Back to School Shopping 101: The Credit Card You Need to Save Big

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Computers, pencils, highlighters, binders, folders, glue sticks, headphones, and dope new jeans.

Back to school expenses are for real. Especially if you have gobs of kids! So you may as well use the opportunity to jump start your miles & points reservoir for summer vacation 2019.

The credit card you use for back to school shopping can really make a difference (probably more than you think!). I’ll share the top 5 best cards you should use for back to school shopping, based on where you shop. You could earn the equivalent of 10% or more back!

The information for the Amazon Prime Rewards Visa Signature Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Here’s a quick round-up of cards your should consider when you’re out ticking items off your school supply lists!

Best Credit Cards for Office Supply Stores

You’ll find the vast majority of back to school expenses at your local office supply store. That’s good news, because plenty of small business cards give you bonus points for shopping at office supply stores!

Just remember, you must have some sort of business to qualify for these cards. That means a for-profit venture, like tutoring, babysitting, selling items on Etsy, etc. You might even qualify for a small business card without realizing it.

Depending on the item, office supply stores can sometimes be a little more expensive than stores like Walmart or Target for school supplies. So be sure to crunch your numbers and get the best deal first and foremost!

Ink Business Cash Credit Card

Apply Here: Ink Business Cash Credit Card

With the Ink Business Cash Credit Card, you’ll earn 5% cash back (5X Chase Ultimate Rewards points per $1) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet, and cable TV services each account anniversary year. So you should have no trouble receiving at least 5% back for all the staplers and pencils and notebooks your kids need.

And if you combine your points with an annual-fee Chase Ultimate Rewards points earning card, you can get significantly more value. You’ll be able to redeem your points for travel at a better rate through the Chase Ultimate Rewards Travel Portal, or transfer your points to valuable Chase partners for Big Travel.

For example, the Park Hyatt Milan costs ~$700, or 30,000 Hyatt points, per night. So by transferring your Chase Ultimate Rewards points to Hyatt, you’ll receive a value of ~2.3 cents per point ($700 cash cost / 30,000 points)!

That’s like getting ~11.6% back on your office supply store purchases (5 Chase Ultimate Rewards points per $1 X ~2.3 cents each)!

The Ink Business Cash Credit Card offers a $500 cash back (50,000 Chase Ultimate Rewards points) welcome bonus after spending $3,000 on purchases in the first 3 months of account opening.

SimplyCash® Plus Business Credit Card from American Express

Apply Here: SimplyCash® Plus Business Credit Card from American Express

The SimplyCash® Plus Business Credit Card from American Express earns 5% cash back at US office supply stores, as well as wireless telephone services purchased directly from US and service providers. This applies to the first $50,000 in purchases per calendar year, then 1% thereafter.

This is a similar earning rate to the Ink Business Cash, except you’ll earn straight cash back. You can’t transfer your earnings to travel partners.

Best Credit Cards for Supermarkets

Blue Cash Preferred® Card from American Express

Apply Here: Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® Card from American Express earns 6% cash back at US supermarkets on up to $6,000 per year in purchases (1% thereafter). That is practically unbeatable.

So if you buy your back to school supplies at stores like Kroger, this is a fantastic option. Plus, it’s a great card for weekly groceries, so you’ll continue to earn 6% back for your kids’ packed lunches and snacks!

Team member Jasmin has found sweet deals on items like lunchboxes, binders, and reusable plastic containers at her local Wegmans for back to school. Although the supermarket isn’t most folks’ first thought for these items, it’s worth checking out.

The AMEX Blue Cash Preferred comes with a $200 statement credit after you spend $1,000 in purchases within the first 3 months of account opening.

Hilton Honors American Express Ascend Card

Apply Here: Hilton Honors American Express Ascend Card

If you’re looking to rack up hotel points for a big vacation with your back to school expenses, the Hilton Honors American Express Ascend Card is a great option!

The AMEX Hilton Honors Ascend earns 6 Hilton points per $1 at US supermarkets, as well as US restaurants and US gas stations. Hilton points are generally worth ~0.5 cents each. So you’re safe in betting that 6 Hilton points per $1 is the equivalent of at least 3% back (6 Hilton points per $1 X 0.5 cents each).

However, it’s possible to get MUCH more value from the points, too! For example, the Hilton Garden Inn Tulsa South costs 10,000 Hilton points per night. But you’d spend ~$140 for the same night!

You can receive a value of ~1.4 cents per point at this hotel ($140 per Night / 10,000 Points). If you get 1.4 cents per point, earning 6 Hilton points per $1 is like earning 8.4% back (1.4 cents per point X 6).

And when you open the AMEX Hilton Honors Ascend, you’ll earn 125,000 Hilton points after spending $2,000 in purchases with your new card within the first 3 months of account opening.

Best Credit Card for Amazon Purchases

Chase Amazon Prime Rewards

Apply Here: Amazon Prime Rewards Visa Signature Card

You can find just about anything you need on Amazon. Office supplies, clothing, and even groceries!

The Chase Amazon Prime Rewards earns 5% back on all Amazon and Whole Foods purchases if you have an Amazon Prime membership. If you don’t have an Amazon Prime account, you’ll earn 3% back.

Amazon Prime is really great, and lots of us at Million Mile Secrets have it! But if you aren’t interested in its benefits, it’s definitely NOT worth applying just to earn an extra 2% back.

The Chase Amazon Prime Rewards comes with a $70 Amazon gift card upon approval (no minimum spending requirement!).

Use ANY Card With a Welcome Bonus You’re Trying to Earn

Remember, the best credit card to use is the one you’re still trying to earn a welcome bonus with!

Earning credit card welcome bonuses by completing minimum spending requirements is the fastest way to get Big Travel with Small Money. So if you need to put all your spending on a certain card to meet the spending requirements, it’s worth doing even if you’re not receiving a nice category bonus.

For example, if you’ve opened the Ink Business Preferred Credit Card and need to put all your spending on the card to complete its minimum spending requirement, DO IT. The welcome bonus you’ll earn is worth much more than 5% back at a grocery store.

The Key to Huge Back to School Savings

Link: Everything You Need to Know About Online Shopping Portals

Online shopping portals are an easy way to earn lots of bonus miles, points, or cash back on purchases you’d probably make anyway. Nearly every airline, hotel, and bank has some kind of shopping portal to help you earn Big Travel extra quickly!

This comes in especially handy for back to school shopping. You’ll earn extra points through the portal in addition to the bonus points you’re already earning from your credit card.

So for example, if you plan to swing by Staples and spend $80 on back to school gear (binders, pens, calculators, flash drives, etc.), you can use the Ink Business Cash to earn 5 Chase Ultimate Rewards points per $1 you spend.

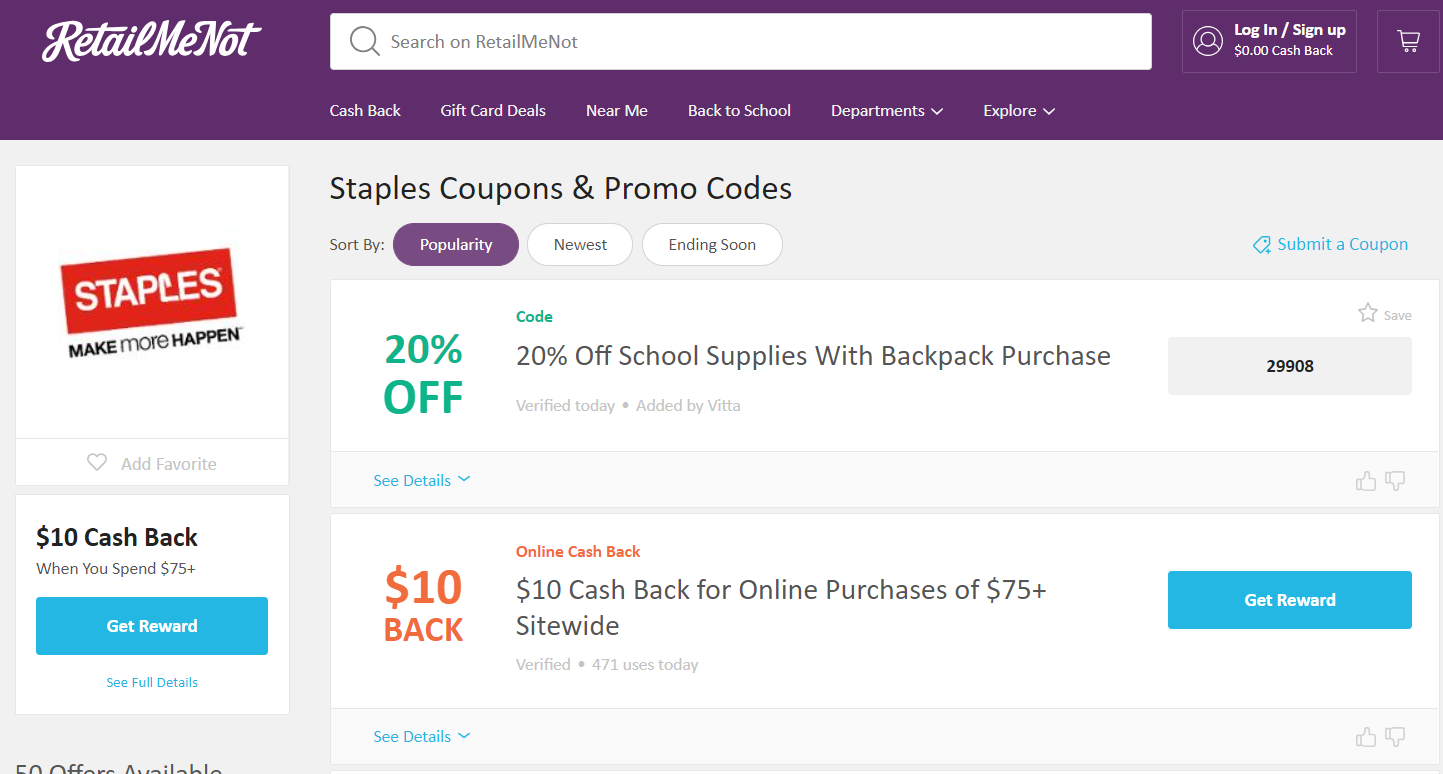

But if you shop on the Staples website through a portal like RetailMeNot, you can get an extra 20% back, or $10 off your bill. And you’ll STILL earn 5 Chase Ultimate Rewards points per $1. That’s called double dipping, folks. And it’s HUGE.

If you shop online and are NOT using online shopping portals regularly, you are leaving LOTS of miles & points (or cash) on the table!

Bottom Line

Ease the unpleasantness of back to school by shopping with a top travel credit card that earns you a whole mess of points or cash back!

Lots of cards offer bonus points for shopping at certain stores with school supplies. My top recommendation is the Ink Business Cash for folks who do most of their back to school shopping at office supply stores.

For folks who shop at stores like Kroger, check out the AMEX Blue Cash Preferred. And for Amazon, try the Chase Amazon Prime Card.

And don’t forget to use shopping portals whenever you can! Most brick and mortar stores have websites you can use while also earning a shopping portal bonus. Read our full guide here.

Happy new school year!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!