Cryptocurrency-earning credit cards have arrived — but are they worth it?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If I don’t have an intervention with myself every now and again, I can begin to value miles and points more than actual cash.

Being in the free travel game can blur your perception of what’s valuable and what’s not. Would I rather cash out 50,000 Chase points for $625 in free groceries, or transfer them to Virgin Atlantic for a round-trip business class seat between Washington Dulles and Senegal? I’d never take that flight normally, but it’s such a better deal that I end up forfeiting the $625 in helpful money to save $3,000 on a trip I’m not interested in taking.

Throw cryptocurrency into the mix. A number of cards have debuted this year that earn crypto currencies like Bitcoin instead of cash. Instead of miles. Instead of points. Why bother with anything other than travel credit cards?

Let’s take a look at a few of the most popular cards in the cryptocurrency world, just to see if they’re worthwhile.

Roundup of cryptocurrency-earning credit cards

BlockFi Bitcoin Rewards

Soon to be issued by Evolve Bank & Trust in spring 2021, the BlockFi Bitcoin Rewards is one of the easiest crypto credit cards to wield. It earns 1.5% back in the form of Bitcoin — There are no bonus categories to remember, no promotional hoops to negotiate. It’s the Chase Freedom Unlimited® of cryptocurrency cards. In other words, it’s not going to be the best option for most of your spending. The best travel credit cards have amazing bonus categories that can give you potentially 7%+ back for purchases on things like travel, dining, groceries, etc. Even other cryptocurrency cards earn a ton more than this one (we’ll talk about that later).

The card incurs a $200 annual fee — but it comes with a $250 Bitcoin bonus after spending $3,000 in the first three months of account opening, so it’s worth at least trying for the first year. Unfortunately, no other benefits have been unveiled for this upcoming card. It is made of metal, though!

MCO Visa Card

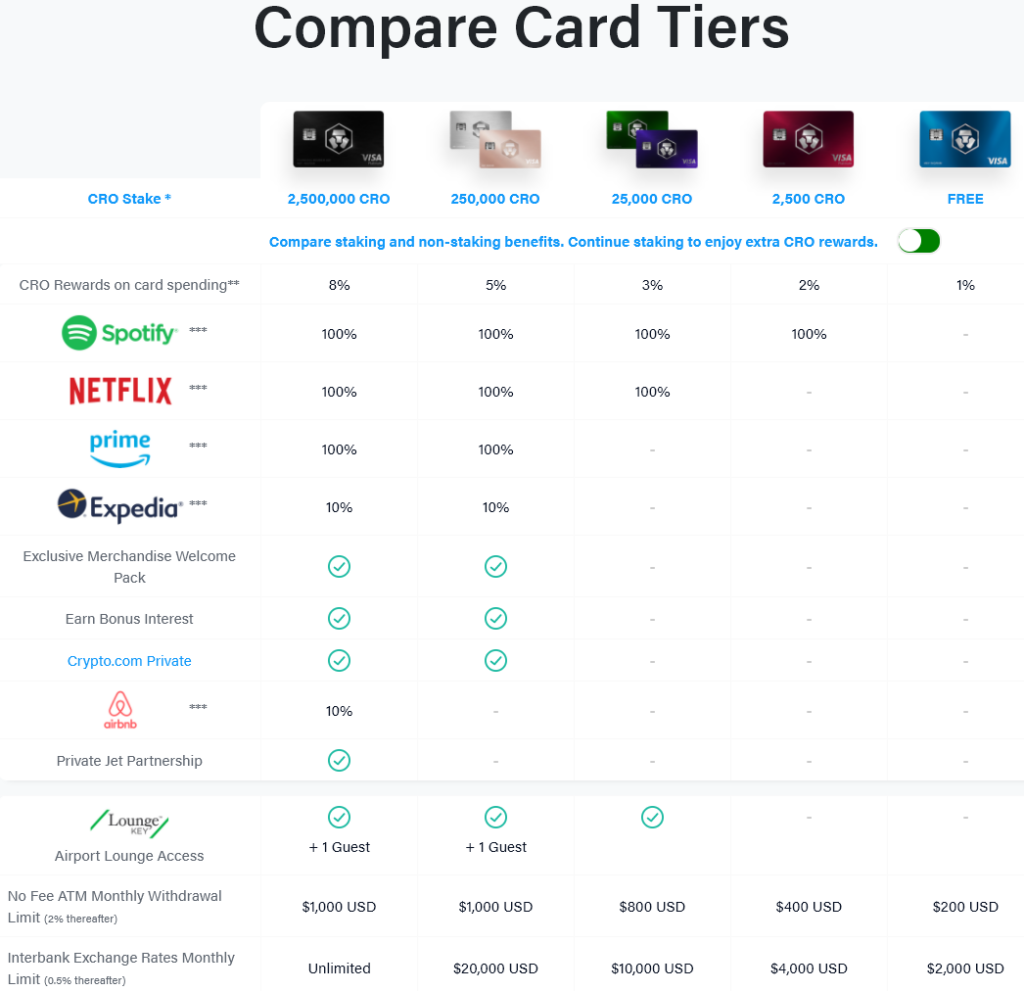

There are five tiers of MCO Visa Cards, all of which come with no annual fee. Each earns rewards in the form of the cryptocurrency CRO.

The type of card you have is based on the amount of CRO you have staked in your Crypto.com wallet in a six-month period. In short, this means you can’t touch your cryptocurrency during that time. This is to help incentivize customers to keep their cryptocurrency in the ecosystem, and prevent people from cashing out their stash and creating some kind of crash.

[ Subscribe to our newsletter for more credit card news and info delivered straight to your inbox ]

The more CRO you stake, the better the benefits you’ll get during those six months. If you choose not to stake your earnings, you won’t get any enhanced benefits (see below). The highest-tier requires 2,500,000 CRO — currently about $152,000 USD.

If you’re willing to invest sufficient capital in CRO, the ability to earn up to 8% back is nothing to sneeze at. And as you can see, depending on the tier you qualify for, you can receive up to a 100% rebate in the form of CRO for select merchants. All rebates are distributed monthly. For example, if you have Spotify Premium, each month you’ll receive the CRO equivalent of $12.99 in credits (the cost of Spotify membership). With Expedia, you’ll get 10% back, up to $50 in value each month. With Airbnb, you’ll get 10% back, up to $100 each month. Astounding savings if you can maximize it.

These rates are incredibly competitive with some of the better traditional cash back cards out there. That being said, you’re earning a currency that wildly fluctuates in value. So earning 4% back in CRO one day sounds pretty good, but those CRO coins could be trading for half the value the next (or double!).

Coinbase Card

The Coinbase Card is a simple debit card giving you the opportunity to spend your cryptocurrency with any merchant. Its presence lies in Europe, while the U.S. is still on a waitlist. You’ll be able to choose what type of rewards you earn, 4% back in Stellar Lumens (XLM) or 1% back in Bitcoin for your purchases. The card has no annual fee, but it tends to nickel-and-dime you a little bit for common things. For example:

- You have to pay 5 pounds or 5 euros to have a card issued to you — presumably $5 when it makes its way to the U.S.

- You’ll be charged a steep 2.49% cryptocurrency liquidation fee (though if you buy in USD Coin, USDC, you can avoid this)

- You’ll be charged a 3% foreign transaction fee if you use it outside your home country (on top of the 2.49% fee)

The 2.49% exchange fee really kills the value of this card, and puts it far behind the others in terms of earning rewards.

Earning cryptocurrency vs. cash back vs. travel rewards

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

While it’s pretty exciting to see these new rewards options, you’re still probably better off with a standard travel credit card or cash back credit card. Here’s why:

Take the Citi® Double Cash Card, you earn 1% cash back on all your purchases and another 1% cash back on payments. Essentially, you’re earning 2% cash back on all purchases. That beats all of the other crypto credit card earning rates (outside of depositing a whole bunch of cash into CRO). If you do want to purchase crypto, you can still use that cash back from the Double Cash (or any other cash back card) to purchase the currency of your choice. The information for the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

For example, if you spent $1,000 on the Citi® Double Cash Card, you’d end up with $20 in cash back and could then purchase $20 of Bitcoin (or any other cryptocurrency) through a website like Coinbase or SoFi. However, if you spent $1,000 on the BlockFi card, you’d end up with $15 in Bitcoin. The Double Cash card also doesn’t have an annual fee, while you have to put $150 upfront to earn Bitcoin through the BlockFi card.

Sign up bonuses could be a quick way to earn cash to purchase crypto. Take the Chase Sapphire Preferred® Card, it comes with a 100,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Those 100,000 points can be cashed out for a $1,000 statement credit. Again, you could take that cash and purchase any sort of cryptocurrency through the brokerage of your choice.

And if you’re interested in travel, those 100,000 Chase can be worth $1,700 towards travel based on our valuation of Ultimate Rewards points at 1.7 cents each. Unless you want to invest long-term in crypto or are willing to deal with the volatility of crypto markets, the best short term bet for your points is to use them for travel redemptions.

Finally, it’s important to note that many cryptocurrencies see huge fluctuations in value, often within days or weeks. Be prepared that the rewards you earn could be worth a lot less, or more, one day to the next.

Bottom line

It’s exciting to see a new form of credit card rewards come to the market. The MCO Visa card’s rewards rates are enticing. I wouldn’t mind picking that up myself — in addition to my lineup of 20+ travel credit cards.

If you’ve got a favorite cryptocurrency earning card, let us know in the comments! And subscribe to our newsletter for more credit card news and info delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!