Better Sign-Up Bonus With This No-Annual-Fee Cash Back Card!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’ve been looking for a cash back card with no annual fee, it’s a good time to consider the Capital One® Quicksilver® Cash Rewards Credit Card.

You’ll now earn a $150 cash bonus after you spend $500 on purchases within the first 3 months of account opening.

Previously, the sign-up bonus was $100 after meeting the same minimum spending requirement. So this is a better deal!

Folks like the Capital One Quicksilver Card because it earns a straightforward 1.5% cash back on all purchases. And there are no foreign transaction fees, which is uncommon for a no-annual-fee card.

But this isn’t the best card to apply for if you’re new to miles & points. I’ll explain why!

Better Bonus for Capital One Quicksilver Cash Rewards

Link: Capital One Quicksilver Card

Link: My Review of the Capital One Quicksilver Cash Rewards

You’ll now earn a $150 cash bonus after you spend $500 on purchases within the first 3 months of opening a Capital One Quicksilver Card.

That’s a better deal than the previous $100 sign-up bonus with the same minimum spending requirement.

You’ll also get:

- 1.5% cash back on all purchases

- Travel accident insurance – Insurance for death or dismemberment at no extra charge when you purchase airfare using your card

- Auto rental insurance – Secondary collision and theft insurance for you and all additional drivers on your agreement

- Extended warranty – Additional warranty protection when you purchase items your card

- Price protection – Get reimbursed the difference if the price drops on eligible items within 120 days of purchase

- NO annual fee

- NO foreign transaction fees

Million Mile Secrets team member Scott has had the Capital One Quicksilver Card for years. He especially likes that there’s no minimum redemption amount for getting cash back.

And team member Keith is keeping his Capital One Quicksilver Cash Rewards card because it has no annual fee. He’s made the most of past Uber promotions and the current Spotify discount that come with the card.

This is a good card to consider if you like cash back and a simple rewards earning structure without having to worry about category bonuses. But it’s not for everyone.

Should You Consider the Capital One Quicksilver Cash Rewards Card?

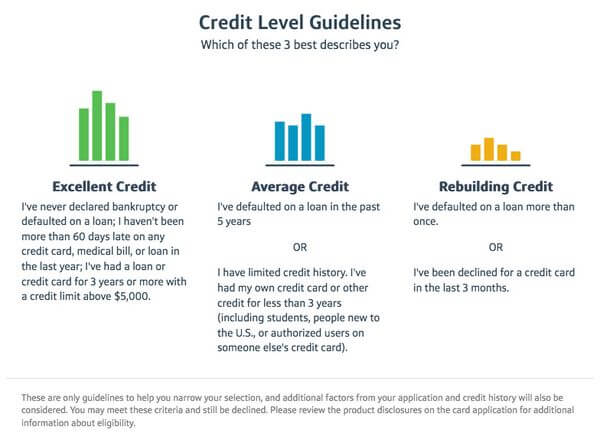

Capital One says the Quicksilver Cash Rewards card is for folks with excellent credit. This means you haven’t been late on any bills, you’ve never declared bankruptcy, and you have an established credit history.

Keep in mind, Capital One pulls your report from all 3 main credit bureaus when they process your application. Most banks, like Chase and American Express, only pull from one.

So applying for a Capital One card has a bigger effect on your credit score. Although the effect is temporary (if you pay your bills in full and on time!), some folks avoid Capital One cards for this reason.

If you’re trying to get under Chase’s 5/24 rule, or if you’re new to miles & points, you should consider other cards first. Because applying for Capital One cards WILL count against Chase’s stricter approval rules.

And because Chase has some of the best travel rewards cards, I always recommend getting any Chase cards you want first.

Bottom Line

There’s a better sign-up bonus for the Capital One® Quicksilver® Card. You’ll now earn a $150 cash bonus after spending $500 on purchases in the first 3 months of opening your account.

That’s $50 higher than the previous sign-up bonus. So if you’ve been thinking about this card, now’s a good time to apply.

Keep in mind, Capital One pulls your report from all 3 main credit bureaus when they process your application. So applying for a Capital One card has a bigger effect on your credit score.

This isn’t a good pick for folks who are new to our hobby. Because of Chase’s 5/24 rule, I recommend you get any Chase cards you want first.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!