Changing credit cards – The advantages and disadvantages to upgrading your card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The best way to quickly earn the miles and points you need for your next vacation is to open a travel credit card and earn its welcome bonus, but it’s not the only tool you should have in your bag. You’ll also want to make sure that you have the right mix of rewards credit cards in your wallet to suit your needs and you can do that without opening a new card.

We’ve already written about downgrading a card instead of canceling if the annual fee is no longer worth it for you, but you can also upgrade your card. This can be a good move if you want to take advantage of perks you won’t get on a credit card with no annual fee. For example, you can upgrade a Chase Freedom® card to the Chase Sapphire Preferred® Card, which enables transfers to Chase’s travel partners.

What to know before you change credit cards with an upgrade

The actual process of changing your credit card is simple, you just need to call the number on the back and let the customer service representative know that you want to upgrade your card (or downgrade). But there are a few factors you’ll want to consider first, including whether or not its possible to change your card, which cards you can upgrade to and what you might be missing by upgrading.

No new credit pull (in most cases)

When you upgrade your account there won’t be a new hard inquiry on your credit report and you will maintain your account history. This is a great way to boost your credit score because you won’t be opening a new account which would lower the average age of your accounts.

The only time when an upgrade may result in a credit pull is if you want (or need) to increase your credit limit when you upgrade. Sometimes when you upgrade you may need a bigger credit line in order to complete the process. For example, if the card you’re upgrading to is a Visa Infinite, you’ll typically need a credit limit of at least $10,000, although it varies by issuer. The bank may do a hard credit pull in order to approve the credit limit increase, so be sure to ask if the upgrade will result in a hard pull.

No bonus offer (probably)

When you change your existing credit card account to an upgraded card you won’t be eligible for that card’s intro bonus. So if you upgrade to the Chase Sapphire Reserve® you would miss out on the card’s 50,000 Ultimate Rewards points bonus after spending $4,000 in three months. That’s a big hit to take, but if you can’t be approved for a Sapphire Reserve card anyway (because you’re over the Chase 5/24 rule) it can be worth it to upgrade to the Sapphire Reserve.

There is an exception to this rule, sometimes banks will send out targeted upgrade offers. These bonuses can be hit or miss, for example, I’ve been targeted for a 10,000-point offer for upgrading my old IHG Select card (no longer available to new applicants) to the IHG® Rewards Club Premier Credit Card. I’ve never taken this “deal” because the IHG Premier credit card always has a much better intro offer and you can have both cards at the same time.

But there are instances when an upgrade bonus is as good as the current offer. I upgraded my no-annual-fee Hilton Honors American Express Card (see rates & fees) to the Hilton Honors American Express Aspire Card because I was able to earn a targeted bonus of 150,000 Hilton points after spending $4,000 in the first three months (upgrade offer subject to change at anytime), which is the same offer you’d get if you put in a new application for the card. The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Can I change my credit card?

In most cases, you’ll need to have a card open for at least a year before you can product change your card to another card issued by that bank. Beyond that, each bank also has specific limitations for which cards you’re allowed to change between. When it comes to Chase credit cards you aren’t allowed to change between cobranded cards and Chase branded cards, that means you won’t be able to switch an airline credit card, like the United℠ Explorer Card, to an Ultimate rewards card, like the Chase Sapphire Reserve.

You also generally won’t be allowed to change between business credit cards and personal cards. If you’re not sure which cards you can upgrade to it’s best to call and ask.

Know what time of year to upgrade

When you upgrade a card can impact when certain card benefits will be available to you. This is where things get a bit complicated because there is a lot of variation in how certain card perks are implemented across card issuers and even different cards issued by the same bank.

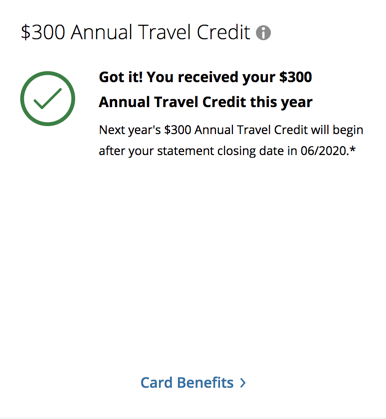

The first thing to know is that when you upgrade a card you’re likely going to pay a prorated annual fee. For example, when I upgraded a Chase Freedom card to a Sapphire Reserve I paid a prorated annual fee on the Reserve card. The reason for this is because my account anniversary date was in October, but I upgrade the card in June, so I paid a bit less than half of the Reserve’s annual fee. But I got access to all of the Sapphire Reserve’s benefits right away.

I was easily able to use the card’s $300 in annual travel credits. When the account came up for renewal in October I paid the annual fee, but the travel credit still won’t reset until next June. That means I only have about five months to use up all the credit before I need to pay the annual fee again.

The Reserve’s travel credit is incredibly easy to use, so it won’t be an issue for me. But it’s important to be aware of when your card benefits reset, especially if the perk is tied to the calendar year and not the account anniversary. If you open The Platinum Card® from American Express its has up to $200 in annual airline incidental fee credits that are tied to the calendar year (Jan.-Dec.). So if you open the card in early December you’ll only have a few weeks to use the credits before they reset on January 1st. Enrollment required.

Also, if you are upgrading (or downgrading) from a card with an annual fee, you will get a prorated refund of the card’s annual fee.

Bottom line

Changing your credit card by upgrading can be a great way to access new card perks without applying for a new card. This is a solid strategy because you’ll keep the credit history on your existing account and you won’t have a new hard inquiry on your account. It’s also a option for getting a card you would otherwise be restricted from opening. For example, you might be over the Chase 5/24 rule, so upgrading might be your only option for getting a Sapphire Preferred approval.

But you won’t be able to earn a welcome bonus if you upgrade, unless you’re targeted with a special offer. And in most instances, you to have a card open for at least a year before you’re allowed to upgrade or downgrade.

For rates and fees of the Hilton Honors Amex card, click here.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!