“I Missed Recurring Fraudulent Charges for 3 Months (But the Bank Came to the Rescue!)”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Using rewards credit cards for all your purchases is key if you’re in the miles and points hobby. But sometimes things go wrong and you’ll suddenly find a charge on your card you didn’t make or authorize. Yikes! Team member Jasmin recently had an interesting experience disputing fraudulent charges on her Chase Freedom card. I’ll let her tell you about it! Jasmin: Let me start this story by saying I feel a little silly. I broke one of the cardinal rules of using (and managing) my 20+ credit cards.

I spend a fair amount at Amazon because I have a Prime membership. So seeing Amazon charges on my accounts is normal. And even though I usually carefully monitor my account transactions, I didn’t notice a recurring ~$8 Amazon charge on my Chase Freedom for 3 months. I was mortified – how could I have been so careless?

Fortunately, I caught it in time and Chase was quick to reverse the charges. But that’s not where it ended…

Zero Liability Protection Is Great…Grumpy Merchants Are NOT

Link: Are Credit Cards Safer Than Debit Cards?

Link: Evil Santa Charged $700 Worth of Toys on My Card!

One of the great things about using credit cards is that under the Fair Credit Billing Act, you’re (usually) NOT liable for fraudulent charges on your card. Most banks, like Chase, and networks, like Visa, have their own zero liability protection guarantees.

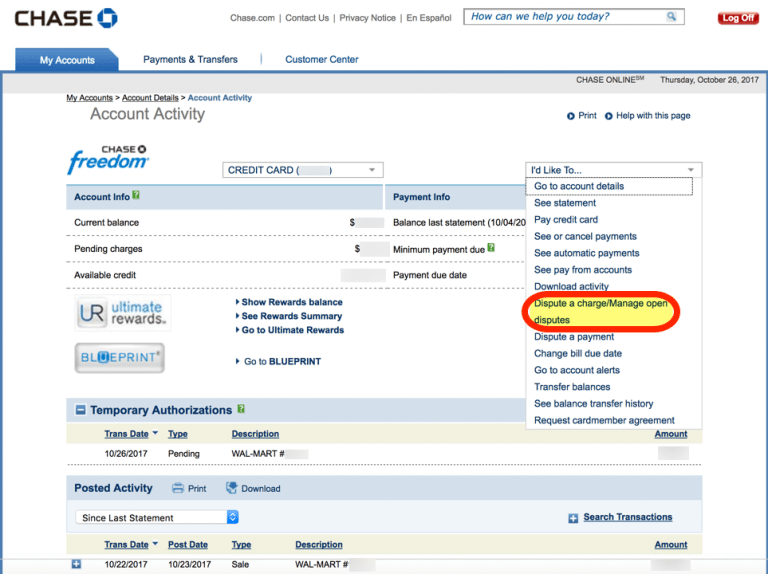

1. Chase Had My Back

When I discovered the ~$8 charge from “Amazon Digital Services” on my Chase Freedom account, I immediately disputed it online, indicating I had not authorized or made the purchase (and didn’t even know what it was for!). A quick check of my Amazon account didn’t show any purchases in that amount, either.

I looked backward to previous statements and discovered Amazon had charged the same amount for 2 billing statements prior (a total of ~$24 in unauthorized charges). Did I mention I felt silly?

After filing my dispute online, I got a secure message response saying they’d cancelled my card and would send a new one. And a few days later, Chase called me for more details. I (embarrassingly) admitted I had not noticed the recurring charge until now.

But the Chase representative was kind and helpful. Soon after, my new card was in the mail and the ~$24 worth of charges were reversed on my account.

2. Then the Amazon Emails Started

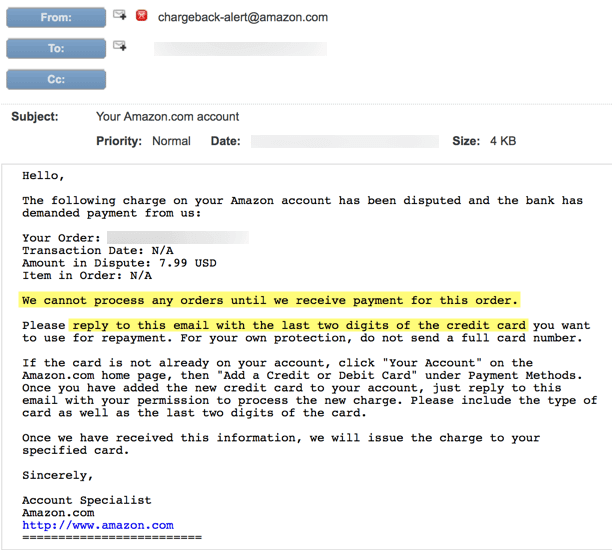

Shortly after the charges were reversed, I got multiple emails (for each of the ~$8 charges) from Amazon stating my account had been suspended until they received payment for the chargeback they got from Chase:

The first version:

I responded saying I hadn’t ordered anything from Amazon in this amount. I tried to log into my Amazon account and discovered I had indeed been locked out.

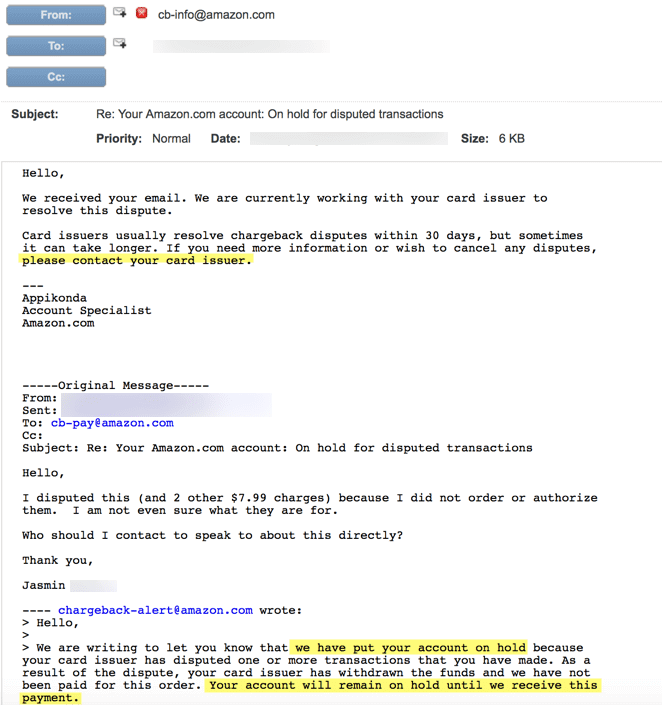

Then the next round of emails came:

Amazon probably knows they’re important to a lot of folks, so can take a hard line on such things. Usually at this point in a dispute it would be up to the seller and bank to duke it out over the fraudulent charge!

If it had been any other merchant, I probably could have dropped it there, written it off, and not shopped there again. But it’s Amazon and I shop there a lot. And I was still locked out of my account (which had a gift card balance in it!).

3. And Then I Made Some Calls

Next, I called Amazon customer service. At first, they didn’t have a clue what I was talking about. After some digging and being bounced around between representatives, they gave me the same line. They wanted a new credit card number to charge the ~$24 I had disputed.

I very firmly (but politely) re-explained my case:

- I had not authorized or made the charges

- There was no record of these charges on my Amazon account

- I would NOT be providing them with a new credit card to bill for the amount

- I expected immediate access to my Amazon account to continue to make purchases with them

When I was able to login again, they’d removed all my saved credit card information. Fair enough. And thankfully, the gift card balance on my account had not been touched.

All told, I spent a couple of hours going back and forth via email and phone with Amazon to get this sorted. That’s a lot of time for a ~$24 charge. But it was the principle more than the amount.

It felt like I was being held hostage for ~$24 by Amazon – I could either never shop with them again (painful), or cough up the cash. I was not impressed with Amazon at all.

But I was very happy with Chase’s response and follow-through. That’s why Chase has such a good reputation for customer service!

Bottom Line

You’re usually NOT liable for unauthorized charges to your credit card. When you dispute a transaction, banks like Chase are typically quick to respond, investigate, and reverse the charges if they’re indeed fraudulent.

But dealing with the merchant can be a different story. And in this case, Amazon (where the fraudulent charges occurred) tried to strong-arm a Million Mile Secrets team member into re-paying the fraudulent charges. And suspended her Amazon account in the process!

In situations like this, it’s important to document your situation (via email or secure message) and be persistent in dealing with customer service representatives. Hang up and call again if you have to.

And always, always double check your credit card statements for unusual transactions. Fraudulent charges can be easy to miss if you’re not paying attention!

I’d love to hear about your experiences disputing charges on your credit card account!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!