How to Pay Rent With a Credit Card Using RadPad

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: On August 24, 2016, RadPad ended its promotion for free rent payments via Android Pay on the RadPad app. There is now a 2.99% fee for rent payments with a credit card. Update: Beginning September 7, 2016, you can add Chase Visa cards to Android Pay. Update: RadPad changed their fees as of August 17, 2016. Now you’ll pay, for debit cards, $4.95 for rents lower than $5,000 and $9.95 for rents over $5,000. For all credit cards there will be a 2.99% fee.Do you pay rent each month? If so, you can earn thousands of extra miles and points by using your favorite credit card!

RadPad allows you to pay your rent with a Visa, MasterCard, AMEX, or Discover card. And your landlord receives a regular paper check in the mail.Even better, you can use a credit card to pay your rent with NO fees through December 31, 2016, when you pay with Android Pay through the RadPad app.

I’ll show you how it works. And why you might consider using this service!

What’s RadPad?

Link: Pay Your Rent With RadPad

RadPad allows you to pay your rent online with any major debit or credit card. You can make rent payments up to $5,000 per month to your landlord or management company. Two friends of mine regularly use RadPad and have had no issues with rents being paid on time.

Debit card payments are $4.95 for payments under $5,000. And credit card payments have a 2.99% fee. But if you have an Android phone, you can make payments for free through December 31, 2016, with the RadPad app.

For example, if your rent is $1,000 per month, and you pay your rent from September through December 2016, you’d earn an extra 4,000 miles or points at the rate of 1 mile or point per $1 spent (4 months of rent X $1,000).

And if you have a 2% cash back card like the Fidelity Visa, you’d earn $80 to use as a statement credit into a eligible Fidelity account.

Here are the top cards I recommend for everyday spending.

If might NOT be worth it to pay RadPad’s fee every month. But if you want to quickly unlock a big sign-up bonus, or you find you’re having trouble meeting your minimum spending requirements, it could come in handy a time or two.

Or Meet Your Minimum Spending Requirements

Folks are always interested in ways to complete the minimum spending requirements on their new credit cards.

Depending on how much you pay each month for rent, you can quickly earn your sign-up bonuses.

For example, you’ll currently earn 3 complimentary nights at any participating Tier 1-4 Ritz-Carlton hotel after spending $5,000 on purchases in the first 3 months of opening the Chase Ritz-Carlton card. So using RadPad to make a rent payment could help you spend that amount to earn the bonus quickly.

And if you have a phone with Android Pay, your payments will be free when you pay your rent through December 31, 2016, via the RadPad app. That means an easy way to earn extra miles and points AND complete minimum spending requirements for free!

How Does RadPad Work?

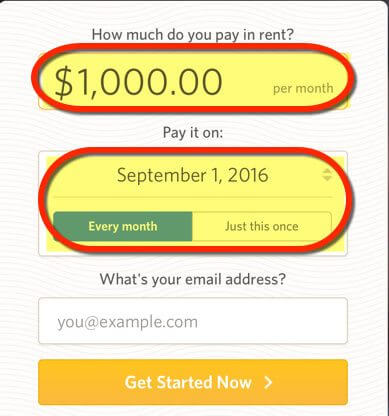

If you don’t already have an account, it’s quick to sign-up. To make a payment, fill-in your rent amount, due date, and email. The process is similar when you use the RadPad app to make a payment.

After you click “Get Started Now,” enter your landlord’s information.

You can schedule a one-time payment. Or set a date every month you’d like your rent to be delivered (like the 1st of every month).

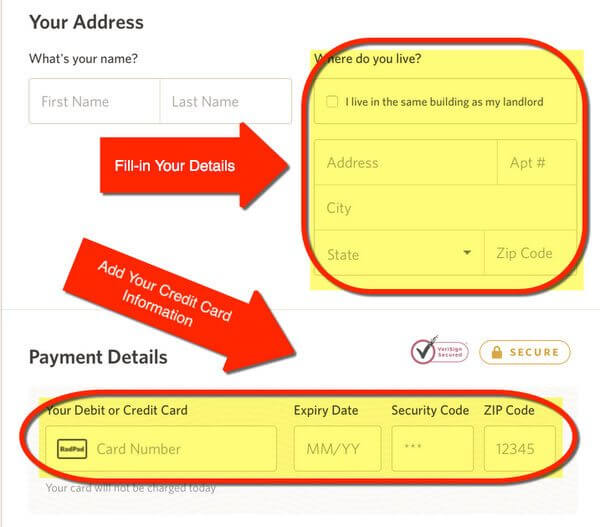

Tip: You can also pay rent to an individual. Select “I want to pay an individual instead.”Then, add your address, and the debit or credit card you want to use.

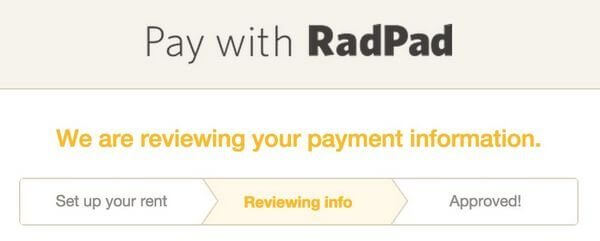

RadPad will verify your rent details. They might ask you to email a scan of your lease. So this is NOT a good way to send money to another person unless you pay them rent.

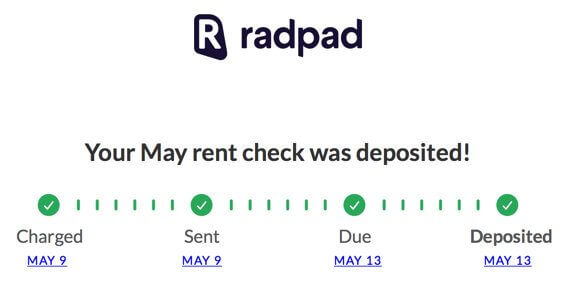

And RadPad is excellent about sending follow-up emails.

You’ll get an email when your rent is charged, sent, due, and deposited. So you always know what’s going on with your payment.

Your landlord or management company will receive a paper check to deposit to their account. And they do NOT have to sign-up with RadPad. The check they’ll receive is marked with your name. But sent from RadPad.

You can also invite roommates to pay rent. This is useful if you want to earn points and miles for your part of the rent. But you’ll have to get your roommate(s) on board with RadPad!

Are There Drawbacks?

If you can’t take part in the Android Pay promotion, RadPad charges a 2.99% fee for credit card payments.

In that case, I’d suggest Plastiq to make rent payments. Because they only charge a 2.5% fee with a Visa, MasterCard, or AMEX card. You can also pay other bills, like utilities, mortgages, and student loans.

So if you’re looking to meet your minimum spending requirements, your fees will be lower with Plastiq.

Also, you can NOT use RadPad to pay HOA fees, mortgages, or to send checks to others. RadPad will verify your details before they’ll send your first payment.

Aside from those things to keep in mind, friends report positive experiences paying their rent with RadPad. But as always, do what you’re comfortable with!

Bottom Line

RadPad is an easy way to make rent payments. And when you pay with a credit card, you’ll earn extra miles, points, or cash back. It’s also an easy way to complete minimum spending requirements! There’s a promotion for free credit card payments with Android Pay through the RadPad app until December 31, 2016. So folks with an Android phone can do well with RadPad through the end of the year!Friends of mine have used it for nearly a year with no issues. And I like how there are no extra steps required for the landlord or management company. RadPad simply sends a paper check on your behalf.

Have you had an experience with RadPad?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!