Evil Santa Charged $700 Worth of Toys on My Card!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.We hope everyone had a wonderful holiday season!

We sure enjoyed the extra family time. There were lots of laughs, hugs, and home cooked meals (pumpkin pie…Yum!). But I did run into a small hiccup along the way.

Find out what happened and why it didn’t ruin my holiday.

How It All Went Down

‘Twas the week before Christmas and I was at my house, Emily was sleeping and Joelle (the cat) was dreaming about catching a mouse.We had plans to visit family, but I couldn’t find a reasonable fare. So I checked to be sure I had enough Chase Ultimate Rewards points to spare.

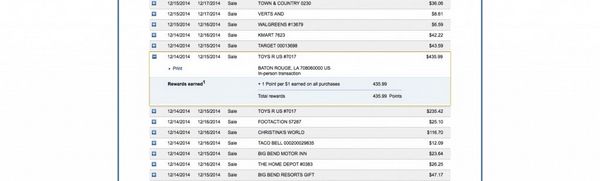

I logged onto my Chase Sapphire Preferred account and to my surprise, I found charges that I did NOT recognize!

Visions of picking the culprit out of a line up danced in my head.

Luckily, the solution was easier than that! I called Chase and they were on the problem, stat!

Chase to the Rescue!

The ~$700 worth of toys (at least the fraudster’s heart was in the right place!) were easy to pick out. The charges took place in Louisiana and I was clearly in Texas.

Within 15 minutes Chase had credited my account and sent me a new card!

How Was Someone Able to Use My Card?

I had my card in my wallet, but someone was still able to make in-person charges to my account. I asked Chase how this was possible. The representative explained it was very likely that my card was skimmed when I swiped it somewhere.

What’s Skimming & How Can You Protect Yourself?

Criminals will attach a skimming device to a place where you would normally swipe your card such as an outdoor ATM machine, a gas pump, or even in a retail store.

When you swipe your card, the device records your card information. This information can then be used to clone your card! They also insert a camera to record your PIN entry.

Here’s how you can protect yourself:

- Use indoor ATM and payment machines – outdoor machines are easy targets because skimming devices can be attached in the middle of the night when no one is around

- Protect your PIN – Cover the keypad as you type your PIN code to prevent a camera from recording your movements

- Watch out for parts that seem out of place – a skimming device is placed over the card scanner and may be a different color or have glue residue around the edges.

- Keep an eye on your bill – The bank doesn’t always catch fraudulent charges. So it’s best to always review your monthly statements for charges that you didn’t make!

The Good News

Ultimately, you are NOT responsible for fraudulent charges to your credit card.

My call was handled very smoothly by Chase.

When you have the Sapphire Preferred card, your call is answered by a human right away (not a computer).

So I was able to speak to a real person instead of navigating through a sea of robotic menus, which made it a relatively easy and painless process.

Bottom Line

An evil santa tried to ruin my holiday by charging ~$700 in toys to my Chase Sapphire Preferred card. Thankfully, having the charges removed was as easy as a 15 minute phone call.

You are NOT responsible for fraudulent charges to your credit card. However, it’s still important to try to keep your information safe.Additionally, look at your statements closely to make certain there are no unusual charges. That’s because if the charges make it past the bank’s fraud department and onto your bill, you pay for them unless you alert the bank that you didn’t make the purchases.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!