What is a credit card statement credit and how does it work?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

What if you could swipe your credit card, receive hundreds of dollars in goods, and never have to pay the bill?

That’s a benefit many of the best rewards credit cards offer every year. And in light of the economic and travel strains from the coronavirus pandemic, credit-card issuers have introduced a whole slew of new (though temporary) statement credits similar to the statement credits we’ve come to love over the years, namely:

- The Chase Sapphire Reserve® — $300 statement credit for travel purchases each account anniversary year

- The American Airlines AAdvantage MileUp℠ Card — 10,000 bonus American Airlines miles and a $50 statement credit after making $500 in purchases within the first three months of account opening

- The Platinum Card® from American Express — Hundreds of dollars in airline and Dell statement credits each calendar year

- The Blue Cash Preferred® Card from American Express — Earn a $350 statement credit after you spend $3,000 in purchases on your new card within the first six months of card membership.

Although all of these cards are solid, there is often (not always) a catch to these statement credits. I’ll explain how statement credits work, and provide a warning before you apply for cards that offer them.

What is a statement credit?

A statement credit is effectively a discount. It’s an incentive for doing something. It’s your card issuer reimbursing you for all or part of a purchase — whether it’s a specific purchase they want you to make, a certain amount of money they want you to spend on your card, or a number of other things.

Statement credits translate to savings on purchases you would have made anyway. They are an important tool for banks to keep customers loyal. And it’s not just a feature found on cash-back credit cards.

How does a statement credit work?

Statement credits are different from cash back. If a card comes with a statement credit as a welcome bonus, that means that once you achieve your spending requirement, the amount of the statement credit will be deducted from your card balance. If your welcome bonus is cash back, you’ll receive cash that you can use at any time or redeem as a statement credit (read our post on how to redeem cash back).

When you see the words “statement credit,” think “rebate.” You pay for something with your credit card, the transaction posts in your online account, and you are promptly refunded a previously specified amount of money. You’ll even earn miles and points like you normally would.

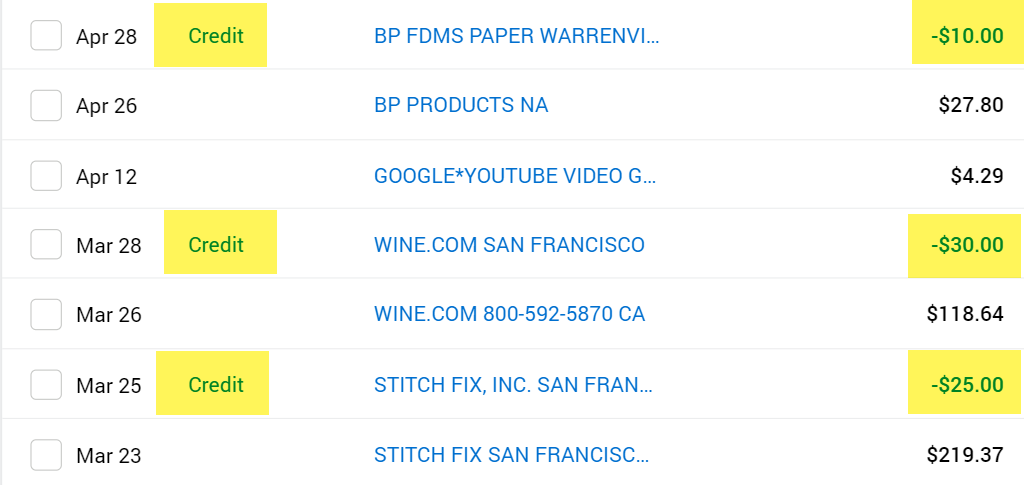

Take a look at one of my recent card statements. In the span of about a month, I saved $65 from statement credits offered by my credit card.

Because you earn these credits by using your card as you regularly would, you can stack credits through online shopping portals or any special deals a website is offering. For example, with the above wine purchase, I was able to:

- Refer a friend to receive $35 in credit (via the wine company’s loyalty program)

- Receive free shipping by ordering a certain number of bottles

- Earn a $30 statement credit from my card for spending a certain amount at checkout

How do you earn statement credits?

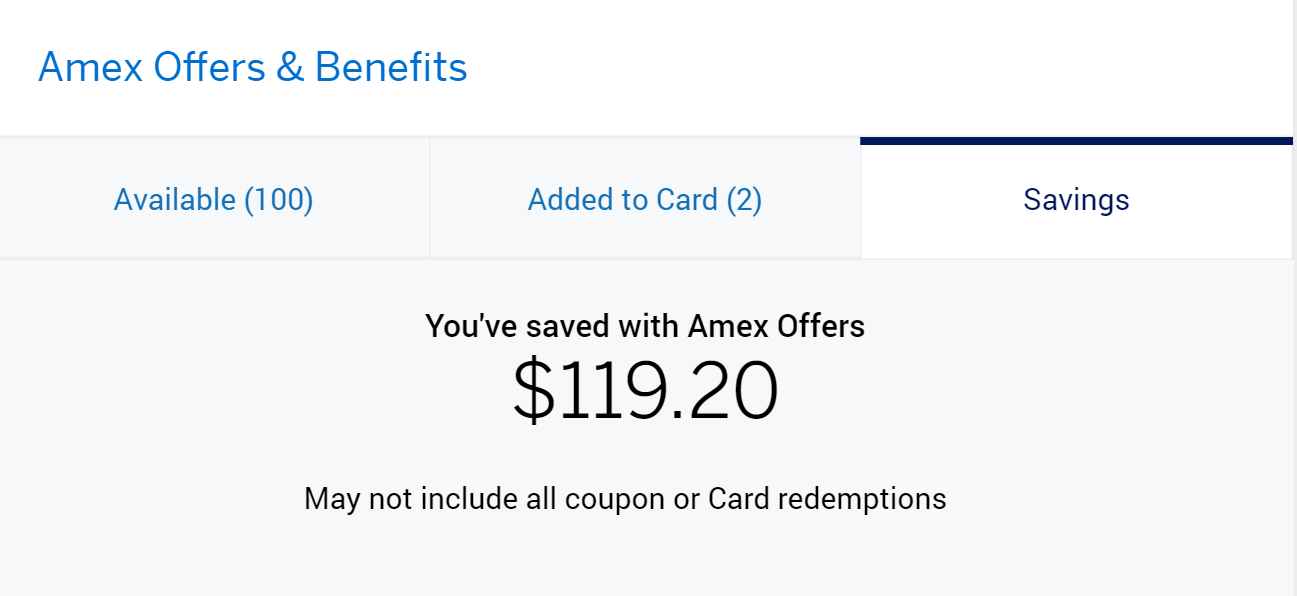

Amex Offers/Chase Offers

The easiest way to get significant savings on statement credits is with Amex Offers. These are targeted statement credits for each account, and provide refunds on purchases for:

- Gas stations

- Streaming companies

- Food subscription services

- Groceries

- Department stores

- Restaurants

- Event tickets (sports, concerts, etc.)

- Tons of other stuff

All you must do is add an offer to your card through your online account, and you’ll receive a credit when you meet the particular offer requirement. Offers are continually changing, so there’s bound to be at least a handful of purchases that fit into your regular spending each year. Read our full Amex Offers guide to harness the power of this benefit.

Chase also provides a similar (yet inferior) service called Chase Offers. You can read our post on how to use Chase Offers to make sure you’re not leaving any money on the table.

Annual benefits

Many credit cards come with annual statement credits that either renew:

- Each calendar year (you receive a new credit on Jan. 1)

- Each cardmember year (you receive a new credit on your cardmember anniversary)

Whichever way your credit works, they’ll expire a year after they’re issued. In other words, you can’t hoard your credits over the years and then spend them all at once.

Another way you can occasionally earn statement credits is by meeting spending thresholds. Cards sometimes give you the opportunity to receive a statement credit after spending thousands of dollars in a calendar year.

Welcome bonuses

Statement credits, which come in the form of welcome bonuses, are not recurring each year. You’ll earn the statement credit once, and that’s it.

Welcome bonuses often provide the statement credit in addition to other incentives, like airline miles.

Retention offers

If your cardmember anniversary is approaching and you don’t want to pay the annual fee, you can call your card issuer and ask them for credit card retention offers. These are incentives that banks provide to pay for your annual fee. Sometimes you can earn bonus miles, sometimes they’ll waive your annual fee, and sometimes they’ll offer you a statement credit for spending a certain amount within a specific time frame.

Redeem rewards

There are other statement credits you can earn by redeeming the rewards you’ve accrued from spending. For example, if you’ve earned $40 from spending on the Citi® Double Cash Card, you can request a statement credit, and $40 of your balance will be wiped away. The information for the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

You can also receive cash statement credits from travel credit cards from issuers like Chase, Amex and Capital One.

For example, the Chase Sapphire Preferred Card comes with 80,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months of opening your account. You can redeem all 80,000 points for a statement credit if you want. Just note that this is not the best way to use Chase points. The value of Chase points is much higher if you convert them to airline miles or hotel points via Chase transfer partners.

Statement credits by each bank

Below is a list, by card issuer, of the statement credits available from the most popular cards. I’ve included the card annual fees to help you weigh the value of the statement credits, because this is the part that can be deceptive.

If a credit card comes with $500 in statement credits, but the annual fee is $595, you should absolutely not open the card just to get those credits. For every credit card listed below that comes with an annual fee higher than the available credits, you need to evaluate the card’s other ongoing benefits to decide if it is worth it. (If you’re a traveler, it’s almost always worth it.)

Read our full credit card reviews on our frequent flyer miles-and-hotel rewards programs page. We even comb through the boring card benefits guides and rewrite them in super concise, easy-to-understand language.

American Express

- Delta SkyMiles® Platinum American Express Card ($250 annual fee, see rates and fees)

- $100 statement credit after you make a Delta purchase with your new card within your first three months of account opening

- Delta SkyMiles® Platinum Business American Express Card ($250 annual fee, see rates and fees)

- $100 statement credit after you make a Delta purchase with your new card within your first three months of account opening

- Delta SkyMiles® Reserve American Express Card ($550 annual fee, see rates and fees)

- Up to $100 statement credit for Global Entry or TSA PreCheck application fee

- Blue Cash Everyday® Card from American Express ($0 annual fee, see rates and fees)

- Earn a $200 statement credit after you spend $2,000 in purchases on your new card within the first six months of card membership.

- Blue Cash Preferred® Card from American Express (annual fee $95, see rates and fees)

- Earn a $350 statement credit after you spend $3,000 in purchases on your new card within the first six months of card membership.

- American Express®️ Green Card ($150 annual fee, see rates and fees)

- Up to $100 in statement credits per year when you use your Amex Green Card to pay for your Clear membership

- Up to $100 in statement credits per year on your LoungeBuddy purchases

- Up to $80 in statement credits when using your card to pay for wireless telephone services directly from U.S. service providers (up to $10 per month from May through December 2020)

- The information for the Amex Green Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

- The Platinum Card® from American Express ($550 annual fee, see rates and fees)

- Up to $320 in statement credits on select streaming and wireless telephone services purchased directly from U.S. service providers (up to $20 per month on each, from May through December 2020)

- Up to $200 in Uber credit per year

- Up to $100 in credit for Saks Fifth Avenue

- Up to $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, inflight food and drink, etc.)

- Up to $100 statement credit for Global Entry or TSA PreCheck application

- Enrollment required for select benefits.

- The Business Platinum Card® from American Express ($595 annual fee ($695 if application is received on or after 01/13/2022), see rates and fees)

- Up to $400 annual Dell statement credit for U.S. purchases

- Up to $100 statement credit for Global Entry or TSA PreCheck application fee

- Enrollment required for select benefits.

- Hilton Honors Aspire Card from American Express ($450 annual fee, see rates and fees)

- Up to $250 in statement credits when you open your card and each year you renew your card. Can be used at any of Hilton’s participating resorts toward eligible purchases, including room rate, resort restaurants, spas, etc. The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

- Up to $250 airline-fee credit to cover incidental air travel fees. You’ll receive this credit each calendar year (but you’ll have to choose the airline you want)

- Enrollment required for select benefits.

Bank of America

- Alaska Airlines Visa Signature® credit card ($75 annual fee)

- $100 statement credit, 40,000 bonus miles and Alaska’s Famous Companion Fare™ from $121 ($99 fare plus taxes and fees from $22) after you make $2,000 or more in purchases within the first 90 days of opening your account. This is a limited-time offer.

Chase

- Chase Sapphire Reserve® ($550 annual fee)

- Up to $300 statement credit each cardmember year for travel purchases

- Up to $100 statement credit for Global Entry or TSA PreCheck application fee

Citi

- American Airlines AAdvantage MileUp℠ Card ($0 annual fee)

- 10,000 American Airlines miles and a $50 statement credit after making $500 in purchases within the first three months of account opening

- Citi Prestige® Card ($595 annual fee)

- Up to $250 in statement credits for travel purchases each cardmember year

The information for the Alaska Airlines Visa and Citi Prestige has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Dozen of the best travel credit cards offer statement credits in some form. Whether it’s through a welcome bonus, an annual perk, or via Amex and Chase Offers, you can receive hundreds of dollars back each year from the credit card spending you would have made anyway — just by paying attention to your credit card benefits.

Let me know your favorite credit card statement credits. And subscribe to our newsletter for more credit card and rewards posts like this delivered to your inbox once per day.

For rates and fees of the Delta SkyMiles Platinum, click here.

For rates and fees of the Delta SkyMiles Platinum Business, click here

For rates and fees of the Delta SkyMiles Reserve, click here

For rates and fees of the Amex Blue Cash Everyday, click here

For rates and fees of the Amex Blue Cash Preferred, click here

For rates and fees of the Amex Green Card, click here

For rates and fees of the Amex Platinum, click here

For rates and fees of the Amex Business Platinum, click here

For rates and fees of the Amex Hilton Aspire, click here

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!