Avoid the Same Silly Mistake I Made When Applying for a Chase Business Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If it ain’t broke don’t fix it.

I wish I would have followed this advice before applying for the Ink Business Unlimited℠ Credit Card. But after successfully getting several business cards over the past years, I decided to change something on my business card application that could cost me a huge sign-up bonus.

If you follow our step-by-step guide to completing a Chase business card application, you’ll likely avoid being in the same predicament as me.

Pay Extra Attention to Your Business Name When Submitting an Application

We have lots of great posts on the blog explaining how you might qualify for a business card without realizing it!

Most folks are happy to learn you do NOT need an EIN (Employer Identification Number) or 6-figure revenue to be eligible for a business card. You can apply using just your social security number as long as you show the bank you’re operating a for-profit venture.

I have a few different side hustles. But I normally submit business card applications and reference my eBay drop shipping business.

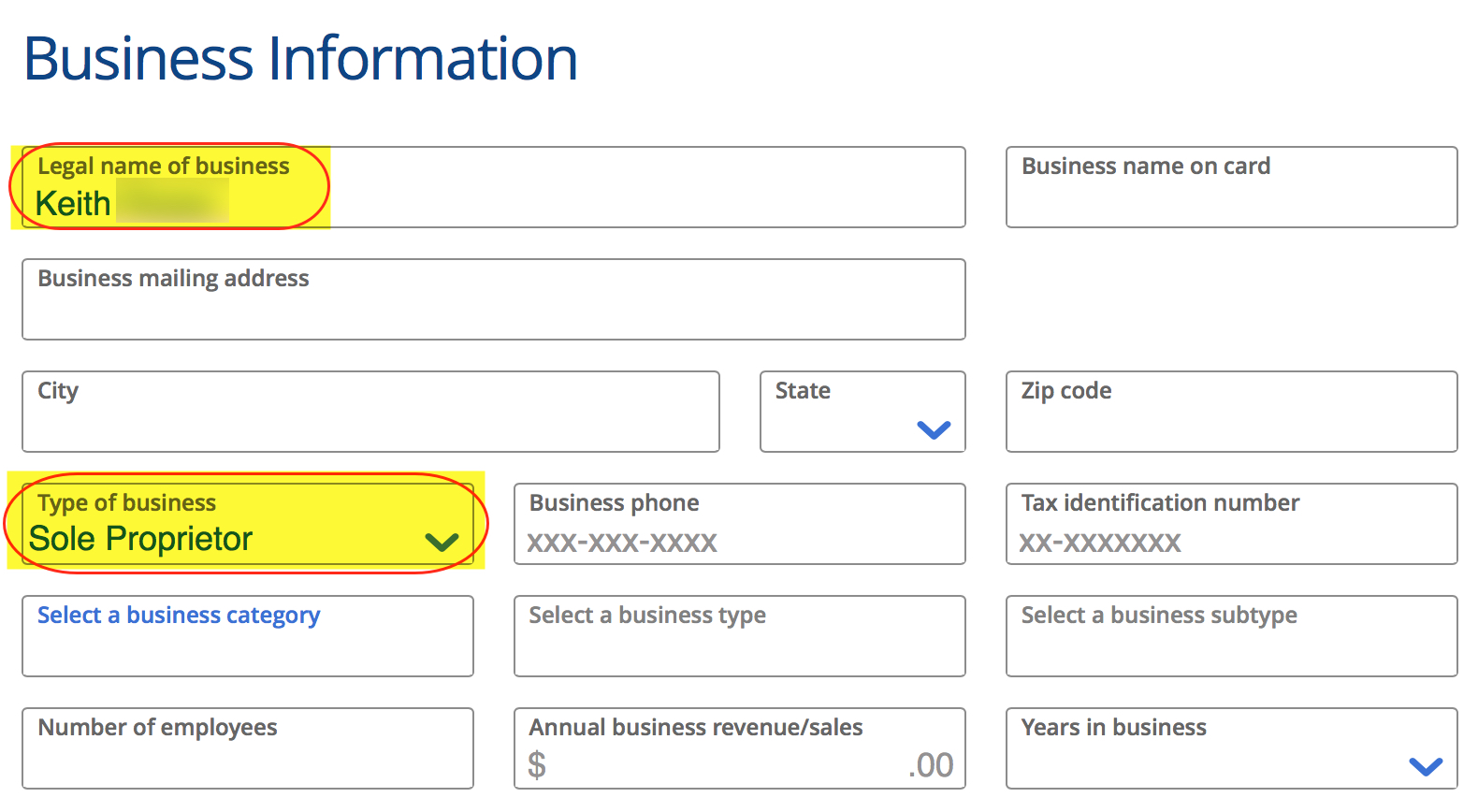

On the application page, I usually enter my first and last name in the “Legal name of business” field. This has worked to get me 4 Chase business cards over the past few years. And I apply as a sole proprietor, which means I don’t have an LLC or other formal business structure.

But on my recent application for the Ink Business Unlimited, I decided to type my first and last name and “eBay” in the legal name of my business. The result? My application went pending.

I immediately called the Chase reconsideration line because I was anticipating getting an instant approval. After speaking with the friendly representative, she said the bank would need to verify the legal name of my business. I explained my situation and that I’m just a sole proprietor looking to use this card for my eBay business. But she told me there wasn’t anything she could do until I receive a letter outlining the list of documents I’d need to submit to the bank to verify my business name.

I’m still waiting on the letter. And I’m optimistic I’ll have enough information to verify my business. But in hindsight, I should have just used my first and last name in the business name field, which would have likely got me an instant approval.

My takeaway from this situation is Chase already knows I have several other business cards that just list my first and last name. And I’m guessing that submitting an application with a new business name prompted them to ask for more information.

I’m especially disappointed in myself for trying to change things up because of I have a few large upcoming purchases that would have allowed me to easily knock out the minimum spending requirement for the card. Instead, I’ll have to wait and hope that the information I provide is enough to switch my pending application to an approval.

Why I Want to Add the Ink Business Unlimited to My Wallet

Apply Here: Ink Business Unlimited℠ Credit Card

Our Review: Review of the Ink Business Unlimited

The Ink Business Unlimited card ranks high on our list of top credit card offers. When you sign-up for this no-annual-fee business card, you can earn a $500 bonus (50,000 Chase Ultimate Rewards points) after spending $3,000 on purchases within the first 3 months of account opening.

The sign-up bonus has the potential to be much more valuable if you have other Chase cards, like the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Ink Business Preferred. Because you can combine points to one of these accounts and then transfer them directly to Chase’s terrific airline and hotel partners, like Hyatt or United Airlines.

I recently shared how I’d use part of this card sign-up bonus to save money on a trip to Bora Bora.

Bottom Line

I’ve been successful getting several Chase small business cards over the past few years by entering just my first and last name in the “Legal name of business” field on the card application page.

But on a recent application for the no-annual-fee Ink Business Unlimited℠ Credit Card, I decided to add the word “eBay” to the business name. The result was my application was not immediately approved. And now I’ll have to submit documentation to Chase to verify the business name.

I’m hopeful that my application will eventually be approved. Because I could really use the valuable sign-up bonus points from the Ink Business Unlimited card. But I learned my lesson to not change things on my application unnecessarily.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!