Small Business Ideas to Earn Big Miles & Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Folks with small business credit cards have lots of ways to earn miles & points thanks to many terrific bonus spending categories.

This is especially helpful for folks who are impacted by tougher credit card application rules, which limits the opportunity to earn new card sign-up bonuses.

So spending a lot in bonus categories is the next best way to increase your points balances! And many bonus categories are common for small business owners, like advertising, office supplies, and shipping.

Keep in mind, earning points with a small business takes time!

I’ll share a few quick small business ideas which can earn bonus miles & points!

Earn Miles & Points With a Small Business

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

Even without a large upfront investment, there are still lots of activities that can qualify you as a small business.

And this means you can get a small business card to boost your miles and points balances by putting spending on the card. And having a small business card is a great way to keep your personal and business expenses separate!

For certain expenses, there are several cards that might be a good fit to get you a bonus. The best rewards to earn will depend on your travel goals.

Here are 7 ways you can earn miles & points with a small business!

1. Selling on eBay and Amazon

Selling items for a profit on eBay or Amazon is a great way to earn extra cash. And you can do it right from your home!

You don’t need much to get started. Just a computer and photos of the products you’d like to sell.

The money you make selling items on ebay or Amazon is business income. Getting a business card will help you separate your business expenses (such as postage) from your personal expenses.

Folks who sell items through these websites can do well with certain business cards that earn bonus rewards at office supply stores. Because you can use your card at stores like Staples and Office Depot to purchase items that help support your online sales business.

For example, office supply stores are included in the 5X rewards category on the SimplyCash® Plus Business Credit Card from American Express, Ink Business Cash℠ Credit Card and Ink Plus (no longer available to new applicants).

For instance, Million Mile Secrets team member Keith actively sells items on eBay and Amazon. And he uses his Ink Plus card to shop at Staples for items like printer ink and paper, shipping materials, and computer accessories.

Keep in mind office supply stores also sell computers, phones, and office furniture. These larger purchases can be a great way to earn 5X bonus points.

2. Etsy Store

For creative folks, setting up an online Etsy store as a side business can be a great way to supplement your income. Some even do it full-time!

I’ve seen lots of unique items on Etsy like custom jewelry, arts & crafts, embroidered goods, and much more. So if you make items like these, you might be able to sell them for a profit through your online store!

Your online store can also earn you flexible Chase Ultimate Rewards points! Because when you pay selling fees with Ink Business Preferred℠ Credit Card, you’ll earn 3X Chase Ultimate Rewards points. Thanks to Million Mile Secrets reader Matt for pointing out these fees count as advertising spending in the bonus category!

Etsy fees are very reasonable. You pay $0.20 to list an item for sale for 4 months. Then, you pay fees of ~6.5% after your item sells, which includes a transaction fee and payment processing fee.3. Airbnb Host

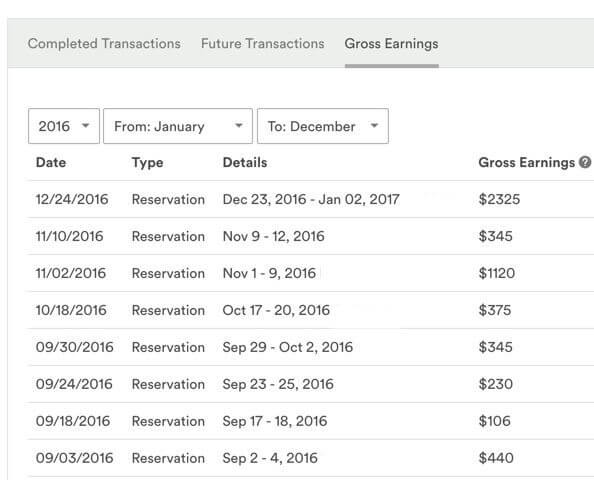

Becoming an Airbnb host can be a great way to make some extra cash renting extra space in your apartment or home. Or renting your entire place while you’re traveling.

Combine the extra cash with bonus miles & points when you use a small business credit card to pay for hosting expenses.

Team members Keith and Harlan are Airbnb hosts and there are lots of Airbnb related expenses they put on their small business cards, including cleaning products, food, toiletries, and internet service.

Depending where you shop, many of these purchases can earn you bonus rewards. For example, you can purchase cleaning products and toiletries at U.S. office supply stores to earn 5X rewards using:

- AMEX SimplyCash Plus

- Chase Ink Business Cash Credit Card

- Chase Ink Plus (no longer available to new applicants)

The Ink Cash and Ink Plus cards are also great because you’ll get 5% cash back (5X Chase Ultimate Rewards points) on landline, internet, and cable TV expenses, which you likely pay for as a host.

And if you offer to pick-up guests at the airport, you can also use a small business card to pay for the fuel expenses and earn bonus points.

For example, you can earn 3X AMEX Membership Rewards points at U.S. gas stations with the The Business Gold Rewards Card from American Express OPEN or AMEX SimplyCash Plus when it’s your selected bonus category.

4. Uber & Lyft Driver

I know folks who drive part-time for Uber or Lyft. You can make your own hours and use your own vehicle.

As a driver, gas will likely be a significant expense. So you’ll want a small business card that earns bonus miles & points each time you refuel.

If you collect AMEX Membership Rewards points, you can earn 3X AMEX Membership Rewards points if gas stations is your selected bonus category on the:

Folks who collect Chase Ultimate Rewards points automatically earn 2X Chase Ultimate Rewards points at gas stations with the Ink Cash or Ink Plus.

For tips and tutorials on becoming an Uber or Lyft driver, I’d recommend checking out The Rideshare Guy.

5. Delivery Driver

If you’re looking to make some extra cash driving, but don’t want to pick up passengers, you can consider working for a delivery service like Caviar, DoorDash, or Postmates.

It’s easier to qualify to drive for these companies, compared to Uber and Lyft, because your vehicle doesn’t have to meet the same requirements. You can even use a motorcycle!

And if you’re a parent who doesn’t want to leave a child at home, you can make deliveries for a few hours while your son or daughter plays on the iPad in the back seat!

Because you work as an independent contractor for these companies, you’ll be able to qualify for a small business card!

And similar to Uber and Lyft, gas will likely be your top expense as a driver. So consider cards like the AMEX Business Gold Rewards or Chase Ink Cash, which earn bonus points on gas purchases.

If you’re interested in learning more about driving for these companies, I’d recommend reading reviews about each service on The Rideshare Guy.

6. Online Marketer

I have friends who are savvy with social media platforms. Some have setup small businesses to help other business owners build a presence on the internet. For example, working with a local plumber or mechanic to create paid advertisements on Facebook or Twitter.

Similarly, you might contract with a real estate agent to help with online advertising campaigns for a house listing or apartment rental.

You can pay for the advertisements with your credit card and then get reimbursed by the small business you’re working for.

This is a great way to earn lots of extra miles & points, especially when you use a card that gets you bonus rewards on advertising purchases.

For example, you can earn 3X Chase Ultimate Rewards points with the Ink Business Preferred on advertising purchases made with social media sites and search engines.

And you can earn 3X AMEX Membership Rewards points if advertising is your selected bonus category on the AMEX Business Gold Rewards or AMEX SimplyCash Plus.

These cards are great if you use advertising platforms like:

7. Freelance Graphic Design & Writing

Many freelance graphic designers and writers also pay to advertise their services and portfolios.

If you’re a freelancer who utilizes coworking space at places like WeWork, you can earn rewards when you pay your rent with a credit card.

There’s no specific bonus category for coworking space. But depending on your arrangement, you might be able to pre-pay your rent for a few months to hit a bonus spending requirement.

As an example, if your payment is more than $5,000, you can use The Business Platinum® Card from American Express to earn 1.5X AMEX Membership Rewards points on the purchase.

I’d only recommend doing this if you can pay the full balance at the end of the month. Because the extra rewards you might earn with a large one-time purchase can be offset by interest charges and fees.

Bottom Line

There are many activities you can do on the side to qualify you as a small business, which don’t require a significant financial investment.

Then, you can get a small business card to earn miles and points by making purchases for your business utilizing a card’s bonus rewards categories.

For example, folks selling on eBay or Amazon can use the Chase Ink Cash or AMEX SimplyCash Plus card to purchase shipping supplies at office supply stores and earn 5X rewards.

Or Etsy sellers can use the Ink Business Preferred to earn 3X Chase Ultimate Rewards points when paying selling fees.

Do you have a small business that earns you extra miles and points?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!