How to set up a Capital One miles account

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It doesn’t take much to set up a Capital One miles account because you’ll be able to use your rewards as soon as you register your Capital One miles credit card, like the Capital One Venture Rewards Credit Card, online.

You don’t need to set up a separate Capital One account – it’s all right there under the same login. But there are some guidelines you’ll need to be aware of when it comes to earning and redeeming your Capital One miles. Here’s what you need to know.

How to set up a Capital One Miles account

First off, here’s a look at all of the Capital One Venture miles earning rewards credit cards:

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

If you have any of these travel credit cards, below are the criteria required in order to earn and continue earning and using your rewards:

- You must pay the minimum monthly amount due by the due date in order to continue accumulating rewards

- Most purchases will earn rewards, but there are some exclusions including things like travelers’ check purchases and cash advances

- Your account must be open and in good standing in order to be able to redeem your rewards

- You’ll lose your rewards if you close your account, but there’s no cap on the number of rewards you can earn and your rewards won’t ever expire

Capital One Venture miles are a favorite of many, mainly because it’s easy to earn Capital One miles. The rewards program is about as straightforward as it gets – the miles you earn are worth one cent each toward travel charges. There’s no worrying about award charts or blackout dates if you use them to “erase” the travel charges on your statement.

Plus, you now have the option to transfer Capital One miles to 17 airline and hotel partners where they’re potentially worth much more.

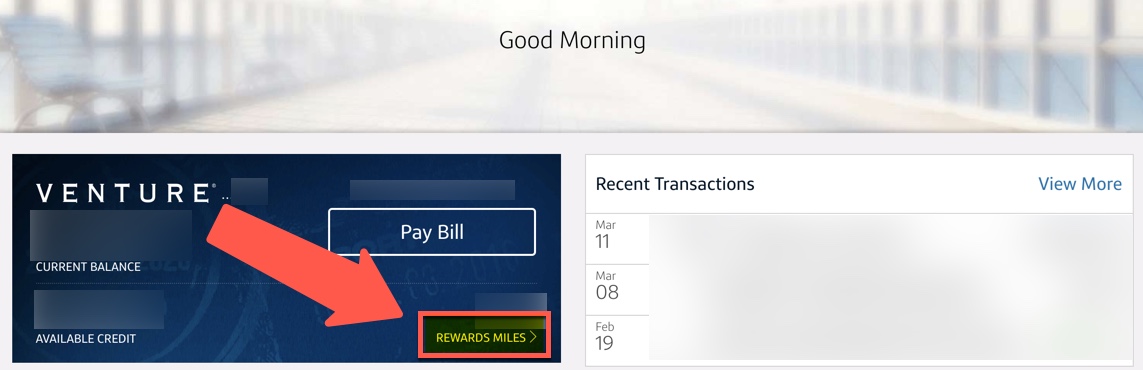

If you have the Capital One Venture card, for example, just log in to your credit card account and click “Rewards Miles.”

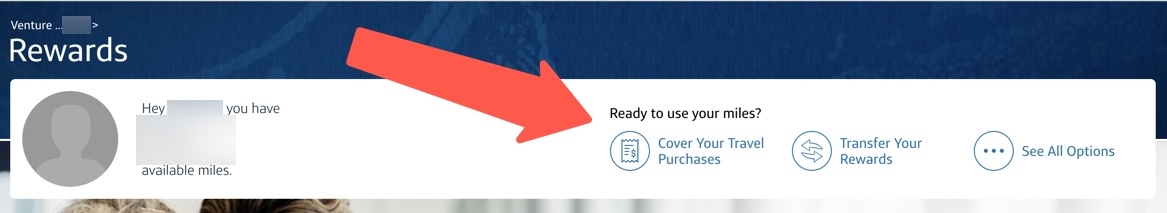

From there you’ll be able to use your miles however you’d like, either to cover your travel purchases or transfer to travel partners.

Again, it doesn’t get much easier than this.

The Capital One Venture – Our favorite for easiest to redeem rewards

Earning the welcome bonus on the Capital One Venture Rewards Credit Card is a super easy way to make your travel dreams a reality.

You’ll earn 60,000 Capital One Venture miles when you spend $3,000 on purchases within the first three months of account opening. You can use Venture miles for practically any travel purchase, like airfare, hotels, and rental cars. You can even use them for things that other miles and points don’t often cover, like Airbnb stays and Uber rides!

Or, you can transfer your miles to 15+ airline and hotel partners where they’re potentially worth much more toward award travel. In most cases, you’ll get a 2:1.5 transfer ratio, so it’s like earning 1.5 airline miles per dollar spent.

You can read our full review of the Capital One Venture card here.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!