Should You Use the Chase Sapphire Reserve or Chase Hyatt Card for Hyatt Stays?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Sudeep, tweeted:

Which card is better to use for an upcoming stay at a Hyatt hotel? The Chase Sapphire Reserve or Chase Hyatt Visa?

Thanks for the question! Both the Chase Sapphire Reserve and Chase Hyatt Visa earn 3 points per $1 spent at Hyatt hotels.

So it depends on what type of points you want to earn. However, I’d recommend paying with the Chase Sapphire Reserve if you have both cards!

I’ll explain why!

Chase Sapphire Reserve or Chase Hyatt Card for Hyatt Stays

Let’s take a look at the Chase Sapphire Reserve and Chase Hyatt Visa to see which card Sudeep should use for his upcoming stay with Hyatt.

Chase Sapphire Reserve

Link: Chase Sapphire Reserve

Link: My Review of the Chase Sapphire Reserve

When you open the Chase Sapphire Reserve card, you’ll earn 50,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening. You’ll also get:

- 3X Chase Ultimate Rewards points on travel & dining

- 1X Chase Ultimate Rewards points on all other purchases

- $300 annual credit for travel purchases including airfare and hotels

- $100 statement credit for Global Entry

- Priority Pass Select for access to airport lounges

- No foreign transaction fees

- Visa Infinite benefits like $25 food and beverage credit at the Luxury Hotel Collection and complimentary car rental elite status with Silvercar

The card has a $450 annual fee, which is NOT waived for the first year. But the annual travel credit and airport lounge access can more than offset the annual fee!

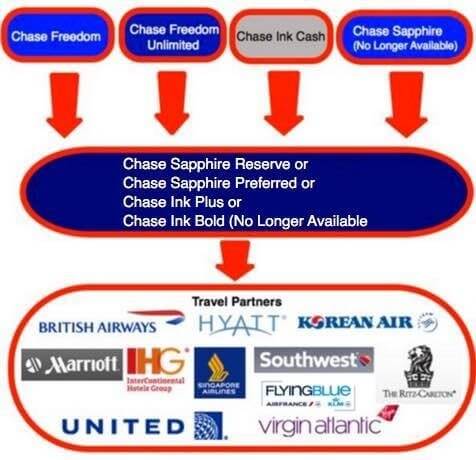

Plus, you’ll earn 3X Chase Ultimate Rewards points on travel purchases, including hotel stays. You can transfer those points to travel partners, including Hyatt, Southwest, and British Airways.

Sudeep could pay for his hotel stay with the Chase Sapphire Reserve. And then transfer his points directly to Hyatt! He’d also gain the flexibility to transfer to Chase’s other airline or hotel partners.

Chase Hyatt

Link: The Hyatt Credit Card

Link: My Review of the Chase Hyatt Card

The Chase Hyatt card comes with 2 free nights at ANY Hyatt after spending $2,000 on purchases in the first 3 months of opening your account. You’ll also get:

- 3 Hyatt points per $1 spent at Hyatt hotels

- 2 Hyatt points per $1 spent at restaurants, on airline tickets

purchased directly from airlines, and at car rental agencies

- 1 Hyatt point per $1 spent on all other purchases

- A free night at a Hyatt Category 1 to 4 hotel each cardmember year

- Automatic Hyatt Discoverist elite status

Sudeep can also earn 5,000 bonus Hyatt points when he adds an authorized user and makes a purchase within the first 3 months of account opening.

The $75 annual fee is NOT waived for the first year. And you can read my review of the card here.

And you might sign-up for it if you want Hyatt Discoverist elite status, which gets you:

- 5 Hyatt base points per $1 spent on Hyatt stays, plus a 10% points bonus on eligible purchases

- A free night at a Category 1 to 4 Hyatt when you stay at 5 or more Hyatt brands

- 2:00 pm late checkout when available

- A preferred room (higher floor or more space)

- Premium Wi-Fi and a bottle of water daily

You can also get Hyatt Discoverist elite status after 10 eligible nights or 25,000 base points each calendar year.

With the Chase Hyatt card, you’ll also earn Hyatt Explorist elite status when you spend $50,000 each calendar year

You should pay with this card if you only want to focus on earning Hyatt points. Or if you’re trying to earn Hyatt Explorist elite status through spending on the card.

So Which Is the Better Choice?

Because both cards earn 3 points per $1 spent at Hyatt hotels, I’d rather pay with the Chase Sapphire Reserve. That’s because you can transfer your points directly to Hyatt at a 1:1 ratio. And, you’ll get the added benefit of Chase’s other travel partners. So you’re not locked-in to one program.

Also, neither card charges foreign transaction fees. So you can use both of them on your hotel stays worldwide.

That said, if you’re considering the sign-up bonus alone, I’d pick the Chase Hyatt card. Because you’ll earn 2 free nights at any Hyatt hotel, including their top-tier luxury hotels like the Park Hyatt Paris-Vendome where Emily and I stayed. Hyatt category 7 hotels normally cost 30,000 Hyatt points per night.

With the Chase Sapphire Reserve, you’ll earn 50,000 Chase Ultimate Rewards points after completing the minimum spending requirements. That’s not quite enough for 2 nights at a category 7 Hyatt.

Other Cards to Consider

Link: Citi Prestige

Link: Chase Sapphire Preferred Card

Link: Barclaycard Arrival Plus World Elite Mastercard

Don’t have either card?

Lots of folks can also do well with Citi Prestige or the Chase Sapphire Preferred card.

With Citi Prestige, you’ll get the 4th night free on paid stays, although the way they calculate the benefit will change on July 23, 2017. If your stays are often 4 nights or longer, you can easily come out ahead with this card. Here’s my review.

And if you have the Chase Sapphire Preferred, you can earn 2 Chase Ultimate Rewards points per $1 spent on travel, including hotel stays. And, like the Chase Sapphire Reserve, you can also transfer your points to travel partners.

Folks with the Barclaycard Arrival Plus will also earn 2X Barclaycard Arrival miles on every purchase. When you redeem them toward travel purchases of $100+, you’ll get 5% of your miles back. Here are some other ways you can redeem Barclaycard Arrival miles.

Bottom Line

You can earn 3 points per $1 spent at Hyatt hotels with the Chase Sapphire Reserve and Chase Hyatt cards.

But, I’d rather pay with the Chase Sapphire Reserve. Because you can transfer the points to lots of travel partners, including Hyatt!

Sudeep might use his Chase Hyatt card if he wants to earn Hyatt Explorist elite status. Or only earn Hyatt points. But all else being equal, I prefer the flexibility of Chase Ultimate Rewards points.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!