How to buy stock with a credit card — here’s what to consider

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The last few weeks have been a whirlwind for the markets. With the meteoric rise and fall of Gamestop shares and retail investors attacking hedge funds’ short positions, there’s a newfound interest in investing in the stock market.

Most invest cash straight into the market, but you may wonder if you can purchase stock with a credit card and earn some rewards to boot?

While there are a few ways to buy stock with a credit card, the bigger question is, should you do it? You’ll need to consider the fees and tax implications before diving in.

How to buy stock with a credit card

Stockpile

There’s only one way that you can directly buy stock with a credit card. That’s through the Stockile app. It’s a simple-to-use investing platform that’s built for beginners.

Stockpile has thousands of stocks available to trade, be it Apple, Tesla, NetFlix or a Vanguard index fund. You can buy and sell stocks like any other normal brokerage like Robinhood, Etrade, or Schwab.

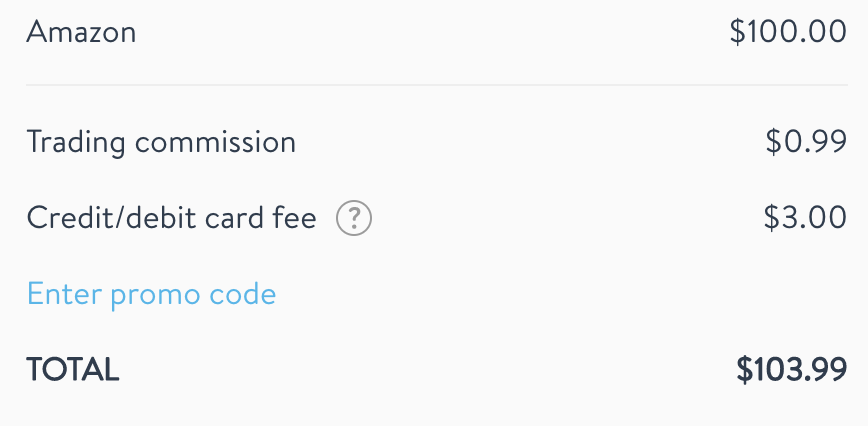

The main catch with Stockpile is its fees. You’ll have to pay a $0.99 trading fee when you buy and sell a stock. And if you want to purchase with a credit card, you’ll have to pay a 3% fee on the total amount of stock you’re purchasing. However, you should earn credit card rewards for your purchase.

For example, purchasing $100 of Amazon stock would lead to about $4 in fees.

Another drawback of Stockpile is that trades aren’t made in real-time — you’ll have to wait for the next business day for them to be executed. The price could significantly fluctuate between the time you hit sell and when the order is actually executed.

American Express Schwab Platinum

Charles Schwab has two American Express cards that earn rewards which are deposited straight into your brokerage account: the Schwab Investor Card from American Express and the Amex Platinum for Schwab.

With the Amex Platinum for Schwab, it functions in a nearly identical fashion as The Platinum Card® from American Express. It earns transferrable Membership Rewards points and comes with all of the same travel benefits, like lounge access and hotel elite status.

However, the Schwab Platinum allows you to cash out Membership Rewards points into a Schwab brokerage account at a rate of 1.25 cents per point. That’s more than double the normal cash-out rate for Amex points (across all Membership-Rewards earning cards), so it’s a great option if you’re interested in investing your points.

And as long as you have a Schwab Platinum card open, you can cash out Membership Rewards points earned from other Amex cards at the 1.25 cent rate.

Use cash back rewards from a credit card

Finally, most rewards credit cards allow you to redeem your points for straight cash. The same can obviously be said for all cash back credit cards. With your rewards in hand, you can take this cash, transfer it to your preferred brokerage and invest the money however you like.

If you don’t want to go through the backdoor process just described you should look to Fidelity. The financial institution has a credit card that earns 2% cash back and those rewards can be deposited straight into a brokerage account, IRA, Roth IRA, 529 account and more.

While you’ll usually get much more immediate value from your bank points when transferring to travel partners and booking luxury accommodations or a first-class flight, this could be a good option if you aren’t traveling much or want to invest for the long term.

The information for the Fidelity Visa, Schwab Investor card by Amex, and the Amex Platinum for Schwab has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Should you buy stock with a credit card?

It needs to be said, you should only be purchasing stock if you actually have the money to invest. And if you do use a credit card, make sure you’re paying it off in full every month. Any interest you’re charged will very likely wipe out the gains on your investments. Investing in the stock market is risky, and you’re not guaranteed a positive return on any of your investments.

Remember that investments are taxable, so any gains are subject to either short or long-term capital gains taxes.

Fees to consider

With Stockpile, you’ll have to pay significant fees, but those could possibly be offset by credit card rewards and investment growth.

Using a card like the Citi® Double Cash Card could be a good option since it earns 1% cash back on all your purchases and another 1% cash back on payments. Essentially, you’re earning 2% cash back on everything. That effectively brings down StockPile’s fees to 1% + $1 per trade. And if you convert cash back earned from the Double Cash into Citi ThankYou points, you could possibly squeeze out more value since we estimate they’re worth 1.7 cents each towards travel.

All this being said, it’s still questionable to purchase stocks for the credit card rewards themself. Investing is risky (especially in individual stocks) — if you’re investment drops by just a few percent, the rewards you earned won’t have really mattered.

Data points around the internet appear to show that you won’t be charged a cash advance fee when using your credit card at Stockpile. That being said, it may be smart to make a smaller test purchase to make sure you won’t be hit with an exorbitant penalty.

The information for the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

If you’re wanting to buy stock with a credit card, it is possible. You’ll just have to weigh if the associated fees are worth it. Make sure you understand all the risks of investing before you purchase stock, especially with a credit card.

For more, subscribe to our newsletter for more credit card and points analysis delivered to your inbox once per day

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!