How to Find Better Citi Hilton Card Offers

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I told you the secret way to find better offers for the Citi® Hilton HHonors™ Reserve Card and Citi® Hilton HHonors™ Visa Signature® Card! In this post, I’ll give you more details.

After minimum spending requirements, you can get 50,000 Hilton points AND a $50 statement credit for your 1st $50+ Hilton stay with the Citi Hilton Visa offer.

And get a $100 statement credit for your 1st $100+ Hilton stay with the Citi Hilton Reserve card. The Citi Hilton Reserve is my favorite Hilton card because you can earn 2 weekend nights for use at almost any Hilton hotel!

Here’s how you can get the better offers!

Find Better Citi Hilton Card Offers

Link: My Review of the Citi Hilton Reserve Card

Link: 5 Great Hotels Where You Can Stay 2 Weekend Nights With the Hilton Reserve Card

Link: Do NOT Make This Mistake With Citi Hilton Reserve Statement Credit

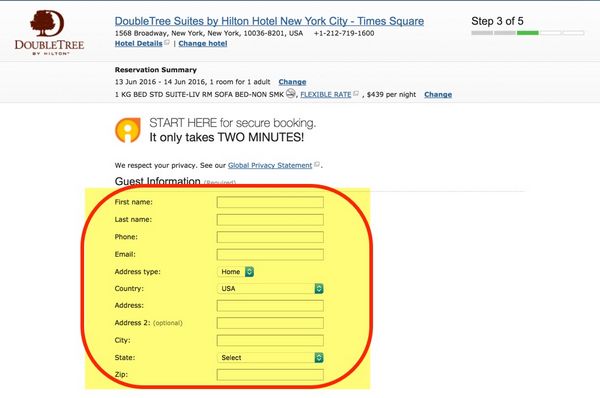

Hilton hotels includes Canopy, Conrad, Curio, DoubleTree, Embassy Suites, Hampton Inn, Hilton, Hilton Garden Inn, Hilton Grand Vacations, Home2Suites, Homewood Suites, and Waldorf Astoria brand hotels.First, go to hilton.com and make a test hotel booking. You can choose any hotel and dates.

I picked a 1-night stay at the DoubleTree Times Square.

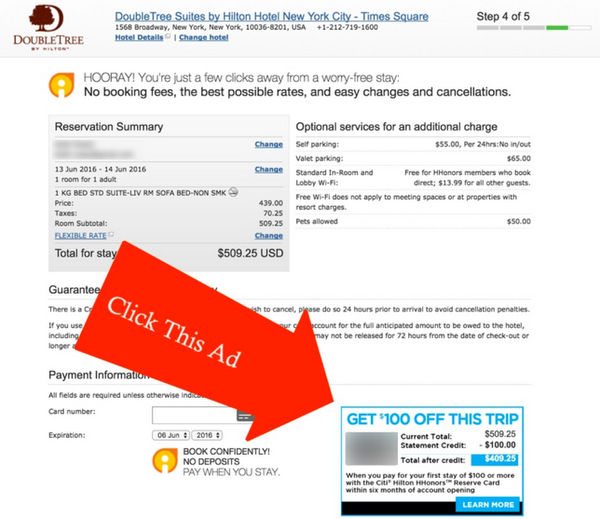

Next, before you pay for your reservation, you’ll see an advertisement to save $100 off your reservation.

And, just like that, you’ll see better offers for both Citi Hilton cards.

The regular offer for the Citi Hilton Visa card is 40,000 Hilton points after meeting minimum spending requirements with no statement credit. And the Citi Hilton Reserve card usually comes with 2 weekend nights after meeting minimum spending, without a statement credit.

Remember to earn the statement credit, you’ll have to spend the $50 or $100 at ONCE on your 1st hotel stay. Otherwise, you will NOT get the credit!

If you don’t have these cards, you can get both because they’re considered different card products. But Citi will only approve 1 credit card application per day, and no more than 2 every ~65 days. And you should wait at least ~8 days between applications.

If you already have these cards you can’t receive the sign-up bonus again on a Citi card if it’s been less than 18 months since you last opened or closed the card.

Other Hilton Card Offers

If you’re looking for other Hilton cards, both AMEX Hilton cards are offering their best ever sign-up bonuses. After meeting spending requirements, you can earn:

- 100,000 Hilton points on Hilton Honors™ Surpass® Card from American Express after spending $3,000 within the first 3 months

- 80,000 Hilton points on the Hilton Honors™ Card from American Express after spending $2,000 within the first 3 months

You’ll also get Hilton elite status with both cards. This means you can get a 5th night free when you book an award stay of 5+ consecutive nights.

Bottom Line

With just a few clicks, you can find better offers for the Citi Hilton Reserve and Citi Hilton Visa cards by making a test booking on hilton.com.

The Citi Hilton Reserve card is one of my favorite hotel cards because you can earn 2 weekend nights to use at almost any Hilton hotel! And the offer I found includes a $100 statement credit, which makes it even better!

Which is your favorite Hilton card?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!