You can now convert Southwest vouchers into points — but should you?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

In light of the restrictions COVID-19 has imposed on the travel industry, Southwest just announced a new flyer-friendly policy: You can now convert Southwest travel vouchers into Southwest Rapid Rewards points. Here’s how the conversion process works, and why it’s worth considering. (Hint: You’ll get more value when you turn vouchers into points!)

How to convert Southwest travel vouchers into Southwest points

When you purchase a Southwest flight, you can cancel it for free and refund yourself in the form of “travel funds.” These can be used towards future Southwest flights.

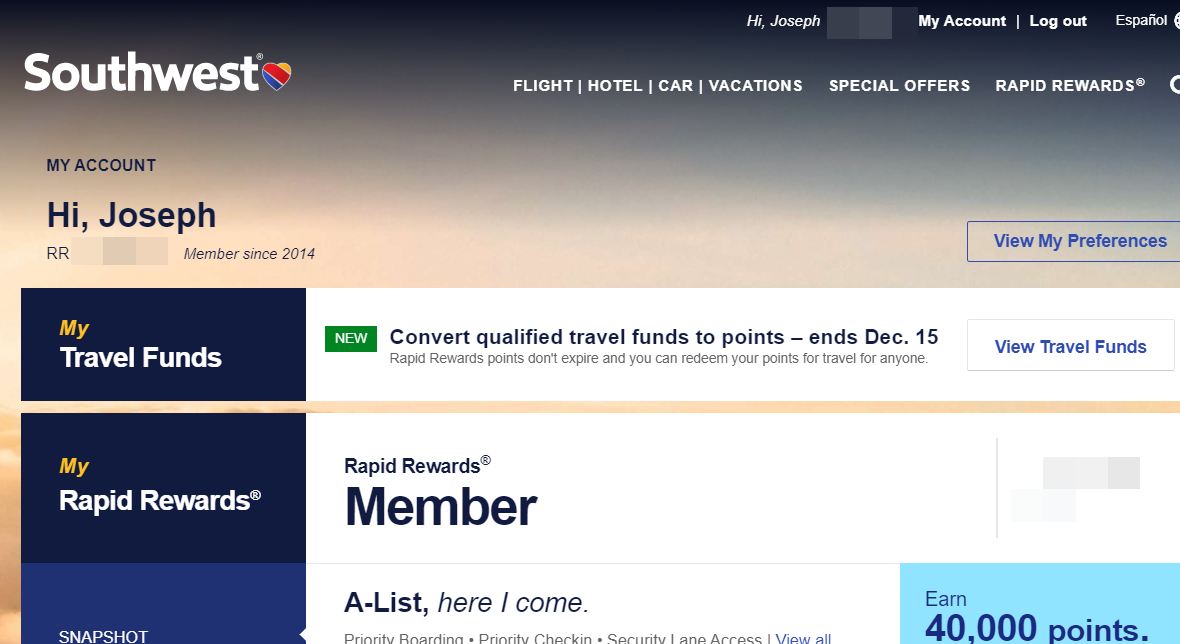

If you’ve got Southwest travel funds that expire by September 7, 2022, Southwest is giving you the option to convert them into Southwest points. You must do so before December 15, 2020, through this link. You’ll see the link at the top of your Southwest account after signing-in.

For every 1.28 cents you have in travel funds, Southwest will give you 1 Southwest point. If you’ve got a $50 travel fund, you can convert it into 3,906 Southwest points. Note that you cannot convert travel funds into points in an account other than your own. The name on the travel fund must be the same as the Southwest Rapid Rewards account in which you’re requesting a points deposit.

Is this a good deal?

Southwest travel funds expire within two years of purchase. In other words, you can generate points when you:

- Purchase and cancel Southwest flights to receive Southwest travel funds until September 7, 2020

- Convert those travel funds into points by December 15, 2020

But why would you want to do this?

1. You can purchase Southwest flights at a discount

With this method, you’re essentially buying Southwest points for 1.28 cents each. The average value of Southwest points is 1.5 cents toward Southwest flights, although redemption values can sometimes be as low as 1.3 cents per point. For example, if you open a personal Southwest credit card and earned its 65,000 point bonus after spending $2,000 on purchases in the first three months of account opening, you could redeem them for $835 to $975 in Southwest flights.

Buying points for 1.28 cents and redeeming them for 1.5 cents is a nice way to get a sizable discount on Southwest flights you’d pay for anyway.

If you have any Amex airline incidental credits left, you may be able to effectively turn those credits into Southwest points. Southwest flights under $100 have been known to trigger the Amex airline credit (although this is an unofficial method and may not always work). You can buy a cheap Southwest flight which will hopefully trigger the airline credit on your Amex card, cancel the flight, receive a refund in the form of a travel voucher and then convert the voucher into points.

2. You’ll earn bonuses on Southwest gift cards

You can find Southwest gift cards at many grocery stores, which allows you to take advantage of grocery store bonuses that come with the best grocery credit cards. For example, the Blue Cash Preferred® Card from American Express offers 6% cash back on the first $6,000 spent at U.S. supermarkets each calendar year, then 1% (terms apply). Cash back is received in the form of Reward Dollars that can be redeemed for statement credits.

On top of that, you can sometimes find discounted Southwest gift cards, making your savings even bigger.

You can use these gift cards to book Southwest flights, cancel the flight and receive a refund in the form of travel vouchers and convert those vouchers into points.

3. It eliminates expiration dates and increases flexibility

Southwest travel funds expire within two years but Southwest points do not expire. If you’re like many other would-be travelers, you’re probably not certain when you’ll travel again. May as well ensure the safety of your travel funds by converting them to points and patiently waiting for travel to return.

Additionally, Southwest points allow you to book a ticket for anyone, while travel funds can only be used for those whose name is attached to the certificate. So if you’re ever booking a flight for a family member or friend, you’ll be much better off with points over funds.

A word of caution

If you’ve got travel funds that expire by September 7, 2022, it seems like a no-brainer to convert them to points. But there are a couple of things you should know.

Most importantly, you cannot redeem a mix of cash and Southwest points for a flight. If you’re using points, you need ALL the points required for your flight, or they’re useless. This is not the case with Southwest travel funds. For example, if a flight costs 10,000 points, but you’ve only got 9,500 points, you’ll have to earn another 500 points before you can book your flight. Alternately, if a flight costs $100, and you’ve got $70 in travel funds, you can redeem your find and pay $30 in cash for that flight. Much less complicated!

If you do need to top up your Rapid Rewards account, you can transfer Chase Ultimate Rewards points to Southwest at a 1:1 ratio.

Additionally, you’re unable to convert your points back into a travel credit if you change your mind later. This is a one-way street, so be sure you want to forfeit your travel fund for points.

Bottom line

For a limited time, Southwest travel funds are more useful than ever. You can convert the cash value to Southwest points at a rate of 1.28 cents per point. This is 0.22 cents less than the average value for Southwest points, so it can be a good deal!

If you’ve got $200 in travel funds, you can convert them to 15,625 points, which are worth ~$234.38 in Southwest flights. That’s a nice boost for very little effort.

You can purchase Southwest flights and refund them in the form of travel funds by September 7, 2020, for your funds to qualify for conversion. And the deadline for converting those funds is December 15, 2020.

Let us know if you have any questions! And subscribe to our newsletter for more posts like this delivered to your inbox.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!