000 Chase Ultimate Rewards points as a sign-up bonus, worth $1,500 in travel. Assuming all your spending was dining or travel (which is 3X on the Chase Sapphire Reserve), you would still need to spend ~$33,000 in order to achieve the same amount of points as the sign-on bonus.

That’s a lot of money for most people, and could take years!

What’s your most memorable travel experience?

I spent a month traveling through Madagascar. It was unlike any place I’d been to before. And this is coming from someone that has traveled extensively through Eastern and Southern Africa. It’s by far the least developed country I’ve ever seen.

There’s not a single traffic light in the entire country, nor are there any street lights. Pulling into a town at night, the only light would come from people’s homes. The main highway that runs through the country is 1.5 lanes and is used equally by cars as it is by ox carts. It felt like we traveled back in time.

Nevertheless, the scenery and landscapes of this country are some of the most amazing and otherworldly things I’ve seen. Very few people visit this country so much of the breathtaking sights are not ruined by swathes of tourists.

What do your family and friends think of your miles & points hobby?

Some people think I’m crazy for opening so many credit cards. Most are vastly intrigued by my methods after I tell them my credit score is near 800.

In this day and age, everyone wants to travel. Travel is expensive, so any way of mitigating costs will grab anyone’s attention.

My dad has gotten on board with collecting miles & points. And he has opened most of the same cards that I have. Because of his business, he is getting some ridiculous value out of the Citi prestige 4th night free benefit.

My mom hasn’t the faintest idea of collecting rewards so this next part is a bit shameful, but I will say it anyway.

I regularly give my mom a credit card of mine to help me spend enough to get the bonus. Am I suggesting everyone exploit their lesser enlightened relatives for personal gain? Certainly not. However, if they don’t care for rewards, and are swiping debit cards, then at least someone should be pocketing the gains!

Is there any tool or trick which you’ve found especially useful in this hobby?

I think having a plan and sticking with it is most essential. Nowadays, there aren’t many ways to skirt the system.

Gone are the days where you could buy thousands of coins from the US Treasury with your credit card and deposit it at the bank. Gone are the days where you could go on “mileage runs” by finding error fares and pocketing thousands of miles.

Sure, there are small hacks like using Rocketmiles, dining programs, shopping portals, or paying your rent with a credit card. The added expenses of most of these methods almost always outweigh the gains, and buying stuff just for the sake of earning miles will certainly lead to financial ruin.

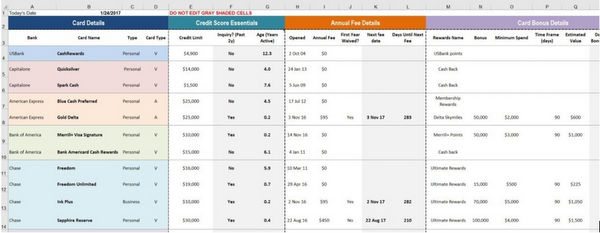

I think keeping organized has really helped me maximize my rewards. I put all my cards and potential cards on a spreadsheet. I also add some formulas so I know when to cancel a card before an annual fee hits.

And of course, keeping updated with the latest news and deals via various blogs is also important so you know when you’ll might potentially get the best deals.

What was the least expected way you’ve earned miles or points?

As per above, there aren’t many ways to game the system anymore. However, I did get very lucky one time with my dad wanting to buy a new car. For some reason, I asked him how he would pay for it and he said by card.

I had no idea you could pay for cars with credit cards so I convinced him to swipe my card. With the Chase Freedom Unlimited giving 1.5 Chase Ultimate Rewards points per $1 back, I earned almost 40,000 Chase Ultimate Rewards points which bought me a nice trip to Europe!

What do you now know about collecting miles and points which you wish you knew when you started out?

Being someone that works in the financial services industry, I knew how to optimize my spend and points earning capacity from the beginning. However, I had always turned a blind eye to hotel cards. Normally, I stay in Airbnbs or am visiting some place so undeveloped that there are no major hotel chains.

It wasn’t until one bored night that I read about how many nights you could get at top hotel chains with just the sign-on bonus alone.

The Chase Hyatt card really caught my eye because you can get 2 free nights anywhere in the world as a sign-up bonus. I’ve been wanting to visit the Maldives for some time now, so my girlfriend and I will both get the cards, combining the bonuses for 4 free nights at the Park Hyatt Maldives in Hadahaa, which could save us almost $4,000!

What would your readers be surprised to know about you?

I grew up with parents that never traveled much. I was never exposed to the wonders of the world, and the American way is not conducive to discovering it. Gap years and sabbaticals are a foreign concept, long vacations are discouraged, and we are expected to go straight into the work force to make as much money as possible.

Aside from Canada and the US, 2 countries I’ve lived in, I did not leave North America until I was 25. My girlfriend insisted we go to Thailand and I hesitantly accepted. 5 years later, I am nearing my 50th country!

Any parting words?

Do not be scared of the big bad credit bureaus. Your credit score does NOT plummet just because you’re opening new cards! Take advantage of what we have in the US.

While we do not encourage travel in our culture as a whole, no other country in the world makes it easier to break the mold with the types of travel rewards we have!

John – Thanks for sharing your thoughts on having Big Travel with Small Money!If you’d like to be considered for our interview series, please send me a note!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!