6 Secret Reasons Why Folks Actually Prefer to Apply for Cards in December

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Ending the year by taking advantage of a top credit card offer can make a lot of sense!

For example, you can put all of your holiday spending on a new card. These purchases can make it easier to meet minimum spending requirements and unlock lucrative sign-up bonus offers!

There are lots of other reasons folks apply for credit cards in December, including some that might not be so obvious!

Why Apply for Credit Cards in December?

1. Make Holiday Purchases to Get a Head Start on Minimum Spending Requirements

Link: 7 Excellent Card Offers to Reward Yourself (Cash or Free Travel) for Holiday Spending!

Lots of folks increase their budgets in December to pay for holiday gifts or travel to see family and friends. Rather than pay cash or use a dusty old credit card, your year end spending could go on a new card and count toward minimum spending requirements!

The quickest way to get Big Travel with Small Money is to earn valuable credit card sign-up bonuses. Or you might prefer to earn a cash back sign-up bonus to offset your holiday gift expenses!

Some cards have a smaller minimum spending requirements than others. It’s possible to earn valuable sign-up bonuses with just $1,000 in minimum spending!

Don’t forget, you can use tools like Plastiq to pay bills which don’t normally accept credit cards, like rent, utilities, mortgages, and HOA fees. You’ll pay a small convenience fee, but folks like team member Harlan love using the service to quickly meet minimum spending requirements on a new card!

Just be sure to only spend what you can afford to pay off when the statement arrives. Because any interest or fees you pay when carrying a balance can erase the value of miles & points!

2. Save Money on Holiday Purchases With AMEX Offers

If you apply for a new AMEX card, you’ll get access to AMEX Offers, which is a fantastic way to save money on purchases you might already be planning this holiday season.

Recent offers include statement credits when you make purchases with Hilton, including Waldorf Astoria & Conrad Hotels, as well as restaurants like Cheesecake Factory and Outback Steakhouse! And other great deals when you make purchases with Lowe’s, StubHub, Universal Orlando, and more!Sometimes gift card purchases qualify for savings with AMEX Offers. But be sure to check the terms & conditions for a specific deal to be sure they’re eligible. And don’t forget you have to add each individual offer you like to your AMEX card and use that card for your spending!

3. Earn Calendar Year Statement Credits 2X With Just 1 Annual Fee!

Link: Apply Before 2018 to Get 2X the Yearly Bonus With These Cards

Some cards offer an annual credit for certain travel purchases. It depends on the card, but the credit could cover airfare, baggage fees, or even airline gift cards.

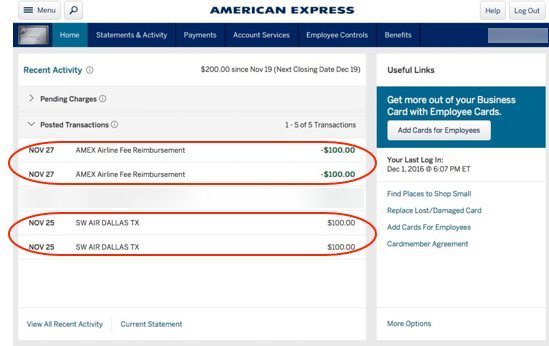

For example, I purchased Southwest gift cards to take advantage of the $200 calendar year statement credit with The Business Platinum® Card from American Express.

I recently shared how certain cards offer a credit based on a calendar year. This means you can earn the credit now before 2017 ends, and again in early 2018. So you’ll only pay one annual fee, but earn 2 credits!

These cards offer calendar year travel credits:

- AMEX Platinum (personal, Mercedes-Benz, or small business)

- Bank of America® Premium Rewards® credit card

- American Express® Gold Card

- Ritz-Carlton Rewards® Credit Card

- Citi Prestige

4. Open a New Card With Better Purchase Protection Benefits!

Link: Avoid Wasting Money on Extended Warranties Just by Paying With These Credit Cards!

Link: Save Money Using Citi Price Rewind to Track Your Purchases

Your holiday shopping list might include a big-ticket item like a computer, television, furniture, or home appliance. Most stores try to sell you an extended warranty plan, which makes your purchase more expensive.

But just paying with a certain credit card can get you automatic extended warranty benefits or other purchase protections. For example, Citi ThankYou Premier Card cardholders get up to 2 years added to manufacturer warranties (not to exceed a total of 84 months from date of purchase).

And Citi cardholders (personal cards only) get access to Citi’s Price Rewind program, which is an amazing perk! When you pay for an eligible item with your card, you can get a refund if the price drops within 60 days. These are some of the items covered by this benefit:

- Appliances

- Clothing

- Electronics

- Furniture

- Toys

Million Mile Secrets team member Jasmin got back $20 from the filing cabinet she bought earlier this year!

5. Start Using Automatic Elite Status Perks for Holiday Travel!

Link: Which Hotel Cards Give You the Best Perks Like Room Upgrades & Late Check-Out?

Some hotel credit cards offer automatic elite status just by keeping the card in your wallet. For example, the Chase Ritz-Carlton card gets you automatic Gold status at Marriott and Ritz-Carlton first year you have the card. After that, you’ll need to spend $10,000 per year on the card to keep the status.

And AMEX Platinum cardholders can get Starwood Gold status. You can then match it to Marriott Gold elite status. You’ll also get free Hilton Gold elite status with any of the AMEX Platinum cards (personal, Mercedes-Benz, or small business).

Elite status benefits vary by hotel chain, but typically include bonus points for stays, late check-out, and room upgrades! These perks can be a nice treat if you’re traveling this holiday season!

6. Deals and Offers Can Change Quickly Without ANY Notice!

Great deals do NOT last forever in the miles & points hobby! And the beginning of the year tends to be when changes are made.

For example, on January 1, 2017, Southwest announced, without warning, points transfers from hotel and car rental loyalty programs would no longer count toward the Companion Pass. Thankfully, they ended up reversing their decision to give folks a few months notice of the change.

But credit card perks and amazing deals are constantly evolving. So if you see an offer you like, don’t hesitate! Because it can disappear as fast as I make holiday desserts go away!

Bottom Line

By applying for a credit card at the end of the year, you can:

- Use your new card for holiday shopping to help meet minimum spending requirements and unlock lucrative sign-up bonuses

- Save money on holiday purchases with AMEX Offers by applying for a new AMEX card

- Earn calendar year travel statement credits by the end of 2017 and again in early 2018

- Get better purchase protections (like extended warranties) on big-ticket items you buy this holiday season

- Take advantage of elite status perks that come automatic with certain hotel credit cards

- Avoid missing out on a great deal because offers or program terms sometimes change at the start of a new year

Let me know if there’s a great offer you plan to sign-up for before the year ends!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!