How to use Chase Offers to easily save money

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you have any Chase credit card (or even a Chase debit card), you can save with Chase Offers. They work like Amex Offers, in that you can earn statement credits for spending you’d make anyway.

You’re eligible for Chase Offers if you have any consumer Chase rewards credit card, like the Chase Sapphire Preferred® Card (our best credit card for beginners to using miles and points). And Chase small business credit cards are also eligible for these deals.

You can add Chase Offers through your online Chase account, but can’t currently do it with the Chase Mobile app (you used to be able to though). Here’s how to add Chase Offers to your travel credit cards.

What are Chase Offers?

Chase has made it super easy to save money on your everyday spending with Chase Offers. All you have to do is add the deal to your account and then make a purchase as you normally would. If the purchase meets the spending requirements the credit will be automatically added to your account, although it won’t be instant.

The actual offers that will be available to you will vary for each card you have and your spending habits can impact which deals you’ll be targeted for. What makes Chase Offers so potentially useful is that the credit is added after you make the purchase, so it’s easy to stack these deals with other discounts codes or with online shopping portals.

Here’s how simple it is to add Chase Offers to your cards.

How to add Chase Offers to your cards

Sign into your Chase account

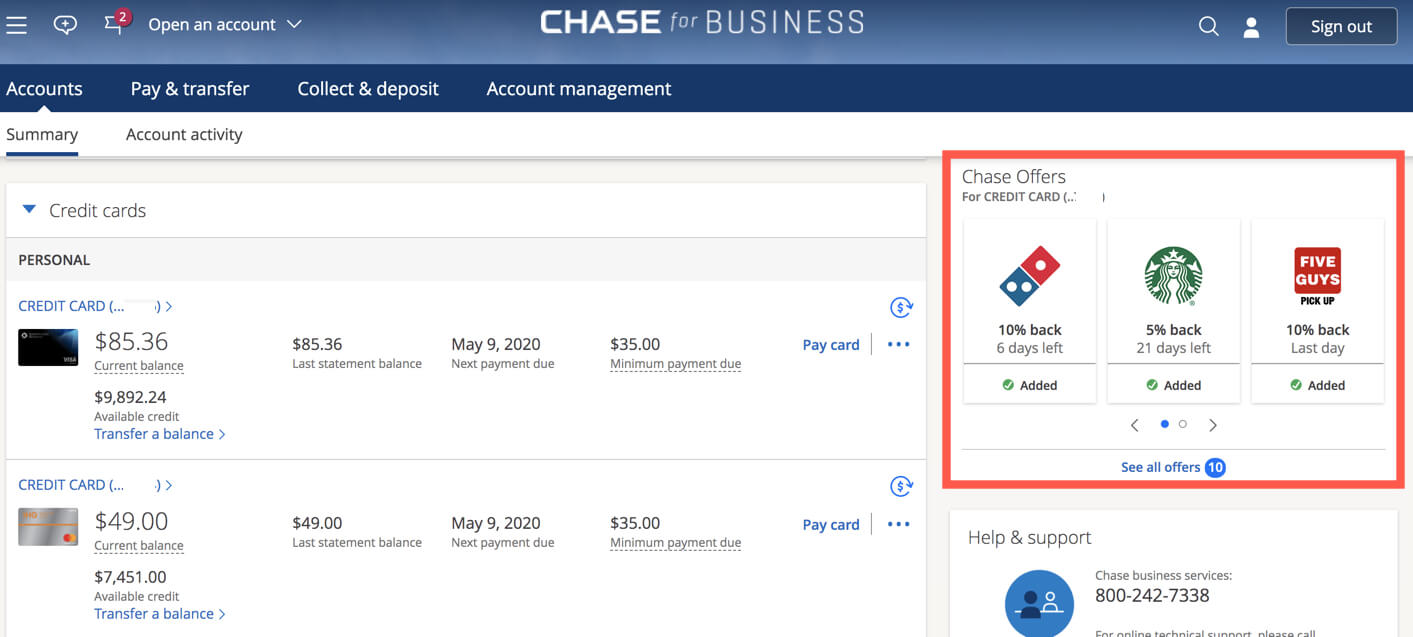

Once you log into your Chase account scroll down a bit and click on the Chase Offers box.

Scroll to the bottom of your account page

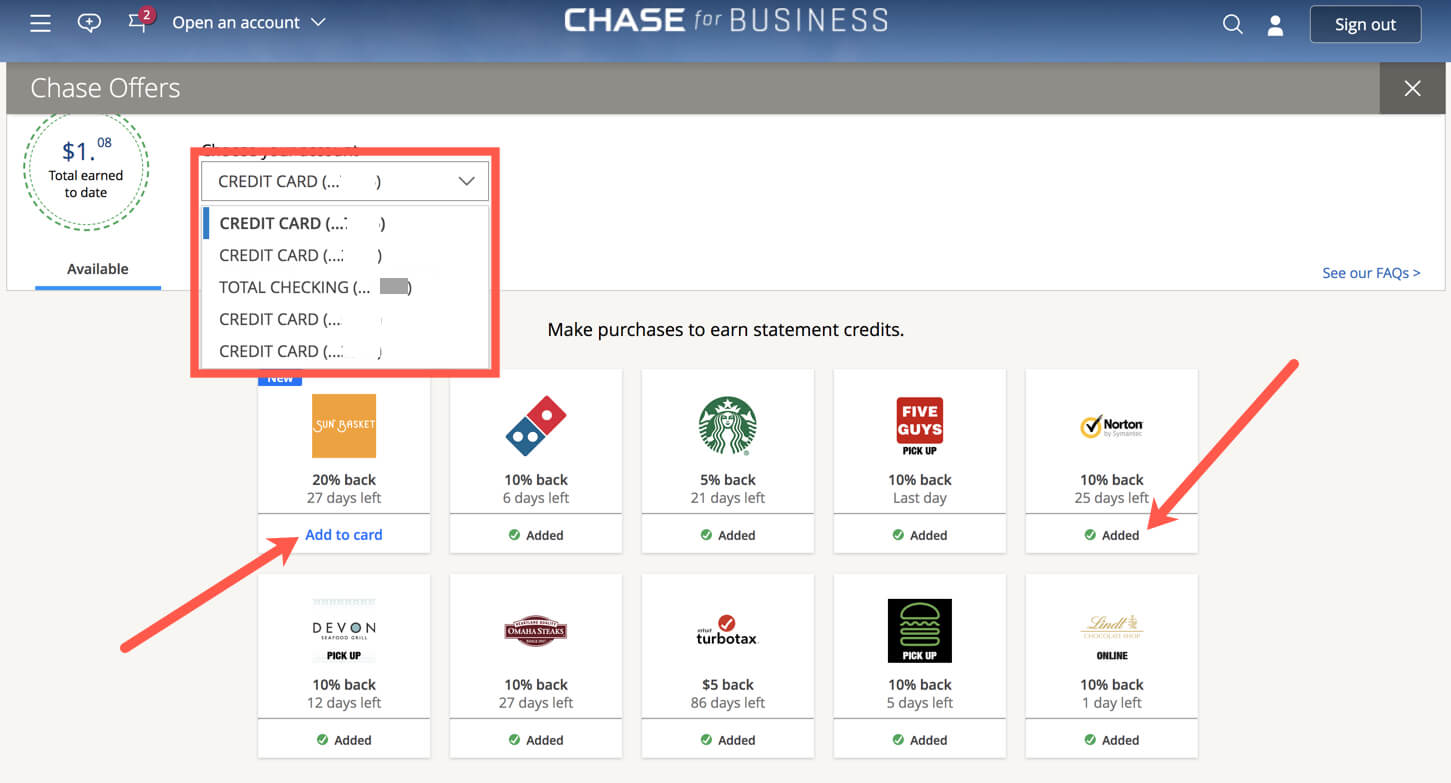

On the next page you can see which offers are available for each of your accounts. Click “Add to card” to add the offer, once it’s added it will be noted with a green checkmark.

To switch between accounts click the drop-down menu at the top of the page and pick the account you want to add an offer to.

Check your offer terms

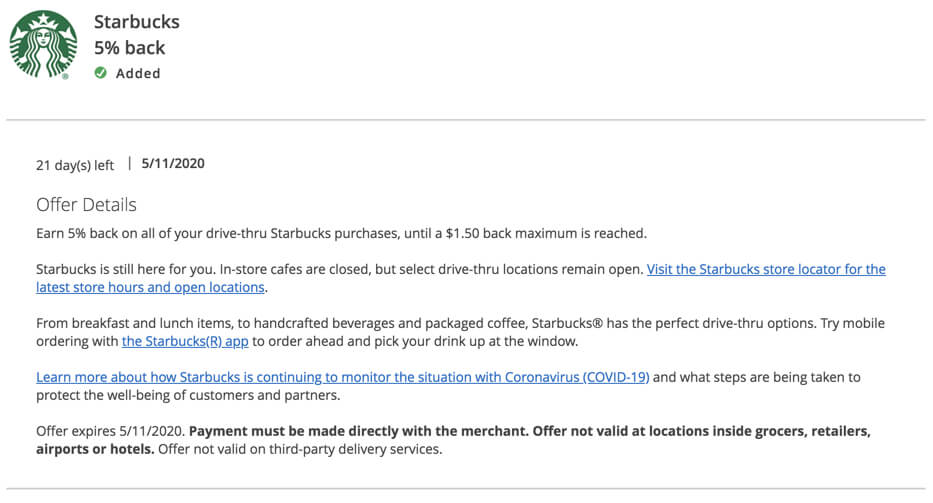

Each offer will have different terms, which you can see by clicking on the offer. Pay attention to the expiration date and what specific purchases will or won’t count. For example, this Starbucks offer I have on my Chase Sapphire Reserve® card will earn 5% back until I earn $1.50 (up to $30 in eligible spending). But, according to the terms, purchases from Starbucks located in airports, hotels, retail locations (like Target) or grocery stores won’t earn the cash back.

Bottom line

Chase Offers are an incredibly easy way to save money you’d probably be spending anyway and adding them to your cards is straightforward. Just sign into your Chase account, browse the offers on each of your cards and add the ones you want. Just remember to use the right card with the right merchant or you’ll miss out on your statement credit.

If you have cards like the Chase Sapphire Preferred, Chase Sapphire Reserve or IHG® Rewards Premier Credit Card, you’re eligible for these discounts.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Featured photo by Trong Nguyen/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!