How to File for Flight Delay Compensation With Chase & Citi Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.It’s tough to deal with delayed or canceled flights. But if you have an eligible Chase or Citi card, you have built-in insurance when your flight is delayed. And, you may be eligible for reimbursement toward certain expenses, like an overnight hotel room, meals, and toiletries.

To be compensated, you need to take certain steps. And file a claim.

I’ll show you how it works!

What Flight Delay Compensation Coverage Do You Have?

Link: Up to $500 Back When Your Trip Is Delayed With These Chase Cards

When your flight is delayed, you could receive reimbursement for certain items needed to make yourself comfortable including, but not limited to:- Hotel for an overnight stay

- Ground transportation

- Meals

- Medications

- Toiletries

- Rental car

That can go a long way toward making a difficult situation a little better!

But the exact coverage you’ll get, and how long you have to wait to file a claim, depends on which card you used to purchase your ticket.

I’ve written you can get up to $500 back with these Chase cards. Chase says:

Coverage with most Citi cards is almost identical in this regard.Trip Delay Reimbursement covers up to a maximum of $500 dollars for each purchased ticket for reasonable expenses incurred if your trip is delayed by a covered hazard for more than twelve (12) hours or requires an overnight stay. To be eligible for this coverage, you need to purchase either a portion or the entire cost of your fare using your eligible card. Coverage is in excess of any expenses paid by any other party, including applicable insurance.

However, if you have the Chase Sapphire Reserve, your coverage kicks in after 6 hours, instead of 12.

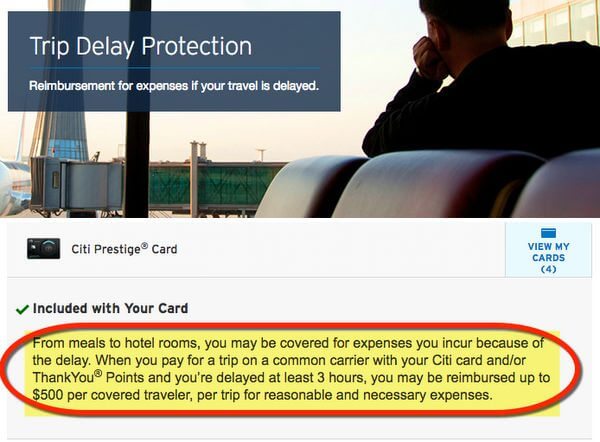

And folks with Citi Prestige only have to wait 3 hours. That’s the best trip delay insurance available!

So if your plane has an equipment failure, or if you run into inclement weather, natural disasters, labor strikes, or another very good reason why your flight is delayed, you are mostly likely eligible for flight delay compensation.

What’s NOT Covered

There are some situations where travel delay reimbursement might NOT cover your expenses, including:

- Advance notice (where the airline told you in advance about the delay but didn’t change your travel plans)

- Missed flights (because of oversleeping, running late, etc.)

- When you accept an offer or coupon in exchange for not boarding an overbooked flight

- When your delay is due to being involved in or under suspicion of any criminal act, illegal activities, or disruptive/abusive behavior

- If you prepaid expenses

So you aren’t covered if you overslept. Or if you’re misbehaving. 😉

It’s up to the claims department what they’ll refund you. As long as your expenses are reasonable, and you can demonstrate you needed the items you purchased, you have a good chance of being reimbursed.

Who Is Covered?

First, you must have paid for your ticket with the card whose benefits you want to use. Award tickets should be covered with both Chase and Citi, as long as the taxes and fees were charged entirely to your eligible card. This includes flights paid for with Chase Ultimate Rewards points or with Citi ThankYou points.

Chase only covers the cardholder and your immediate family, which is defined as your spouse, and children under 22 years old. So if you bought a plane ticket for your friend, they can’t use your benefit.

Citi is much more generous. They’ll cover family members AND any traveling companions. They say:

Family Members means your children, spouse, fiancée, Domestic Partner and their children, including adopted children or step-children; legal guardians or wards; siblings or siblings-in-law; son-in-law or daughter-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews.

Traveling Companion means any individual(s) for whom you have paid to travel on your or your Family Member’s Trip.

What to Do When You Experience a Delay

As soon as you realize your flight is delayed, start documenting.

For example, if the last flight of the night gets canceled and you’re forced to wait until the next morning to fly, that situation could qualify you for reimbursement. But it’s NOT enough to take screenshots of your delay. Or print out your new flight time. Because the claims processor will also need to see the reason for the delay.

While at the airport ask a customer service agent for a military excuse (you may have to ask for a supervisor). You do NOT have to be in the military to ask for one of these.

Tell the agent why you want the statement and ask that they include the following:

- That you were delayed

- The reason why you were delayed (mechanical, weather, etc.)

- How many hours you were delayed or that you required an overnight stay

As soon as your coverage begins, keep records of everything. If you grab a meal, buy a set of clothes, or book a hotel room, be sure to keep copies of all your receipts. Also, make sure each receipt is itemized so you can prove what you bought and that each one has a clear timestamp.

Keep in mind, if the airline offers you meal vouchers or volunteers to cover your accommodations, your trip delay reimbursement is second to that. But keep track of any additional expenses, because you’ll need records of everything once you begin your claim.

How to File a Claim With Chase

Within 60 days of your trip delay, you have to call the number on the back of your Chase card and talk to a benefits administrator to start a claim.

You have to submit your claim form within 100 days of the delay with the following:

- A completed and signed claim form

A receipt showing the trip was at least partially charged to your eligible card- Any additional documents requested by the benefits administrator

- Copies of your tickets (the original ticket and delayed trip ticket)

- Copies of receipts for claimed expenses

- Statement from your airline, cruise line, or train operator explaining why your trip was delayed

They will ask you to upload your documents online. Your benefits administrator will send you an email with the instructions.

How to File a Claim With Citi

Filing a claim is easy, especially if you keep your itineraries and receipts handy.

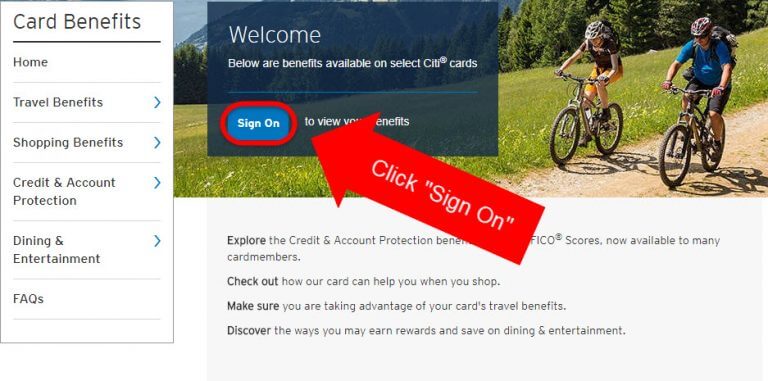

Step 1. Navigate to CardBenefits.Citi.Com

Go to the Citi Card Benefits website and sign-on to view your credit cards. From here you will be able to see all the benefits that come with each card.

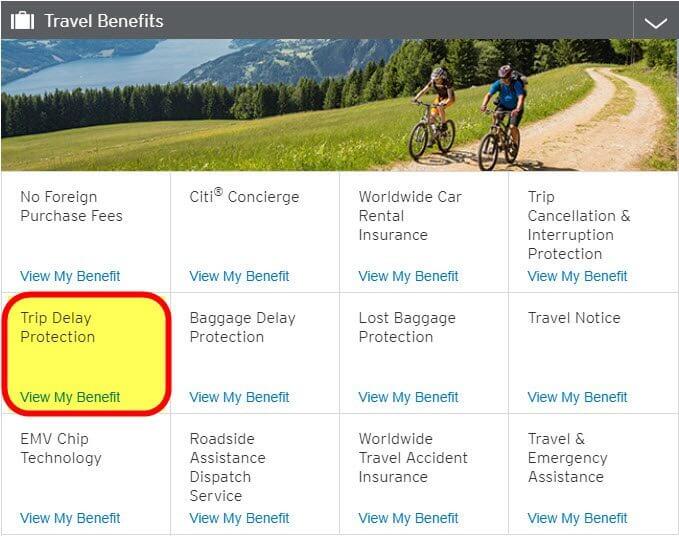

Step 2. Click on “Trip Delay Protection”

Scroll toward the bottom of the page until you find your card’s benefits. Find the “Trip Delay Protection“ benefit and click on it.

Step 3. Download a Claim Form

Scroll down until you find the “How to File a Claim” box. Click the”claim form” link to download a claim form.

Step 4. Send the Claim Form

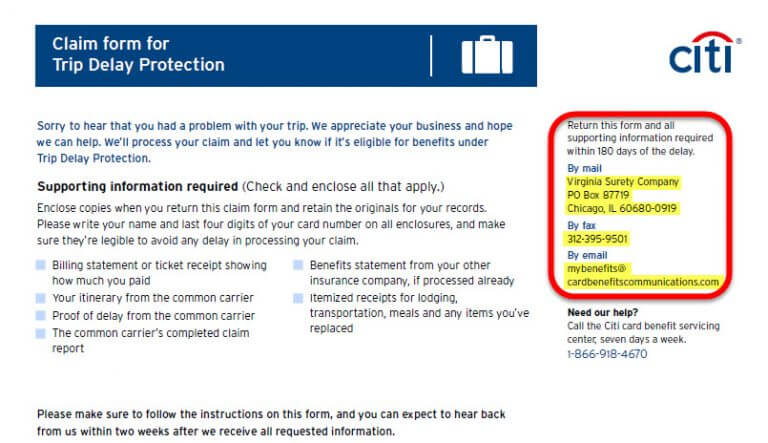

The form is 3 pages long. You will need to fill-out your contact information, details of the trip & delay, and an itemized list of expenses you are claiming. Because this coverage is secondary, you will also need to provide the information for any primary insurance coverage you may have.

You can send your form and the supporting documents by mail, fax, or email. You’ll need to submit your claim to Citi within 180 days of your delayed trip.

Bottom Line

Chase and Citi cards have some of the best travel insurance, including flight delay compensation.If you find yourself in a situation where you have to use it (but hopefully you won’t!), the key is to keep meticulous records from the start. And to ask for documentation from the airline stating the reason and number of hours you were delayed.

From there, it’s easy to file a claim. And folks report success getting some of their money back!

Have you had an experience getting reimbursed for a delayed flight?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!