3 Tips for Maximizing Your Barclaycard Miles Value

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.INSIDER SECRET: Barclaycard Arrival miles can be used for more than just airfare. You can redeem Barclaycard miles toward all sorts of travel expenses, like hotels, rental cars, timeshares, trains, buses, and even cruise lines!

Barclaycard Arrival miles are worth one cent each toward eligible travel purchases; this makes figuring out Barclaycard miles value easy. Now is a great time to earn a stack of miles because the Barclaycard Arrival Plus® World Elite Mastercard® has a bonus of 70,000 miles (worth $700 in travel) after spending $5,000 on purchases within the first 90 days of opening your account.

The minimum travel redemption amount is $100 (10,000 Arrival miles). You can also redeem Arrival miles for 1 cent each toward the Barclaycard Arrival Plus’s $89 annual fee with a minimum redemption amount of $25 (2,500 Arrival miles).

If you use your Barclaycard Arrival miles for any of the other available redemption options (gift cards, statement credit, merchandise, etc.), you’ll be getting a value of less than 1 cent per mile. Avoid these redemptions. The one exception is if you have fewer than the minimum amount you need to make a travel redemption and you want to use up your points.

One perk of the Barclaycard Arrival Plus is a 5% miles rebate on all redemptions. So even though Arrival miles are worth a penny apiece toward travel, once you include the rebate you actually get a bit more per mile. Note: There are other cards that earn Arrival miles, but none of them are currently open to new applications.

I’ll show you a few redemptions that can help you make the most of your valuable Barclaycard Arrival miles.

3 Tips for Maximizing Your Barclaycard Miles Value

1. Redeem for Flights to Avoid Award Taxes & Fees

When it comes to using airline miles to book award flights, you’ll still be responsible for paying taxes and fees. For domestic flights this isn’t much of an issue, with taxes of only $5.60 one way. But outside of the US, award flights can have fuel surcharges and taxes that can get out of control quickly.

Depending on the airline and destination, the fees on an award flight can be more expensive than a cheap ticket paid with cash! That’s where your Barclaycard Arrival miles can come to the rescue.

Because you pay for your travel with your card and then redeem miles for the travel charge, all taxes and fees are included in the ticket price. So a $500 fare will only require 50,000 Barclaycard miles to “erase,” not 50,000 miles + $475 in taxes and fees.

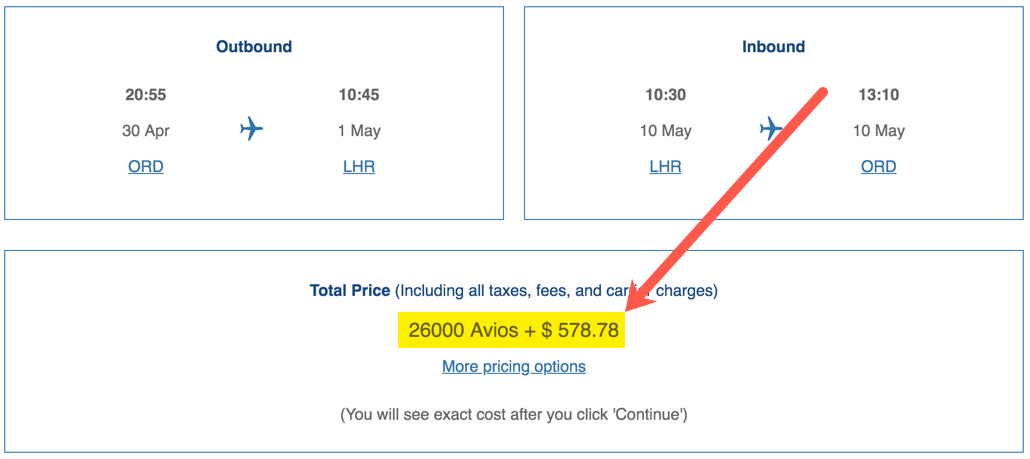

This can be a lifesaver if you’re traveling to the UK where taxes are exceptionally high. Just take a look at this off-peak Economy fight to London.

The other advantage to using Barclaycard Arrival miles toward airfare is that you’ll still earn frequent flyer miles and elite status credit for your flight! Paying nothing out of pocket and earning airline miles too can be an excellent deal.

2. Pay For Non-Chain Accommodations

Hotel points are a handy way to book free nights and they are often easy to earn. But what about those great accommodations that aren’t part of a major hotel chain? Or home sharing services like Airbnb?

These are great opportunities to use your Barclaycard Arrival miles to save. The caveat here is that the purchase needs to code as “travel” with Barclaycard. And sometimes it won’t always be clear what is going to code as travel and what won’t. For example, Airbnb typically will code as travel, but stays with some vacation rental services like HomeAway can code as “real estate.”

Barclaycard Arrival miles are great for booking boutique accommodations, but you’ll want to be aware of this potential snag.

3. Cover Extra Trip Expenses

Using miles and points to book incredibly cheap hotels and flights will do wonders for your vacation budget, but you’ll still have hundreds of dollars in other expenses like food, transportation, and activities.

While these expenses won’t often qualify as travel, there are ways to use your Barclaycard miles for them. For example, if you charge a meal or spa treatments to your hotel room, it could easily qualify as travel.

Other purchases like theme-park tickets or tours can also qualify as travel in some cases. If you want to save on Disney tickets you can purchase them through Undercover Tourist and lots of people have reported that the transaction codes as travel. But if you buy tickets directly from Disney, that won’t be the case.

If you’re not sure whether or not a purchase will code as a travel transaction, the best thing to do is make a small test purchase. Or do research in miles-and-points forums to see what other people’s experiences have been.

To learn more about Barclaycard miles check out our full review of the Barclaycard Arrival Plus.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!