Do You Need to Close Your Current Chase Credit Cards to Get New Ones?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader JRog @jcrew24 tweeted:

Should I get rid of 1 of my existing Chase cards in order to be approved for other Chase cards? I currently have 2 Chase Southwest cards and could close 1 of those accounts.

Great question, JRog!

Chase usually considers the total amount of credit they’ve extended to you, NOT the number of cards you have. So you do not have to close Chase cards to get new ones.

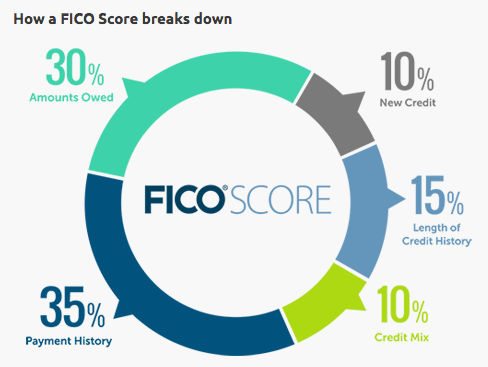

Plus, closing cards can impact your credit score! Although sometimes it might make sense to close a card, especially if it has an annual fee you don’t think is worth it.

I’ll show you how closing cards can affect your credit score. And explain more about Chase’s stricter rules, to help improve your odds of being approved for other Chase cards.

Closing Chase Credit Cards

With the new Chase Sapphire Reserve card, it’s no wonder folks are asking us how to increase their chances of being approved for Chase cards.

Chase offers some of the best miles & points cards. And you can get award flights, free hotel stays, or lots of flexibility, depending on which cards you choose.

Some card issuers, like American Express, limit the total number of cards they’ll approve you for. But Chase is more concerned with the amount of credit they’ve given you, not the number of cards you have.

So, JRog does NOT need to close 1 of his Chase Southwest cards to be approved for new Chase cards! Because Chase can often move credit from an existing Chase card to a credit line on a new card.

But keep in mind, because of Chase’s stricter approval rules, if you’ve opened more than ~5 credit cards (except these business cards) within the past 24 months from ANY bank, it’s unlikely you’ll be approved for most Chase cards.

Also, there’s almost no reason to ever close a no-annual-fee Chase card, like the Chase Freedom, because you can offer to move part of the credit line from that card to a new card, in case you aren’t approved immediately. And it doesn’t cost a thing to keep the card forever. 😉

JRog should also consider how closing a card might affect their credit score. Because closing cards will increase your credit utilization and decrease the average age of your accounts. This could cause your score to drop.

And you shouldn’t close cards too soon after you’ve received the sign-up bonus either.

In fact, I like to keep a card ~10 months and then decide if the card is worth the annual fee. Because this helps establish a good relationship with the banks.

And many cards offer perks like free checked bags and free hotel nights for keeping the card open.

Great Chase Cards

JRog wants to add a Chase card. I think we all do because of all their hot deals recently!

Here are my favorite current Chase offers:

- Chase Sapphire Reserve – my review of the most exciting card offer ever!

- Chase Sapphire Preferred Card – my review of my favorite card for beginners

- Chase Ink Plus – how small business owners can get Big Travel with this card

- Chase Ritz-Carlton – my review of this great deal for 3 complimentary nights

- Chase Freedom – my review of this card

- Chase Freedom Unlimited – my post about whether you should apply for this card

- Chase Southwest Cards – how to get (almost!) enough points for the Companion Pass

- Chase IHG Rewards Club Select Credit Card – my post about getting Big Travel with this card

And don’t forget to check the Hot Deals page for the latest offers!

Bottom Line

You do NOT have to close Chase cards you already have in order to be approved for new ones.

Because Chase is more concerned with the total amount of credit they’ve given you. And often times, they can move part of an existing credit line to a new card.

Just remember, because of Chase’s stricter approval rules, it’s unlikely you’ll be approved for most Chase cards if you’ve opened more than ~5 credit cards (except these business cards) within the past 24 months from ANY bank.

So you’ll need to plan ahead when applying for new Chase cards!

Thanks again for the question, JRog!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!