How You Earn Flexible Bank Points With Several Cards in the Same Program

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Amy, commented:

Is American Express Membership Rewards similar to Chase Ultimate Rewards where you earn points on each card individually? Or are AMEX Membership Rewards points pooled into one account automatically?

Fantastic question, Amy!

When you have multiple cards that earn AMEX Membership Rewards points, all of your rewards will automatically accumulate in one account.

This is different from other flexible bank points programs like Chase Ultimate Rewards and Citi ThankYou where you earn points in separate accounts.

But with all 3 programs, it’s important to keep at least 1 card active to avoid losing all your flexible points.

I’ll explain how folks with multiple cards in the same program earn flexible points with AMEX, Chase, and Citi!

Earn Flexible Bank Points With Multiple Cards

Link: Beginner’s Guide to Using Flexible Points for Big Travel With Small Money

Link: The Trick to Travel Flexibility: Transferable Points

Link: Will You Lose Flexible Points If You Cancel a Card?

Emily and I love to earn transferable points. Because if we’re unsure of upcoming travel plans, flexible points give us the option to choose from dozens of travel partners when we’re ready to book flights or hotel stays.

And there are lots of great cards to earn flexible points across these 3 major bank programs:

- AMEX Membership Rewards

- Chase Ultimate Rewards

- Citi ThankYou

Lots of folks in the miles & points hobby sign-up for multiple cards in each of these programs. This way you can accumulate points more quickly to reach your travel goals!

Here’s how you earn points with several cards in the same program.

1. American Express Membership Rewards

Link: Keep Your AMEX Membership Rewards Points Active With No Annual Fees

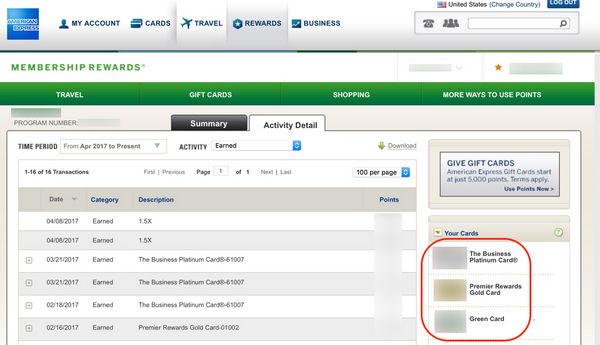

All points you earn from AMEX Membership Rewards cards are deposited into one account. This includes points from personal and small business cards.

This makes it easy to manage all of your points. Because you can quickly transfer points directly to airline and hotel partners without having to combine points from other cards.

Just remember, to avoid losing your AMEX Membership Rewards points, you must keep 1 card active.

2. Chase Ultimate Rewards

Link: Chase Sapphire Reserve Increases Value of Your Ultimate Rewards Points

Link: Not All Chase Ultimate Rewards Points Are Equal!

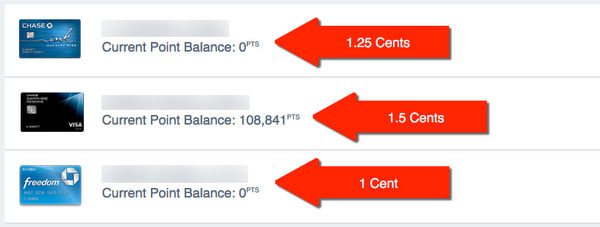

Folks with more than one Chase Ultimate Rewards card will accumulate points in separate accounts. So you’ll have to manually combine the points.

This is important because Chase Ultimate Rewards points can have different values depending on which card they’re linked to.

For example, points linked to the Chase Sapphire Reserve are worth 1.5 cents each for travel through the Chase portal. But points linked to the Chase Sapphire Preferred® Card are worth 1.25 cents each.

That’s why I recommend folks combine points to the Sapphire Reserve to increase the value of your Chase Ultimate Rewards points.

And keep in mind, you can only transfer Chase Ultimate Rewards points directly to airline and hotel partners if you move points to the following cards:

- Ink Business Preferred℠ Credit Card

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Plus (no longer available)

- Chase Ink Bold (no longer available)

So having one of these cards can make the points you earn on the Chase Freedom or Chase Freedom Unlimited more valuable.

And before cancelling a card, be sure to transfer points to a different Chase Ultimate Rewards card. Otherwise, you’ll lose your hard-earned points.

3. Citi ThankYou

Link: How to Combine Your Citi ThankYou Points for Big Travel

If you have more than one Citi ThankYou card, you’ll earn points in separate accounts.

But you have the option to combine Citi ThankYou accounts. Keep in mind, once your accounts are combined, they can NOT be separated.

There are benefits to combining your accounts because the redemption value of your Citi ThankYou points varies depending on the card.

For example, you’ll get 1.25 cents per point for points linked to your Citi Premier Card when you book hotels, cruises and car rentals through the Citi travel portal.

But if you book airfare, you might want to combine points to your Citi Prestige account. Because you can currently redeem points at a rate of 1.6 cents each for American Airlines and partner flights, and 1.33 cents each on other airlines with no blackout dates when you book through the Citi travel portal.

Note: Starting July 23, 2017, Citi ThankYou points linked to your Citi Prestige will be worth 1.25 cents each for bookings made through the Citi Travel Center no matter which airlines you fly.Bottom Line

The way you accumulate flexible points with more than one credit card in the same program depends on the bank.

With American Express Membership Rewards, you’ll automatically earn points in one account.

Folks with more than one Chase Ultimate Rewards card will earn points in separate accounts. But you can manually combine points to the card that gets you the most value.

And you’ll earn Citi ThankYou points in separate accounts. But you have the option to combine accounts. However, after they’re combined, you will NOT be able to separate them.

Thanks for the question, Amy!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!