Exploring the Amalfi Coast: How I’d Use 50,000 Chase Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of my favorite trips so far was traveling the winding roads around Italy’s stunning Amalfi Coast.

From the fresh seafood to the crystal clear water to the picturesque views, the Amalfi Coast is something everyone should experience at least once!

And with the sign-up bonus you can earn from the no-annual-fee Ink Business Unlimited℠ Credit Card, you could fly to Italy for just the cost of taxes and fees!

I’ll show you how you can use the sign-up bonus on the Ink Business Unlimited℠ Credit Card to get to Italy for nearly free!

Chase Ink Business Unlimited Credit Card $500 (50,000 Chase Ultimate Rewards Points) Offer

Apply Here: Ink Business Unlimited℠ Credit Card

Our Review of the Ink Business Unlimited℠ Credit Card

The Chase Ink Business Unlimited Credit Card is currently offering a $500 cash bonus (50,000 Chase Ultimate Rewards points) after spending $3,000 on purchases within the first 3 months of account opening.

What really sets this card apart is that it’s has no annual fee! Most business cards with high intro bonuses typically have annual fees attached, but this card doesn’t which makes the welcome bonus even more valuable!

In order to get the card, you need to be a small business owner. However, qualifying for a business credit card is easier than you think! You don’t need a large brick and mortar business to qualify – perhaps you sell items on Ebay or do some paid tutoring or coaching on the side? Any of those activities would qualify you as a small business when applying for a business credit card.

The Ink Business Unlimited Credit Card earns 1.5% cash back (1.5 Chase Ultimate Rewards points per $1) on all purchases you make! It also comes with a few additional benefits, including:

- Extended Warranty – extend the time period of a US manufacturer’s warranty by an additional year

- Purchase Protection – protection against damage or theft for up to 120 days on new purchases up to $10,000 per claim and $50,000 per account

- Primary Rental Car Insurance – you’ll get primary rental insurance when renting for business purposes which covers damage due to theft or collision to the vehicle

Get The Most Value Out of Your Ink Business Unlimited Credit Card Sign-Up Bonus

Currently, the Ink Business Unlimited Credit Card has a $500 cash back (50,000 Chase Ultimate Rewards points) welcome offer. Points earned from the card are worth 1 cent each toward cash back or paid travel through the Chase Ultimate Rewards Travel Portal.

However, a simple trick lets you turn that welcome bonus into travel worth much more! If you have the Chase Sapphire Preferred Card, Chase Sapphire Reserve, Ink Business Preferred Credit Card, or Ink Plus / Ink Bold (no longer available) cards, you can transfer the sign-up bonus you earn to one of these cards. Once you move those 50,000 points, you can really start to maximize the value of your points!

After combining your points, you can transfer them to Chase’s travel partners, like United Airlines or Flying Blue (Air France / KLM). Then redeem them for award flights to Europe!

The Insider Trick to Use Your Ink Business Unlimited to Fly Round Trip to Rome for Free!

Earlier I mentioned getting you to Italy using the sign-up bonus from the Ink Business Unlimited. I’ll walk you through step by step and show you how easy it is!

In order to earn the 50,000 Chase Ultimate Rewards point bonus, you will need to spend $3,000 on purchases in the first 3 months from account opening. This $3,000 in spending will earn you 4,500 Chase Ultimate Rewards points ($3,000 x 1.5 points per $1 spent), which in addition to the welcome bonus will give you a total of 54,500 Chase Ultimate Rewards points.

Step 1. Transfer Points to Flying Blue (Air France / KLM)

Flying Blue (the frequent flyer program for Air France and KLM) recently revamped their award prices, and though some flights have gotten more expensive, some have gotten cheaper! I’ve found some flights for as low as only 21,500 Flying Blue miles from New York to Rome using Flying Blue’s new award system!

Your first step is to find one of those flights on the Air France website, like the one above, and transfer 22,000 Chase Ultimate Rewards points to your Flying Blue account to cover your flight to Rome! We’re halfway there!

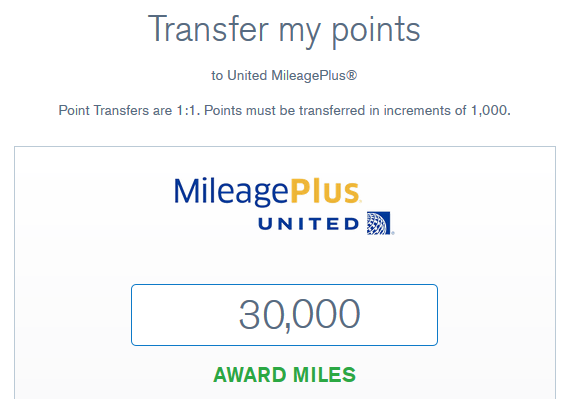

Note: Transfers are at a 1:1 ratio, but you can only transfer in 1,000-point increments.

If you’re able to find a return flight for the same number of miles, just repeat the process! But if not, you can also find inexpensive award flights on United Airlines.

Step 2. Transfer Points to United Airlines

Next, low level flights from Europe to the US on United Airlines or their partners cost 30,000 United Airlines miles. For the return portion of your trip you’ll want to find a flight home that works for you. If you were to book the above flight from New York to Rome on Air France, you could book any of the below flights home with United Airlines miles!

Just transfer 30,000 Chase Ultimate Rewards to your United Airlines account, book your flight, and you’re on your way!

So with the sign-up bonus and points from meeting minimum spending requirements on the Ink Business Unlimited Credit Card, you’ll have more than enough for a round-trip flight to Italy!

Bottom Line

Currently, the Ink Business Unlimited Credit Card has a $500 (50,000 Chase Ultimate Rewards points) welcome offer after meeting minimum spending requirements. You can turn this into Big Travel if you also have the Chase Sapphire Preferred, Chase Sapphire Reserve, Ink Business Preferred, or Ink Plus / Ink Bold (no longer available to new applicants).

You can combine points from the Ink Business Unlimited to one of those cards. Then, transfer your Chase Ultimate Rewards points to any of Chase’s airline partners to book award flights, getting you even more value from the card than you would if you just redeemed for $500 cash!

If you have a small business, you are eligible to apply for the no-annual-fee Ink Business Unlimited Credit Card and start earning Chase Ultimate Rewards.

Where would you go with 50,000 Chase Ultimate Rewards points? Let us know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!