Reader Question: Do You Pay Taxes On Hotel Award Stays?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

Million Mile Secrets reader Gabe writes in:

Hey Daraius, do you know when staying at a Hyatt on points are you charged taxes on top of the points?

I’m staying at the Park Hyatt in Milan next year and I wanted to see if I would be charged taxes because the confirmation email says something about 10% tax but I wasn’t sure if that was only for paid stays. Would I get taxed 10% on the going rate even though I’m using points? Thanks!

Hotels Charge Taxes On Cash Bookings

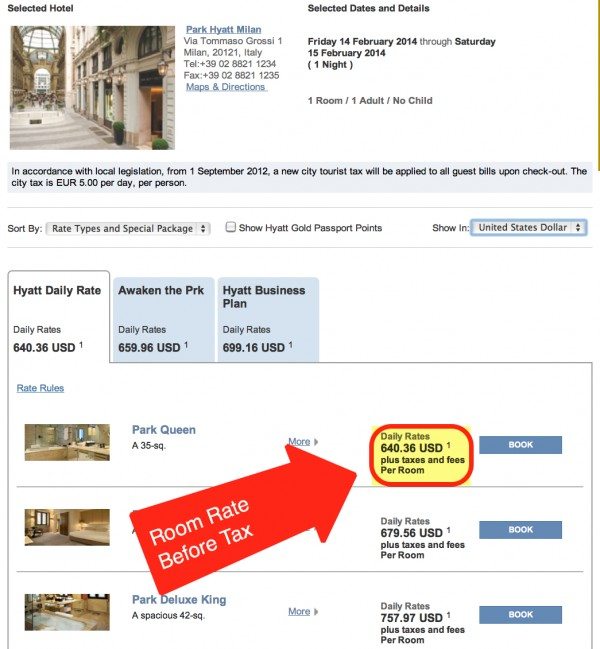

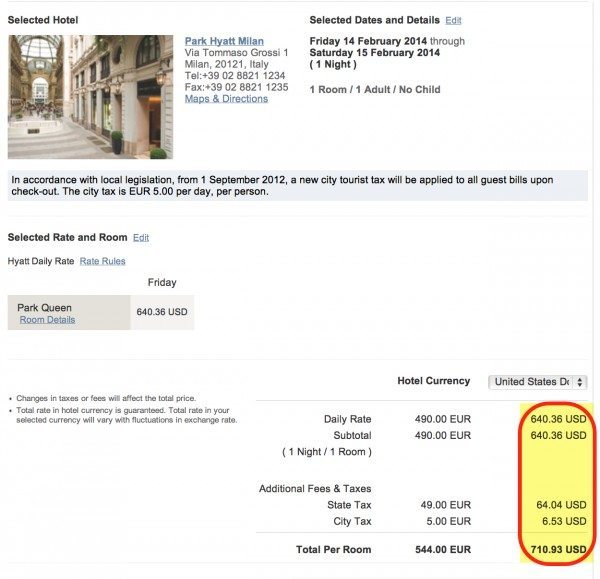

If you pay for a hotel with cash (not points), you also have to pay tax on the room price. The rate you see on a hotel website does NOT include taxes on the room.

For example, if you pay $640 in cash (instead of 22,000 Hyatt points!) for a room at the Park Hyatt Milan, your total cost is not $640.

Hotel Award Bookings Are Free

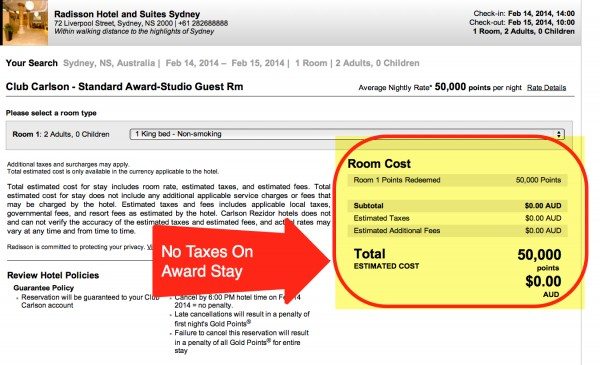

However, you don’t usually pay taxes on a hotel award stay.

Hotel award stays, unlike airline award seats, are usually completely free.

But There May Be Other Fees

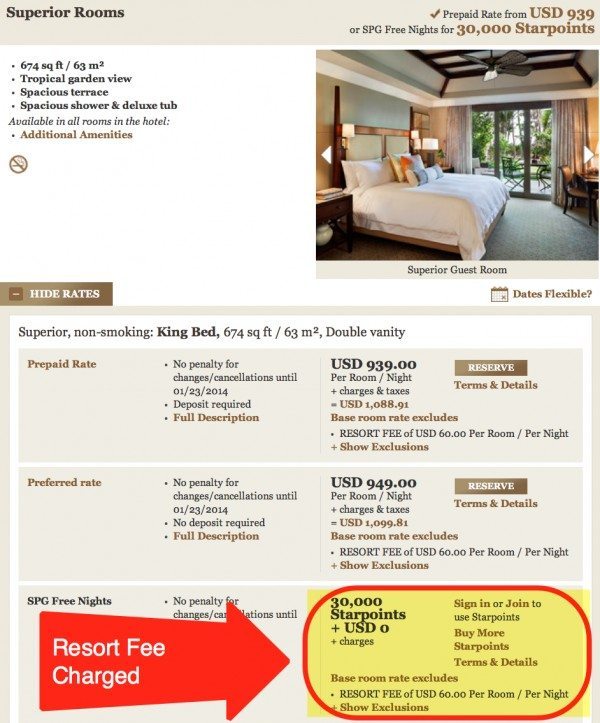

Even though you won’t pay taxes on a hotel award stay, you may have to pay resort fees in some hotels.

“Resort fees” are extra fees which some resort hotels charge all guests. These fees are a sneaky way to charge guests extra for things like newspapers, access to the fitness centers, (slow) internet connections etc.You will pay the resort fee for Best Western award stays.

For award stays at Club Carlson hotels, it is up to the individual hotel if they want to charge a resort fee on an award stay.

Some Starwood hotels charge resort fees even on award stays.

For example, the St. Regis Bahia Beach Resort in Puerto Rico charges a $60 per night resort fee EVEN on award stays!

I called a few hotel chains, and Hilton, Hyatt, Intercontinental Hotels Group, and Marriott said that they do NOT charge resort fees on award stays. Do note that you will pay resort fees if you redeem Hyatt points for select MGM hotels in Las Vegas, but not at other Hyatt hotels. You may see a resort fee mentioned on the hotel’s website, but you shouldn’t be charged the fee if you redeem points for the stay.

That said, I’m not sure how accurate this is for Marriott because Googling around brings up reports of folks charged resort fees on Marriott award stays.

We weren’t charged resort fees at the Hyatt Regency Maui when we stayed there in March. But you should always confirm if there are resort fees before you book the hotel.

However, you will have to pay valet and parking fees on award stays. Valet and parking fees are considered incidental expenses just like laundry or minibar charges. For example, we had to pay $30 for mandatory valet parking at the Grand Wailea in Maui.

Bottom Line

Hotel award redemptions are usually completely tax free, and you will not pay taxes on hotel award stays. This means that you really can get a free stay at a hotel using your points!

But you might have to pay a resort fee or valet fees if the hotel charges them, though resort fees are usually waived on award bookings.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!