Bank of America Premium Rewards benefits and perks

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

When you sign-up for the Bank of America®️ Premium Rewards®️ credit card, you’ll earn 50,000 Bank of America points after spending $3,000 on purchases within the first 90 days of account opening. Bank of America points are worth 1 cent each, making this bonus worth $500! With no blackout dates, the points you’ll earn will give you flexibility in booking your next trip. That’s just one great reason to open the card.

Aside from the alluring welcome bonus, the benefits of this rewards card make the card well worth keeping for the long run, for both frequent and casual travelers and everyday users. I’ll show you why this card’s perks can easily offset the card’s annual fee and save you hundreds each year.

Bank of America Premium Rewards Card benefits and perks

While the Bank of America Premium Rewards welcome bonus is enough to outweigh the card’s annual fee, there are many other ongoing perks and benefits that make the card worth keeping.

I’ll point out some of the card’s standout benefits. You can read the full Bank of America Premium Rewards credit card review here.

Up to $100 airline incidental statement credit

This is by far my favorite benefit offered by the Bank of America Premium Rewards credit card. Each year, you’ll receive up to $100 in statement credits each year for airline incidental purchases on domestic-originating itineraries with most U.S. airlines.

I usually come up short on elite status with major airlines, so I use this statement credit as a way to get elite benefits like preferred seating and lounge access without spending the money on the fees.

Here are a few of the ways you can maximize your annual $100 statement credit:

- Use all or part of your $100 statement credit to pay for upgrades to business or first class offered by airlines usually during check-in or booking

- Airlines sell day passes to their lounges for non-members. Day passes in the U.S. are usually around $59. Pay with your card and get the entry fee reimbursed

- When you need to check a bag or pay for an overweight bag fee, use your card to avoid these fees

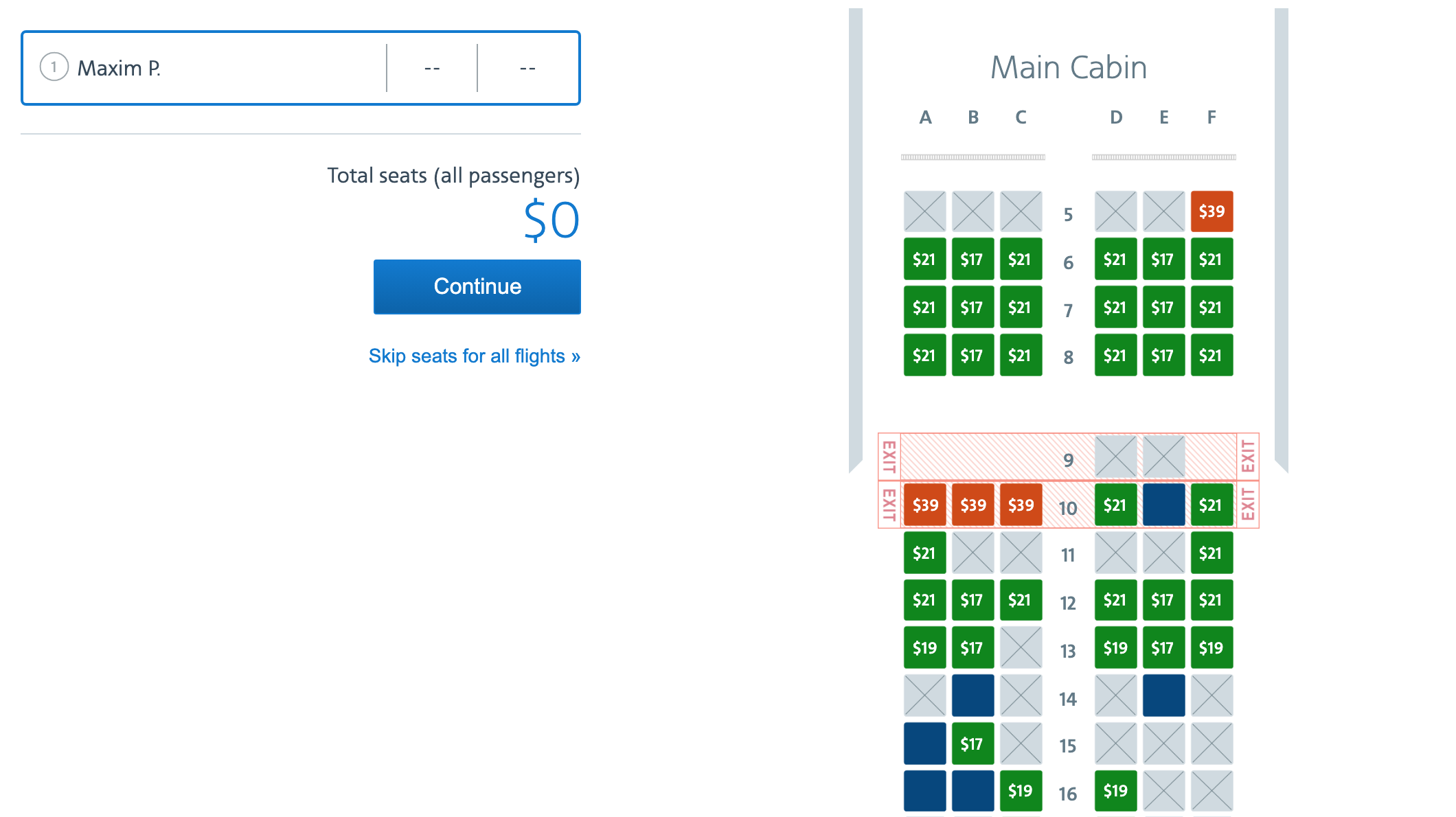

- If you’re offered the option to pay for a preferred seat — in the exit row, for example — use your Premium Rewards card to offset the fee

- Use your card inflight to purchase premium drinks or snacks and receive the amount back in the form of a statement credit

Global Entry ($100) or TSA PreCheck ($85) application fee credit

I can’t imagine a world in which I don’t have TSA PreCheck. With the days of randomly being assigned TSA PreCheck long gone, you’ll need to apply and be approved for TSA PreCheck if you want expedited security in the U.S.

If you travel internationally or at least have a passport, I recommend applying for Global Entry rather than TSA PreCheck. If you’re approved for Global Entry, you’ll automatically receive TSA PreCheck as well. You’ll be able to use Global Entry upon entry into the U.S. and TSA PreCheck at airport security.

Both services come with an application fee, and you’ll have to renew TSA PreCheck ($85) or Global Entry ($100) every five years. When you pay with your Bank of America Premium Rewards credit card, you’ll get a statement credit for the application fee once every four years.

Visa Signature Luxury Hotel Collection

The Bank of America Premium Rewards credit card is a Visa Signature card, which means you’ll receive benefits including access to the Visa Signature Luxury Hotel Collection. When you use your Bank of America Premium Rewards credit card to book a stay at a Visa Signature Luxury Hotel, you’ll receive benefits that include:

- Automatic room upgrade upon arrival, when available

- Complimentary in-room Wi-Fi, if available

- Complimentary breakfast for two guests

- $25 food or beverage credit

- VIP Guest status

- Late check-out upon request, when available

This is another one of my favorite benefits. If the hotels offered by my preferred hotel chain are too expensive or are super boring, the benefits I receive at Visa Signature Luxury Hotels makes it much easier to accept that I’m not earning an elite night or points.

Access to concierge service

Another great Visa Signature benefit offered by the Bank of America Premium Rewards credit card is access to concierge service. Simply call Visa Signature’s concierge team and they’ll be able to assist with a variety of requests, such as:

- Getting last-minute reservations at top restaurants

- Making recommendations on where to eat, stay, or what to do while on the road

- Finding tickets to top events, including concerts and theater productions

- Reminding you of important dates like anniversaries and even having gifts delivered

In the past, I’ve used concierge services to get last-minute tickets to concerts like Lorde’s Melodrama world tour and reservations at one of the most popular restaurants in West Hollywood.

Extended warranty

The Bank of America Premium Rewards credit card also offers extended warranty. When you purchase an eligible item with your card, it doubles the time period of the manufacturers’ warranty, up to one additional year.

To learn more about what’s covered and what’s not, as well as coverage limits, consult Visa Signature’s detailed terms and conditions.

Purchase security

When an eligible item you’ve purchased with the card is accidentally broken or stolen within 90 days of purchase, you could receive up to $10,000 per claim.

Return protection

Another benefit for shoppers offered by the Bank of America Premium Rewards credit card is return protection on eligible purchases. Again, you’ll need to use your card for the full amount of the purchase for an eligible item to be covered under this benefit.

If you need to return an eligible item within 90 days of purchase and the merchant won’t take it back, you could be reimbursed up to $250 per item and up to $1,000 annually.

Travel coverage

There’s nothing worse than when a vacation or trip does not go as planned. Often, you can be left helpless and required to spend hundreds, if not thousands, just to get your trip back on track or to get home. However, the Bank of America Premium Rewards credit card takes a lot of this stress away, thanks to the card’s travel coverage.

The Premium Rewards card offers expansive travel-coverage options including in the event of a long delay, lost or delayed bags, or damaged rental car. Here are the benefits offered by the card for travelers:

Travel Cancellation/Interruption

The Bank of America Premium Rewards credit card covers eligible expenses should something not go as planned during your trip. If your trip is interrupted or canceled for a covered reason, you’ll be eligible for reimbursement for prepaid, unused, non-refundable travel expenses including passenger fares, tours, and hotels. The maximum amount you can receive is $5,000 per person per trip.

Baggage delay and loss

The Bank of America Premium Rewards credit card also offers baggage delay or loss insurance. As long as you use your card for the full amount of a ticket booked with a common carrier (airline, cruise, train, bus), your bags will be covered.

For delayed luggage, you will receive up to $100 per day (for up to five days) when your bag is delayed more than six hours, for necessities like clothing and toiletries. If your bag is lost or damaged by the common carrier in transit, you’ll be eligible for reimbursement for all or part of the value of the contents in your bag.

The terms of this card benefit rank among the best travel credit cards.

Trip delay coverage

Stuck in the airport because your flight’s delayed? You may be eligible for reimbursement for expenses during your delay. The Bank of America Premium Rewards credit card offers delay coverage.

If your delay is 12 hours or more and is the result of a covered event, you can be reimbursed up to $500 for things like meals, ground transportation, or even hotel rooms.

Rental car insurance

Don’t let a little dent wreck your next trip. With the Bank of America Premium Rewards credit card, you’ll receive secondary rental car insurance in the event that your rental takes a turn for the worse.

The Premium Rewards card offers secondary coverage in the U.S. but in most countries abroad, the card offers primary coverage. Basically, the card’s rental car insurance will kick in for amounts not covered by your personal policy.

So, if like MMS team member Harlan, you get dinged for a small dent in one of the doors, you won’t have to worry about paying the cost of the damages.

Overall value

If you even just use this card’s annual airline incidental fee statement credit worth up to $100, you shouldn’t have any trouble justifying the low annual fee. If you manage to use other benefits and earn the welcome bonus, you’ll easily get the annual fee back — and then some.

If you’re a frequent flyer, this card is amazing, considering the reasonable annual fee. Another of my favorite benefits of this card is the statement credit toward either Global Entry ($100) or TSA PreCheck ($85) application fees every four years. Even if you’re not a big-time flyer, you can still get a lot of value out of benefits like purchase protection and extended warranty.

Bottom line

I highly recommend the Bank of America Premium Rewards credit card. You’ll earn 50,000 points (worth $500) after spending $3,000 on purchases within the first 90 days of account opening. And you can more than offset the card’s reasonable annual fee by maximizing one single card benefit.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!