Citi American Airlines MileUp Credit Card Benefits and Perks (With NO Annual Fee!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Citi is an MMS advertising partner.

The American Airlines AAdvantage MileUp℠ Card is unique because it’s the only no-annual-fee card that earns valuable American Airlines miles.

While that’s reason enough for lots of folks to consider applying, the Citi American Airlines MileUp benefits and perks make it worth keeping long-term, like:

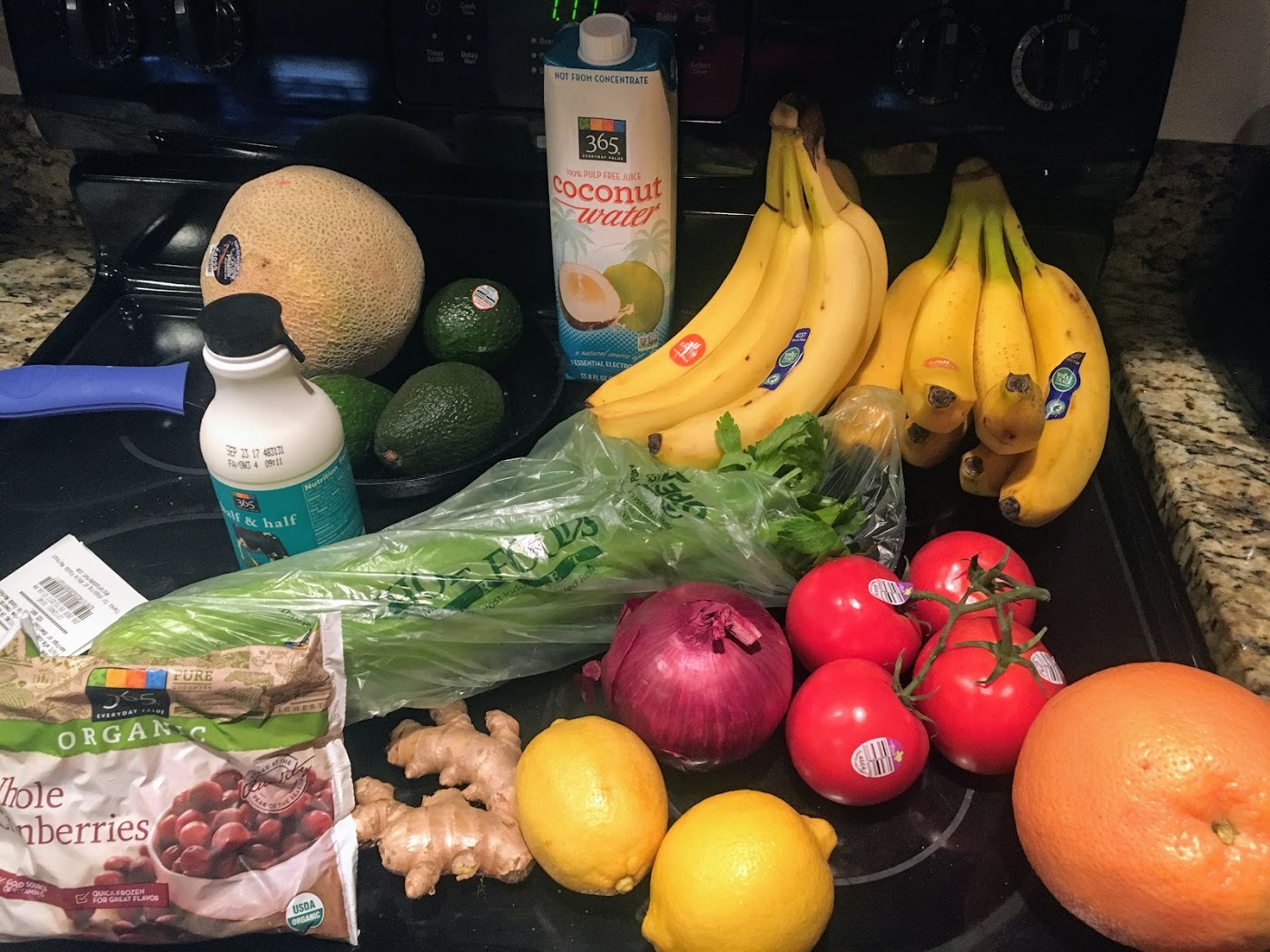

- 2 American Airlines miles per $1 spent at grocery stores, and eligible grocery delivery services

- 2 American Airlines miles per $1 spent on eligible American Airlines purchases, including flights

- 25% discount on in-flight purchases of drinks or snacks on American Airlines flights

- Travel insurance, purchase protection, extended warranty, early access to special events, and much more

Plus, you’re eligible to open this card even if you have other Citi personal American Airlines cards, including:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- Citi® / AAdvantage® Executive World Elite Mastercard®

The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

That’s because Citi’s usual application rules don’t apply!

Here’s what you get with this card!

Citi American Airlines MileUp Benefits and Perks

Apply Here: American Airlines AAdvantage MileUp℠ Card

Read our review of the American Airlines AAdvantage Mileup Card

With the American Airlines AAdvantage MileUp card, you’ll earn 10,000 American Airlines miles and a $50 statement credit after spending $500 on purchases in the first 3 months of account opening. That’s more than enough for a short-haul domestic coach flight, and a nice deal for a card with no annual fee.

Because it’s free to keep forever, it can help increase the average age of your credit accounts, and possibly raise your credit score, which is a nice side effect!

And you’ll get many great benefits. Let’s take a look.

2X American Airlines Miles for American Airlines Flights and at Grocery Stores

The American Airlines AAdvantage MileUp card comes with perks that make it worth keeping in your wallet for day-to-day spending. You’ll earn:

- 2 American Airlines miles per $1 on eligible American Airlines purchases

- 2 American Airlines miles per $1 at grocery stores, including eligible grocery delivery services

- 1 American Airlines mile per $1 for all other purchases

If you have a big family, or spend a lot on groceries, this card is a great way to rack up extra American Airlines miles for items you’d purchase anyway.

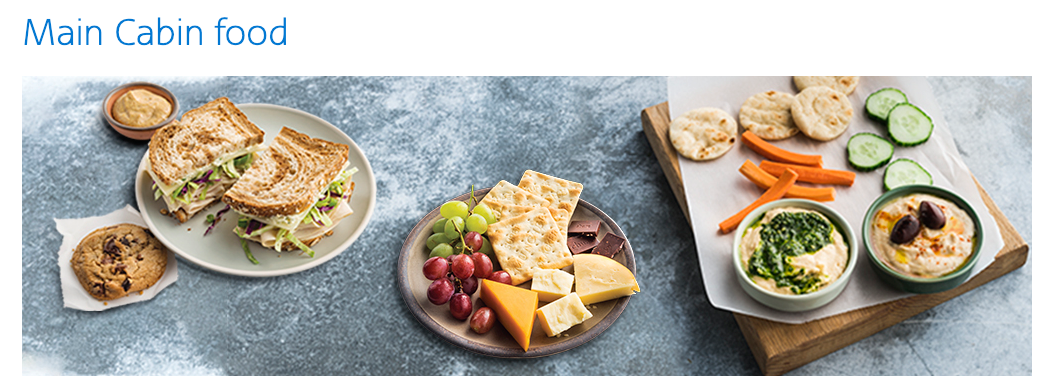

25% Savings for In-Flight Snacks

When you fly American Airlines, you’ll save 25% on in-flight purchases of drinks or snacks when you pay with your card.

Next time you order a snack during your flight, remember to get your discount!

Access to Citi Price Rewind to Save on Price Drops

The American Airlines AAdvantage MileUp card comes with price protection from Citi Price Rewind, which is a feature of Citi’s personal cards.

I use this perk all the time for smaller purchases like clothes, household products, and pet supplies.

You can save up to $1,000 per year, and up to $200 per item, when you register your purchases with Citi. If they find a lower price within 60 days, you’ll get the difference credited back to your card.

Not many cards offer price protection any more, so getting it with a no-annual-fee card is even better.

So not only is the American Airlines AAdvantage MileUp card free to keep, but can also save you money!

Trip Cancellation & Interruption Protection for Travel Emergencies

If you have to cancel or end a trip for an emergency, like sickness, injury, or severe weather, you can recover non-refundable expenses when you pay for your travel with the American Airlines AAdvantage MileUp card.

You can get up up to $1,500 per trip, and a maximum of $5,000 per calendar year in coverage.

Rental Car Insurance That’s Secondary at Home, but Primary Abroad

When you pay for your car rental with the American Airlines AAdvantage MileUp card and decline the coverage offered by the rental company, you’ll get coverage up to $50,000 in case of an accident or theft. You’re covered for rentals up to 31 consecutive days.

What’s good about this benefit is, while coverage in secondary within the US, it’s primary overseas. That means you won’t have to file a claim with your personal insurance before you can use it.

We don’t see this on many no-annual-fee cards. If you don’t have other cards with car rental insurance, this one is a good one to use, especially internationally.

Travel Accident Insurance

If you die, or lose a limb, sight, speech, or hearing during your travels, Citi may provide up to $250,000 in compensation. You, your spouse or domestic partner, and dependents are covered if something happens when you’re traveling with a common carrier (like airlines, trains, ferries, and cruise ships).

Shopping Return Protection

If a merchant won’t take back your unwanted item, you can file a claim for return protection if you paid with your American Airlines AAdvantage MileUp card. You can get a refund up to $300 per eligible item, and up to $1,000 per year, within 90 days of purchase.

Damage & Theft Purchase Protection

If your eligible purchases are damaged or stolen within 90 days of purchase, you can file a claim for repair or reimbursement.

With this benefit, you’re covered up to $1,000 per incident, and up to $50,000 per calendar year. Note this coverage is secondary to other insurance you might have, like homeowner or rental insurance.

Extended Warranty Protection up to 84 Months

Get an extra 24 months added to an original manufacturer’s warranty when you pay with your card. If a covered item breaks, you can file a claim for repair, reimbursement, or replacement up to the lesser of the original amount or $10,000 per item.

With this perk, you can get a maximum of 84 full months of warranty coverage for eligible items. That’s an excellent perk from a card with NO annual fee!

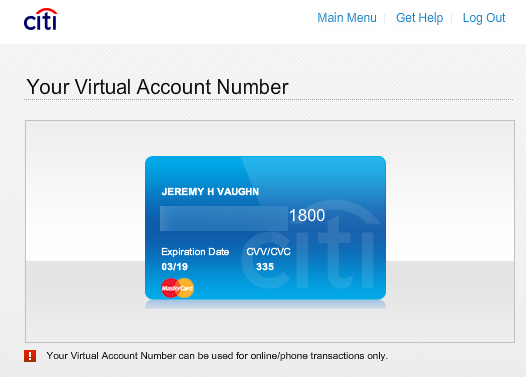

Virtual Card Number for Online Purchases

If you shop online a lot, you can generate a virtual card number to use. This number is linked to your American Airlines AAdvantage MileUp card, but is different from your actual card number, which gives you more protection against fraud.

You’ll get brand new information to shop like you normally would, without having to enter the number on your physical card.

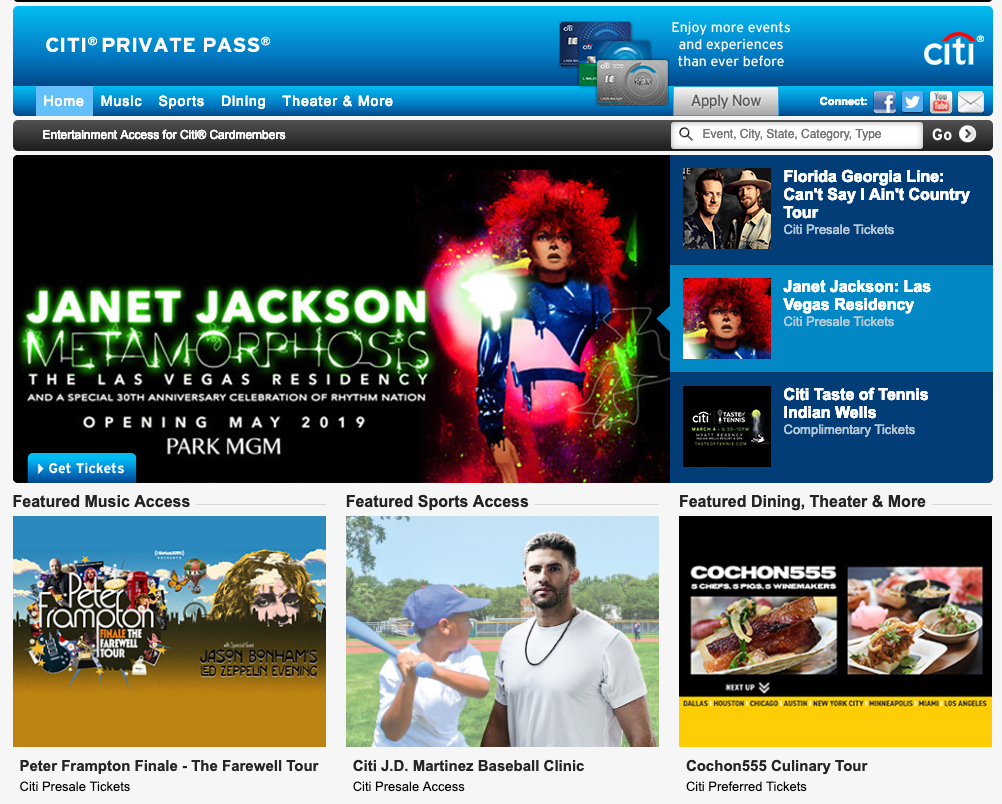

Early and/or Better Access With Citi Private Pass

Citi Private Pass gives Citi customers early access to concerts, sports events, theater performances, and more. Other times, you’ll get preferred access for better seats, or invitations to special events.

There are lots of events listed on the website, and they’re always changing. It’s worth a look to see what’s coming to your area, or somewhere along your travels, so you can score better tickets.

Concierge Access for Help With the Details

You can call Citi Concierge to help with:

- Travel plans

- Shopping or finding a specific item

- Dining reservations

- Entertainment tickets or arrangement

- Everyday needs

If you can’t get a reservation at a restaurant, for example, you can ring the Concierge to see if they can work their magic. It’s a free perk to use, and never hurts to try!

The Citi AAdvantage MileUp Is Exempt From Citi’s Application Rules

Citi has rules in place for their other personal American Airlines cards, including:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- Citi® / AAdvantage® Executive World Elite Mastercard®

Usually, you can’t get a personal American Airlines card bonus if you’ve opened or closed another personal American Airlines card in the past 24 months.

However, that rule isn’t in place for the American Airlines AAdvantage MileUp card. So even if you’ve earned a bonus with other Citi American Airlines cards in the past year or two, you can still get this one. This isn’t necessarily a benefit, but if you want to earn bonus American Airlines miles, the option is open to you!

Bottom Line

With the American Airlines AAdvantage MileUp card, you’ll have access to benefits including:

- 2 American Airlines miles per $1 spent at grocery stores, and eligible grocery delivery services

- 2 American Airlines miles per $1 spent on eligible American Airlines purchases

- 1 American Airlines mile per $1 for all other purchases

- 25% discount on in-flight purchases of drinks or snacks on American Airlines flights

- Access to Citi Price Rewind, Citi Concierge, and Citi Private Pass

- Travel and purchase protections

- No annual fee

Remember, you can also earn 10,000 American Airlines miles and a $50 statement credit after meeting minimum spending requirements, which is a decent sign-up bonus for a card that’s free to keep and has so many other built-in perks. And you can open it even if you have other Citi personal American Airlines cards.

Which of these benefits is your favorite?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!