Chase Offers Have SO Much Potential – Why Haven’t They Taken Off Like AMEX Offers?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

There was a ton of excitement last year when Chase Offers were introduced to certain cardholders, with the ability to earn automatic discounts when you enroll an eligible card (like the Chase Sapphire Preferred Card) and spend at a participating merchant.

Getting money back on everyday purchases without having to clip coupons or think much is a nice perk, but Chase has lagged behind AMEX on this concept. AMEX Offers have been kicking around for years, and many of us have saved hundreds of dollars on regular spending using our American Express cards. I saved over $50 in ~6 months just at gas stations using The Blue Business® Plus Credit Card from American Express, for example.

I’ve tried out Chase Offers over the past few months, and saved a bit (emphasis on bit) of money. It’s better than nothing, but it really hasn’t compared to the savings and ease of use with AMEX Offers so far. I’m not giving up hope – my fingers are crossed that Chase Offers will catch on and offer better deals.

For more credit card and travel tips & tricks, subscribe to our newsletter!

Here’s how Chase Offers are working so far, and what I hope they’ll change for the future.

Chase Offers Need to Improve to Compete With AMEX Offers

1. I Wish There Were More Substantial (and Relevant) Deals

Full admission: I love my AMEX Offers. They’re one of the reasons I keep American Express cards in my wallet year after year, even with an annual fee. The savings just on regular purchases make it worthwhile, sometimes many times over.

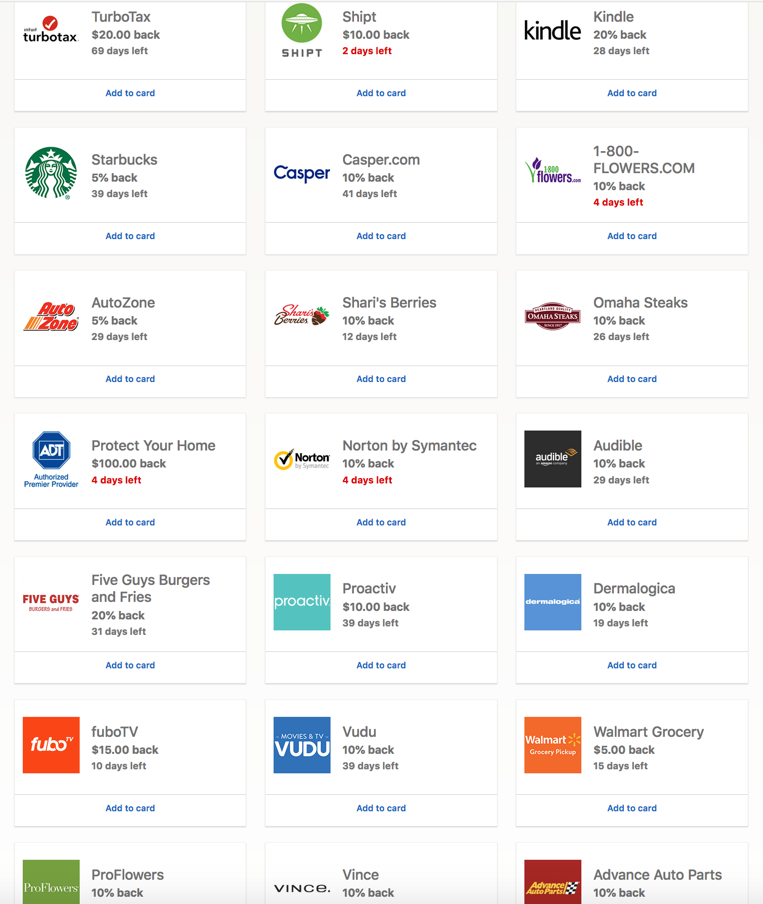

Chase Offers have the potential to be equally good, but so far, the offers I’ve been targeted for are often mediocre, there aren’t many of them, and they don’t usually fit (at all!) into my spending habits.

I’ve been targeted for offers on these cards:

- Chase Sapphire Preferred Card

- Southwest Rapid Rewards® Priority Credit Card

- Chase Hyatt (now the World of Hyatt Credit Card)

- Chase IHG (now the IHG® Rewards Premier Credit Card)

- Chase Freedom

Some cards only have a handful of offers – on my Southwest Rapid Rewards Priority Credit Card, for example, I’ve only got 3 available (Starbucks and those auto parts stores again).

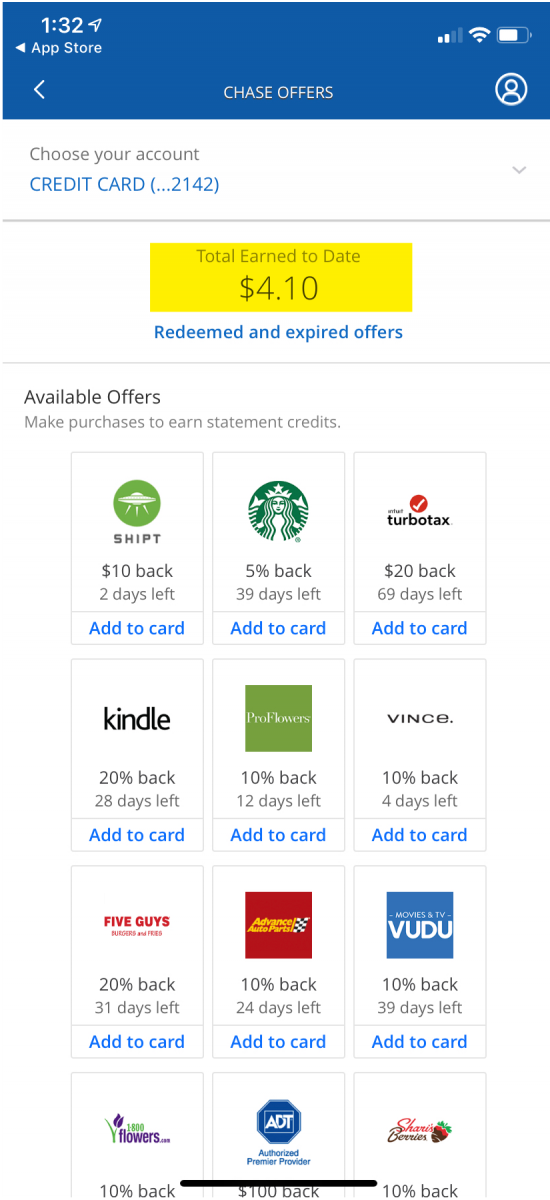

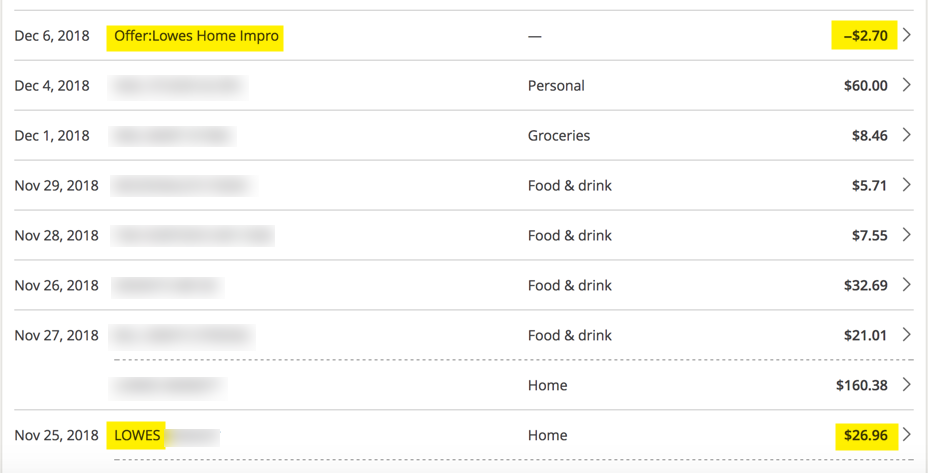

I’ve been using Chase Offers for ~3 months, and so far have saved a whopping ~$4 on purchases I would have made anyway (Lowe’s and Smart Style):

To compare, here’s what I saved with The Blue Business® Plus Credit Card from American Express in ~6 months last year.

Maybe I’ve just had bad luck or timing with the offers in my Chase account. I have found that AMEX Offers seem to be much better targeted to my previous spending patterns (travel for example). So I’m not sure if this is something Chase is doing or just hasn’t fine-tuned yet.

2. Chase Offers Can Be Tricky to Find

You can access Chase Offers through the Chase mobile app (you can read more about how to install it here), Chase Pay app, or through targeted links in emails that have come from Chase, in which case there’s limited access through the desktop site. The mobile app has been finicky though, and offers have vanished only to re-appear when I delete the app and re-install it.

It would be so much easier to have Chase Offers available when you log into your regular Chase account. This would remind folks to check them more often, especially for those of us who don’t regularly use mobile banking apps.

3. It Can Take a While for Credits to Appear in Your Account

With AMEX Offers, statement credits and bonus points have almost always appeared a few days after an eligible purchase has posted. Chase says with Chase Offers it can take 7 to 14 business days for a credit to appear in your account, and that’s been my experience exactly:

This isn’t a deal breaker by any means – it’s just a bit of a hassle to wait so long wondering if the purchase has tracked and if the rebate will appear.

4. Not ALL Chase Cards Are Eligible for Chase Offers

All AMEX cards (personal and small business) are eligible for AMEX Offers, except for American Express Corporate Cards, American Express Gift Cards, and Prepaid Cards. And typically you’ll have dozens of offers on each of your card accounts to choose from.

With Chase Offers, it’s not so straightforward. Folks report not all their cards are targeted for Chase Offers, and some cards only have a couple of deals. And as far as I can tell from MMS team experience and reader reports, small business cards aren’t yet included with Chase Offers (if you’ve had a different experience, please share in the comments!).

It sure would be nice to earn rebates on small business purchases with cards like the Ink Business Preferred Credit Card or Ink Business Cash Credit Card (I have both). Hopefully this is something Chase will add in the future.

Bottom Line

Oh, Chase Offers, I so want to love you as much as I do AMEX Offers. So far, I can’t say I do – but there’s still hope.

It’s not that Chase Offers are bad all around – you really can’t sniff at saving a few dollars here and there on purchases you’d make anyway. To compete with AMEX Offers, I think Chase needs to up their game in a few areas:

- Offer deals that are more generous and relevant to individual spending patterns

- Make Chase Offers easier to access instead of just through mobile apps or email links

- Speed up the time it takes for statement credits to post to your account

- Roll out Chase Offers to all Chase cards (including small business cards)

Have you been using Chase Offers? What’s your experience been like so far?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!