Best Hotel Credit Card: How I’m Going to the Maldives and Getting $1,863 From One Card Bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. INSIDER SECRET: If you have Marriott Platinum status, you can receive free breakfast at the St. Regis Maldives. That’ll save you and your travel buddy $130 per day (breakfast is crazy expensive).The title of this post is reverse clickbait. If I had written the actual amount of money this credit card is saving me, you wouldn’t have believed me.

My wife and I have finally earned enough Marriott points for our upcoming stay at The St. Regis Maldives. By using points, we’re saving $7,823 for a five-night stay. We’re using 240,000 points (we booked the room before the award prices increased), which gives us an unbelievable value of 3.26 cents per Marriott point.

The last bunch of points that we needed was earned on the Marriott Bonvoy Brilliant™ American Express® Card. The card comes with 75,000 bonus Marriott Bonvoy points after spending $3,000 on purchases in the first three months. That welcome bonus alone is saving us $2,445 (3.26 cents per point x 75,000 points).

But that’s far from where the Amex Marriott Bonvoy Brilliant‘s value ends. It can fully revolutionize your travel. Here’s the full power of the card:

Best Hotel Credit Card: Amex Bonvoy Brilliant Will Overhaul Your Travel

Apply Here: Marriott Bonvoy Brilliant™ American Express® Card

Read our Amex Marriott Bonvoy Brilliant Credit Card review

You can read about the Amex Marriott Bonvoy Brilliant card benefits in our card review. I want to show you in real terms how the card will affect my upcoming travel.

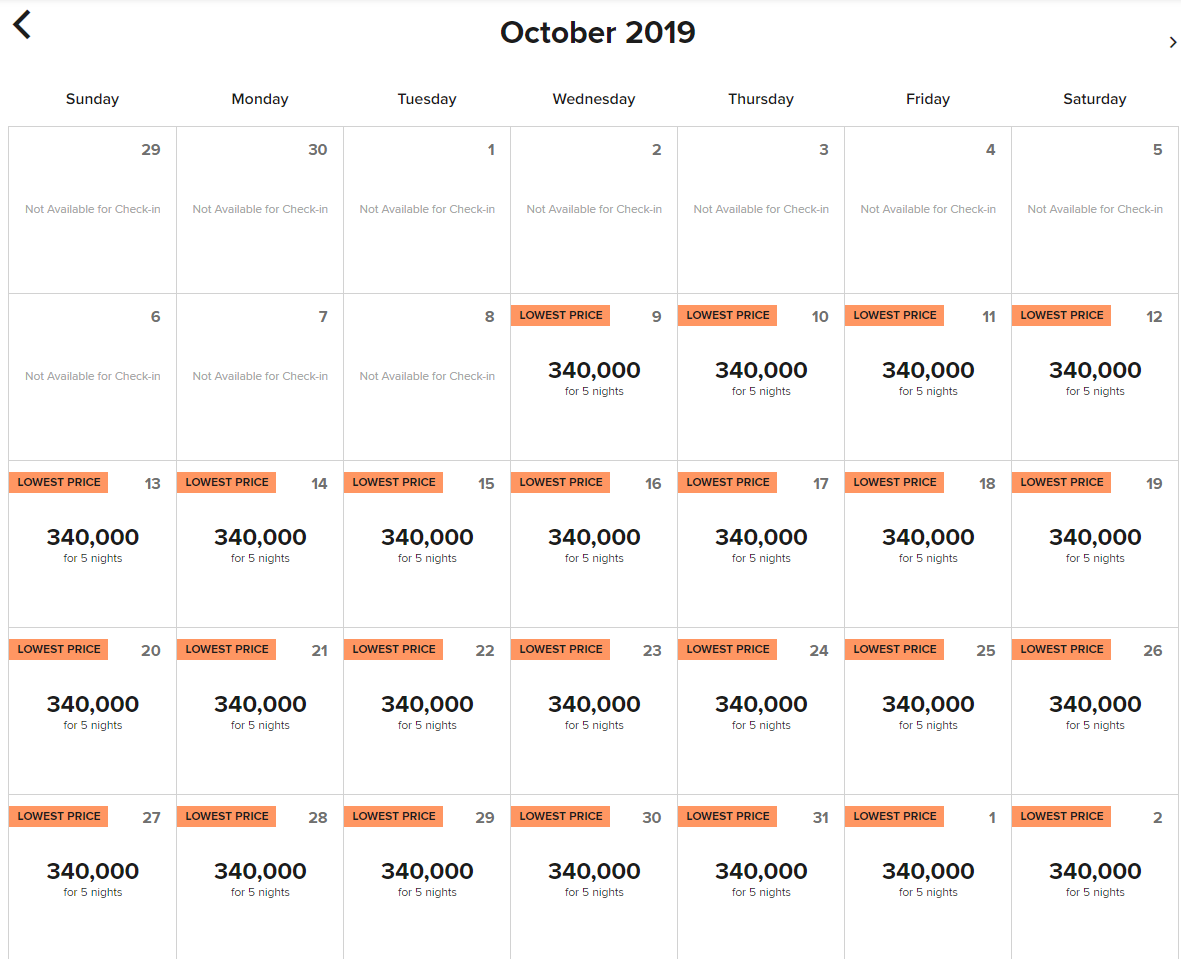

I first want to note that Marriott has changed the award price of this hotel, and you’ll now pay 340,000 points for five nights. I’ll calculate my savings with this number.

Card Bonus

Numerous considerations were taken into account when calculating the actual value of the card bonus. Let me explain.

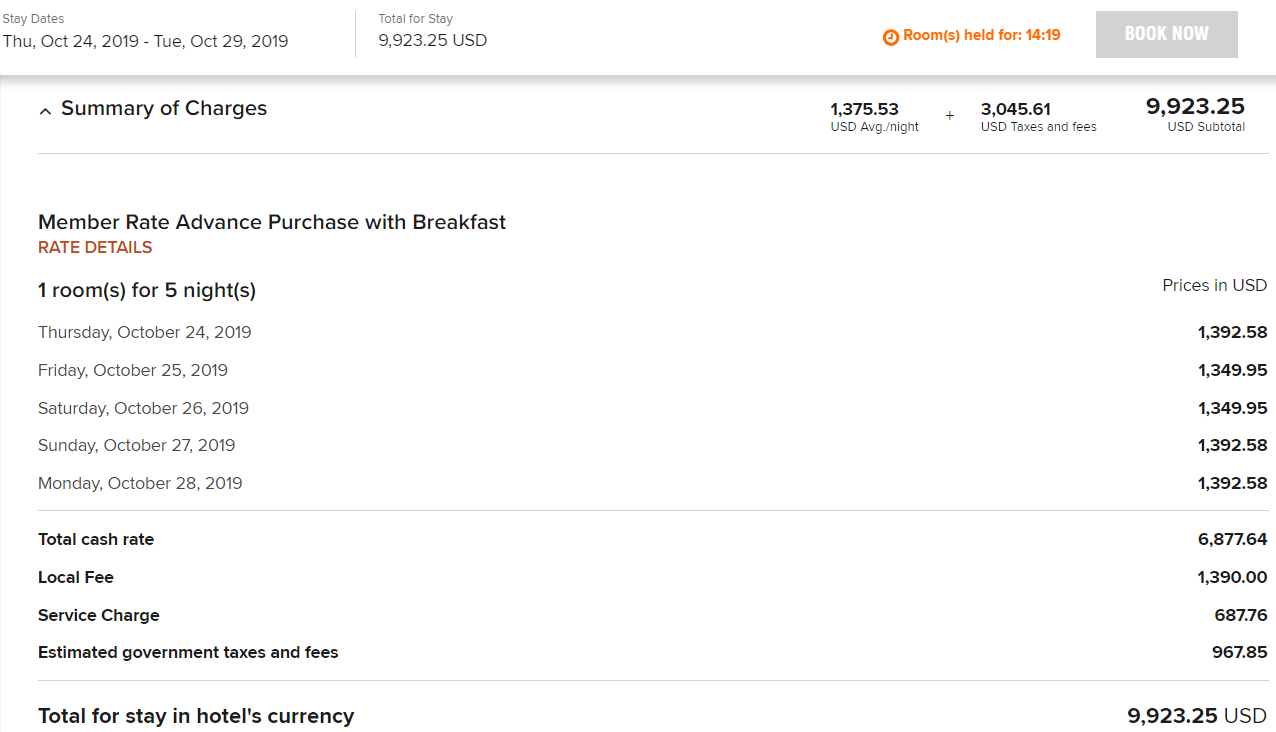

Below is a breakdown of the cash price of a hotel stay during the same dates as my award stay.

This bill is confusing at first glance, so I’ll break down what’s happening:

- The astronomical “Local Fee” is the seaplane transport for two people from the main island of Male in the Maldives ($695 per person). I’ll have to pay that, so I’ll subtract that from the final bill

- You won’t pay a “Service Charge” if you book with points, so that’s a huge savings of $687.76

- The “Estimated government taxes and fees” are only $30 per person when booking with points, so we’ll pay $60 instead of the $967.85 listed above

The $9,923.25 hotel bill minus $1,390 for the seaplane and $60 in taxes and fees equals $8,473.25. Quite a savings!

But wait, the cash rate includes mandatory breakfast. Breakfast for two normally costs ~$130 per day (which I’ll probably end up spending anyway), so let’s subtract that from my savings, too ($130 per day for five days equals $650). Subtracting $650 for breakfast from my total savings, I’m left with $7,823.25 in savings.

Using 340,000 points for this stay is about 2.3 cents per point. That means the 75,000 point bonus from the Amex Marriott Bonvoy Brilliant plus the 6,000 points we earned from meeting minimum spending is worth $1,863. That’s excellent. Pro Tip: In examining the hotel cancellation policies, a flexible paid rate for a standard room (a garden villa) doesn’t seem to exist. If you’re reserving anything above the standard room, you’ll have 30 days before arrival to cancel. But if you reserve a standard room with points, you’ll have 30 days to cancel. That’s another benefit of using points.By the way, The St Regis Maldives award availability is fairly wide open for the foreseeable future.

Annual $300 Travel Credit

The Amex Marriott Bonvoy Brilliant comes with a $450 annual fee (See Rates & Fees). But it also comes with an annual $300 travel credit. That means as long as you’d normally spend $300 per year for Marriott stays, you’re effectively paying a $150 annual fee.

You can use this credit for just about anything, including Marriott room rates, hotel restaurants, activities, anything that Marriott charges you for. I’ll easily spend $300 in food at the St. Regis Maldives, so this $300 credit will go to good use.

Priority Pass

Priority Pass membership gives you access to 1,200+ airport lounges worldwide. And the Marriott Bonvoy Brilliant Amex gives you a free membership (plus two free guests).

If you were to buy a similar Priority Pass membership outright, you’d pay $429. And that membership doesn’t allow free guests.

During our vacation to the Maldives, we’ll have plenty of opportunity to use the Priority Pass airport lounge membership that comes with the card. Lounges almost always offer free alcohol, and some even provide a hot meal.

Marriott Gold Elite Status

This is a hard perk to calculate, because the value you’ll receive is such a grab bag. Marriott Gold Elite status comes with benefits like 2pm late checkout and a room upgrade, which could translate into hundreds of dollars in value. But both of these benefits are based on availability.

At the St. Regis Maldives, I probably won’t get any special treatment for Gold status. But I’ll get some bonus points for all my Marriott spending, which will still be quite a lot.

No Foreign Transaction Fees

I’m aware that many cards (even no-annual-fee cards) don’t charge foreign transaction fees. But I wanted to point out the savings from using this card for our Maldives trip (See Rates & Fees).

I estimate we’ll be spending $2,000 on food for five days. We’ll also pay $1,390 for our seaplane. If we were to use a card that didn’t waive foreign transaction fees, we’d pay 3% of that bill, which amounts to $101 in meaningless fees.

If you’ve never booked overseas accommodations before, many international hotels charge you a foreign transaction fee even if you reserve the hotel from the US. So make sure to use a travel card (with no foreign transaction fees) even when you’re reserving from home.

How to Cover Expenses Your Bonvoy Brilliant Won’t

Even if you reserve your stay in the Maldives with points, you’re going to spend a bundle of money. You’re bullied into paying exorbitant fees for their food (everything’s imported, after all), and the transfer from the main island to your resort is usually $500+ per person, no matter where you stay.

The best way to recoup these inescapable charges is with a card like the Capital One Venture Rewards Credit Card. The card comes with 50,000 Capital One miles (worth $500) after you spend $3,000 on purchases within the first three months from account opening. Capital One miles can be used to erase just about any travel purchase, including hotel restaurant bills.

In other words, you can receive $500 in free food in the Maldives when you open the Capital One Venture. Or $500 off your island transfer. Or $500 toward an upgraded room. As long as the charge is travel-related, you should be able to offset the charge with Capital One miles.

I’ve used my Capital One miles for free accommodations in Barbados and a free meal in Dubai. They’re an underrated player in the miles and points game. You can read our Capital One Rewards review to learn more.

Bottom Line

The Amex Marriott Bonvoy Brilliant is an amazing travel companion. It comes with:

- 75,000 points after meeting spending requirements

- An annual up to $300 travel credit

- Priority Pass membership (unlimited access to 1,200+ airport lounges)

- Marriott Gold status (free room upgrades and late checkout when available)

- Terms apply

Plus, it comes with TSA PreCheck/Global Entry credit, which makes your airport security experience way faster. It also comes with a free night at any hotel costing 50,000 points or less on every account anniversary (that alone can be worth hundreds).

I’ll be using all these benefits during my upcoming trip to The St. Regis Maldives. But I’ll still be spending a pretty penny on food and island transfers …

You can offset those extra costs with Capital One miles, which you can earn by opening cards like the Capital One Venture. Capital One miles can erase nearly any travel purchase. They’re key to a truly inexpensive Maldives experience.

Let me know if you’ve ever visited The St. Regis Maldives, or if you’ve got tips for travel to the Maldives. And subscribe to our newsletter for more travel tips and musings.

For rates & fees of the Amex Marriott Bonvoy Brilliant, click here.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!