These 3 Mistakes Can Kill a Deal – Here’s What You Need to Know Before You Transfer Your Flexible Credit Card Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

When you’re first starting out with miles & points, I always recommend earning transferable or flexible credit card points. You can transfer flexible points, like Chase Ultimate Rewards, to various airline or hotel partners. This is a huge advantage because you aren’t stuck having to book a trip with a single airline or hotel chain. So you can pick and choose the sweet spots from multiple loyalty programs.

If you’re not familiar with how transferable points work, I’ll explain the basics and cover a few simple mistakes to avoid when you’re making your first transfer. If you want more miles & points tips, tricks, and deals, then subscribe to our newsletter and we’ll send them to you daily.

Mistakes to Avoid When Making Your First Credit Card Miles Transfer

Not all miles and points are created equal. When it comes to travel rewards there are 3 main types of miles and points:

- Airline miles

- Hotel points

- Bank points

Companies create reward programs to help build loyalty. So you will never be able to transfer points between competitors. Airline miles don’t transfer to other airlines unless they are owned by the same parent company and the same goes for hotel points.

In most cases, you’re able to move miles or points between accounts within the same company. But there might be a fee for these transfers. Most airlines charge you to transfer miles from one account to another. And most hotels allow you to make transfers between accounts for free. But the rules vary for each individual hotel or airline rewards program.

If you want the most flexibility, the sweet spot is with points that are flexible and allow you to convert them into lots of different types of airline miles or hotel points. Below are our guides to each of the major transferable points programs:

Each of these loyalty programs allows you to transfer your points to multiple airlines. And some even allow transfers to specific hotel chains.

When you transfer points from the above programs to an airline or hotel chain, there is no fee you’ll need to pay. The only exception to that rule (there’s always one isn’t there?) is when you transfer AMEX Membership Rewards points to US airlines. You’ll pay an excise fee of 0.06 cents per point up to a maximum of $99 when you transfer your American Express Membership Rewards points to a US airline.

If you’re interested in earning flexible rewards, I suggest reading the guides listed in the bullet points above. But before you make that first transfer, here’s what you need to know.

1. The Cost and Availability of the Award You Want to Book

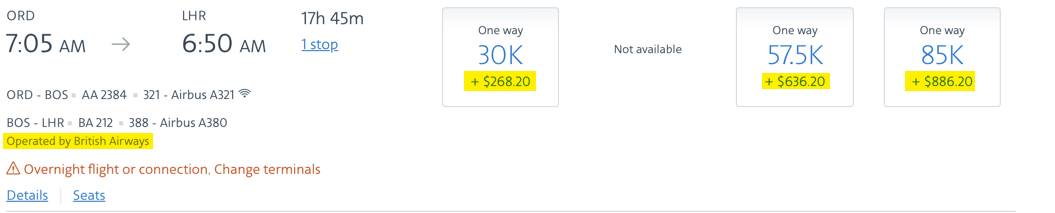

Once you know what airline or hotel you want to travel with, you should make sure there are award nights or flights available when you want to travel. You don’t want to make the transfer in hopes of being able to find travel that works for you. This is doubly important if you plan on traveling during peak season or to a popular destination.

Airlines only release a limited number of award seats, especially in Business and First Class. Other times, you might find an available award ticket but not at the cheapest award level.

In general, I’ve found it easier to find available award nights with hotels compared to award tickets, but some programs (and even specific hotels) play games with what nights or rooms are available to book with points. Lots of hotels advertise “no blackout dates” for award stays, but it doesn’t always work this way in practice.

Usually, the no blackout dates policy applies only to certain room types, like standard rooms, and the hotels get to choose which of their rooms qualify as “standard.” Or you might be able to book the last available room with points, but the price will be astronomical.

Once you’ve found a flight or night you can book with points, you’ll want to make sure you’re aware of all the costs associated with your “free” travel. Hotels in certain areas (Hawaii, Las Vegas, New York) have been getting worse with adding resort or destination fees even on award stays. And there can be extra fees for stuff like parking, which can really add up on longer stays.

But some hotel loyalty programs waive these fees on award stays or for members with elite status!

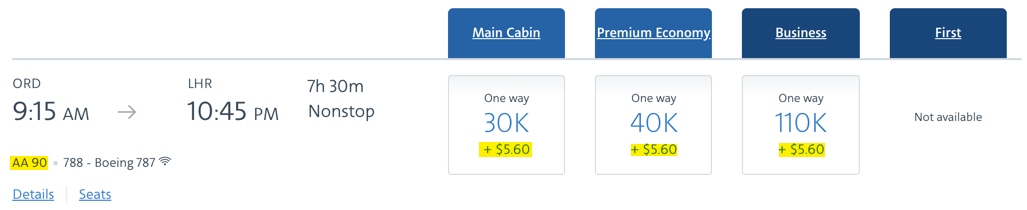

Watching out for extra fees is especially important when you’re making your first international award flight booking. You’ll always pay taxes on award flights, but if you’re only flying domestically it’s a reasonable ~$6 fee per one-way ticket. That’s not the case for most international destinations. Fly to the Caribbean and plan to pay an extra $70+ per ticket, and it can be way worse if you’re going to Europe.

But taxes aren’t the biggest expense to pay attention to; fuel surcharges (aka carrier-imposed surcharges) can be an absolute deal breaker. Most US airlines don’t add fuel surcharges to award flights, but sometimes they do if you use their miles to book a flight with one of their partners.

For example, you can use American Airlines miles to book flights with British Airways. Even though American Airlines doesn’t add fuel surcharges to award flights on their own planes, they do add fuel surcharges to award flights on British Airways planes.

There are some frequent flyer programs that don’t pass on fuel surcharges at all, like United Airlines, which makes them a better option for booking award flights on certain airlines. And there are other airlines that tack fuel surcharges onto award flights for some partner award flights, but not others, like Air Canada and American Airlines.

So when you’re pricing out an award flight, the miles or points cost is only one thing to consider. You don’t want to transfer your credit card points to one airline only to realize you could have saved $100s in fees be transferring them somewhere else.

2. Transfer Times

Before you transfer flexible credit card rewards to an airline or hotel, you’ll want to make sure that there is an available award for you to book. Once you’ve found that, you’ll need to know how long it will take for your bank points to show up in your loyalty account.

Many transfers are instant, but not all of them. And that makes a big difference.

With instant transfers, you can find the award you want to book, make the transfer, and book it. But if the transfer will take a day or a week, the award you wanted could easily disappear while you’re waiting for the transfer to go through.

There are some airlines that allow you to put an award flight on hold, which gives you some time to complete the transfer. Singapore Airlines will typically allow you to put an award on hold for up to 2 weeks for their own flights. And Flying Blue, the loyalty program for Air France and KLM, will let you hold an award for 3 days for any of their flights or awards with their SkyTeam partner airlines.

It’s not a guarantee the airline you want to transfer to will allow holds, but it’s worth checking because it can be a lifesaver.

3. All Transfers Are Final

When you’re transferring bank points to an airline or hotel they only move in one direction – once you complete the transfer you can’t transfer them back. So it’s best to wait until you’re ready to book to make a transfer. Once you hit the transfer button you’ve committed to one loyalty program and lost your flexibility.

The one exception to the “don’t transfer until you’re ready to book” rule is when there is a transfer bonus. Sometimes you’ll get a bonus for transferring to a specific airline. AMEX Membership Rewards and Citi ThankYou often have bonuses from 15% to 40% for specific partners.

For example, for the next couple of weeks, some folks have been targeted for a bonus when transferring hotel points to Etihad or Aeroplan. Hotel transfer bonuses like these can make Marriott transfers a good deal.

If the bonus is a particularly generous one and you’ve got a flexible schedule, it can make sense to transfer when there is a transfer bonus and use the points later. Just be aware that there is no guarantee that you’ll be able to find available award seats in the future when you want to travel.

Hopefully, these tips help make your first flexible points transfer to an airline or hotel a bit less painful. If you’re an old hat at this, what do you wish you’d known when you first started learning about miles & points?

To get more miles & points tips, tricks, and deals sent straight to your inbox, subscribe to our newsletter:

[gravityform id=”3″ title=”false” description=”false”]Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!