How to file a Trip Delay insurance claim with Chase (my recent American Airlines delay fiasco was completely reimbursed)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

COVID-19 continues to haunt the travel world — and making no promises to slow. I thought this would be a good time to revisit Chase Trip Delay insurance. After all, Chase cardmembers with select cards are covered when paying for travel with their card (as are travelers on the same reservation). And while this novel coronavirus is a bit unprecedented, Chase says they’ll work with their cardmembers to find solutions to their travel troubles.

Here’s a real-life example of Chase Trip Delay insurance at work. My American Airlines flight over the holidays was delayed, causing me to spend an extra night in Dallas.

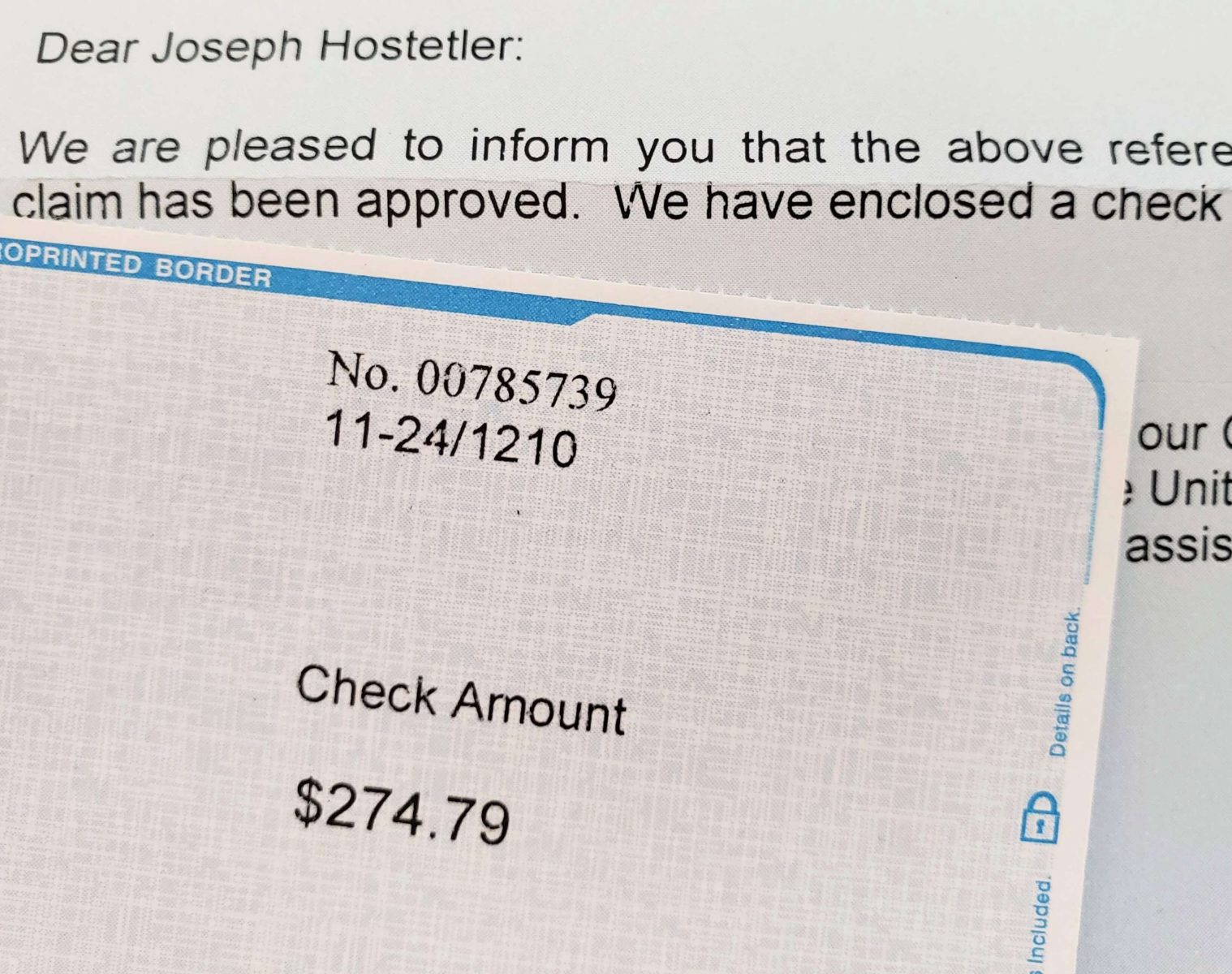

Because I used my Chase Sapphire Preferred® Card (one of the best credit cards for travel) to pay for the taxes on my award flight, I was eligible to be reimbursed for expenses related to my unplanned night. I filed a claim for the money I spent on food and a fancy hotel, and earlier this month I received my reimbursement from Chase. They approved every penny of my claim.

I’ll show you how easy it is to file a claim. And you can enroll in our newsletter for more need-to-know travel tips.

Receiving full reimbursement after my American Airlines flight delay

I’m no virgin to Chase travel claims — they cover a WHOLE BUNCH of travel ordeals in which I find myself. I’ve filed claims for:

- Scratching a rental car

- Delayed checked baggage (more than once)

- Trip delays (more than once)

The best part about the insurance you’ll get with the best Chase credit cards like the Chase Sapphire Preferred and Ink Business Preferred Credit Card travel insurance is the reliability. I’ve never had a claim denied, and I’ve received literally thousands of dollars back. One of the best features is its trip delay insurance. If you experience a delay of 12+ hours, or if you’re required to stay overnight, Chase will reimburse you for all your reasonable expenses. That includes stuff like:

- Hotel

- Meals

- Toiletries

- Transportation

As long as you pay for your airfare at least in part with one of these cards, you can be reimbursed. It’s also worth noting that Chase Sapphire Reserve® Trip Delay insurance kicks in after just six hours (that’s amazing).

Here’s how to file a claim if you’ve got one of the above cards.

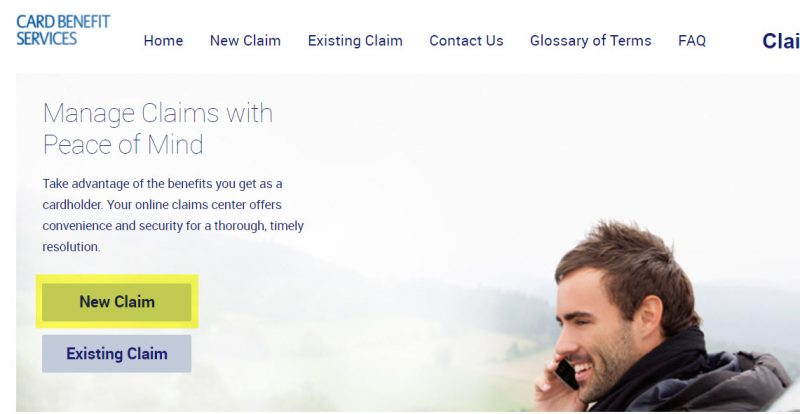

Step 1. Head to the Eclaims Line website

Chase processes everything through Eclaims Line. On the website’s home page, click “New Claim.”

And as you can see, it’s easy to modify a current claim by clicking on “Existing Claim.”

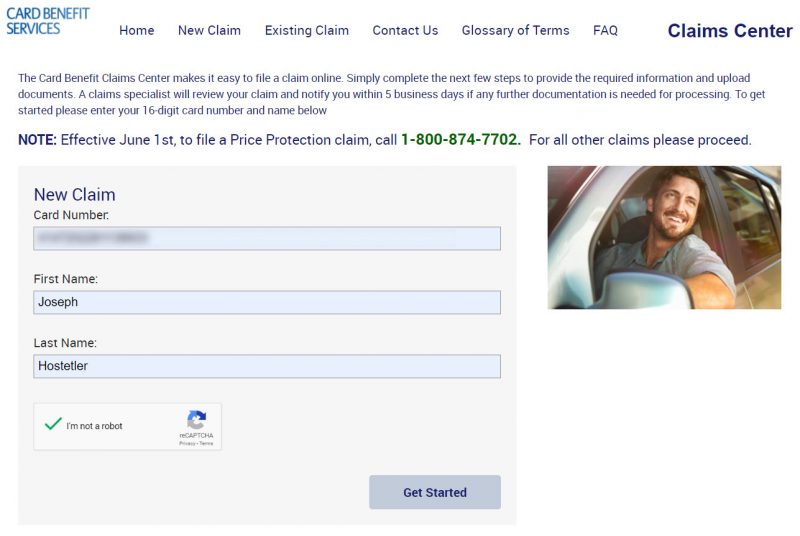

Step 2. Enter your card info

To begin your claim, you’ll need to enter the Chase card with which you reserved your travel plans.

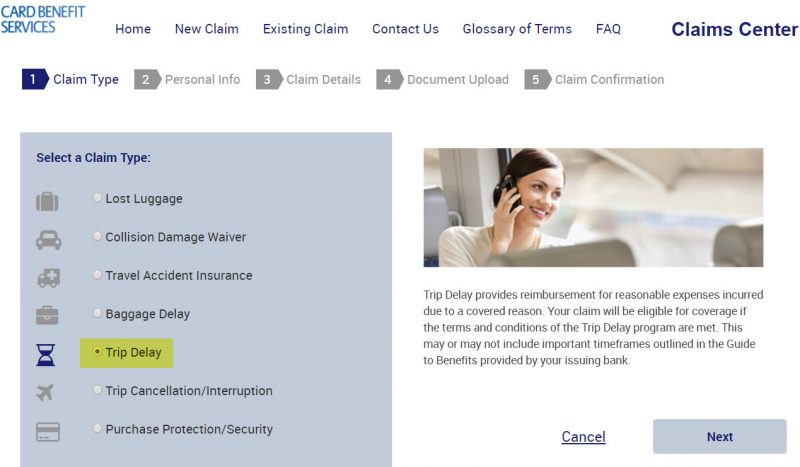

Step 3. Choose your claim type

Here is where you’ll see a full list of all types of claims you’re eligible for with your Chase card. Click “Trip Delay.”

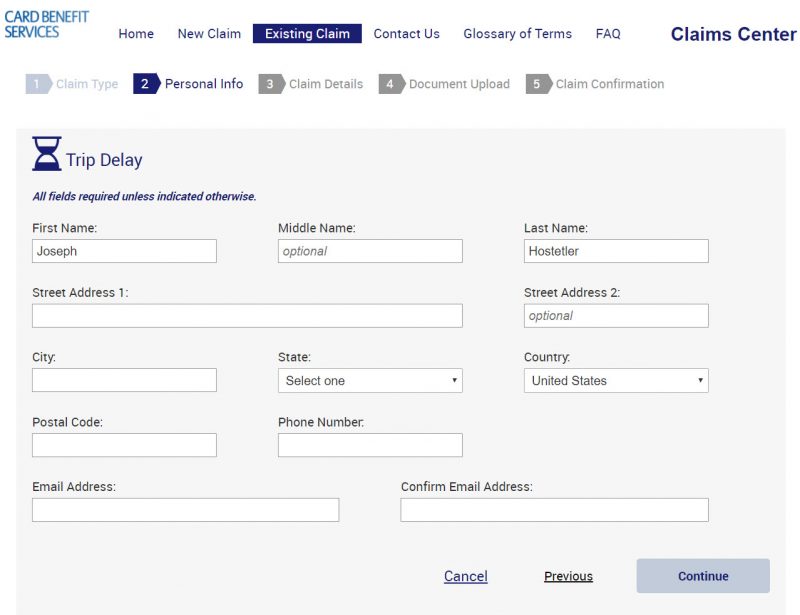

Step 4. Enter your personal info

It’s all easy stuff. Name, address, phone number, email, etc. It should match your card info.

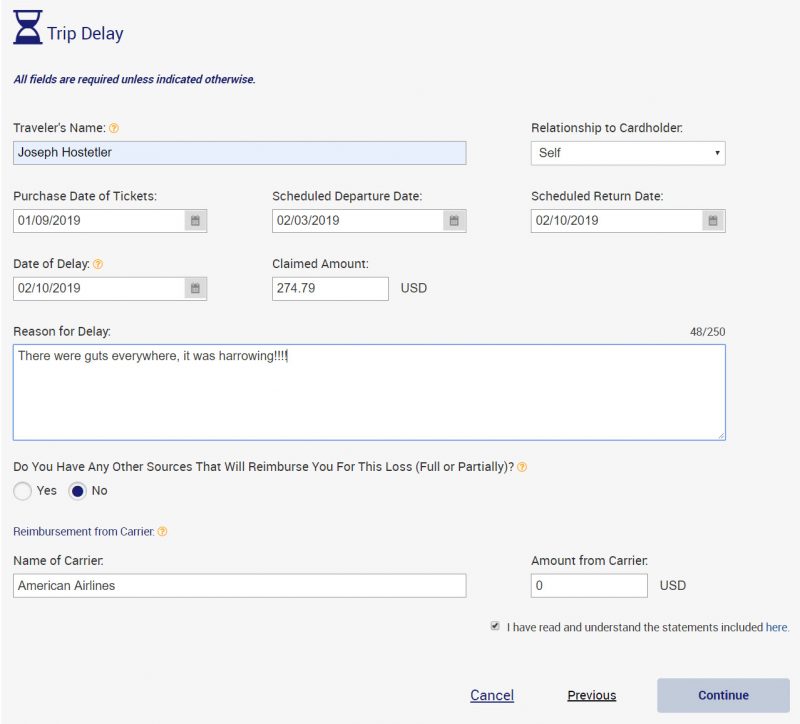

Step 5. Enter travel details

You’ll need to enter the dates of your trip, as well as the specific day you encountered a delay. Then enter the amount you want to claim, along with a short explanation for the delay.

For example: My flight was delayed from mechanical issues causing me to miss my connection which resulted in an overnight stay.

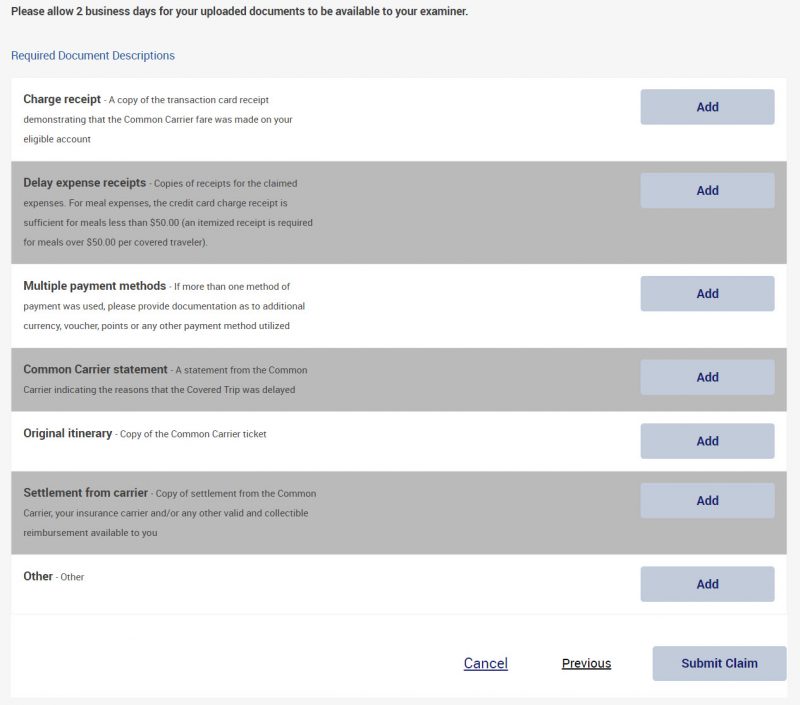

Step 6. Upload pertinent documents

This is by far the most laborious step. To substantiate your claim, you’ll need:

- Proof that the travel was charged to your card

- A copy of your ticket

- Copies of receipts for the claimed expenses

- A statement from the common carrier (i.e. the airline) indicating the reasons

the trip was delayed (check out my post on how to get one of those here)

Ensuring you have all the documents you need is a bit of a pain. But the half hour it took me to compile everything was definitely worth the ~$270 I received back. When I first submitted my claim, I was missing one piece of documentation. After I added the missing document, I received a check in the mail about one month later. Not bad!

Let me know if you’ve had experience with Eclaims Line. I’ve got nothing but glowing reports.

You can check out our post of the best travel insurance cards. And subscribe to our newsletter for more step-by-step guides like this.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!