Will You Be Approved for the 3-Night Ritz-Carlton Card?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

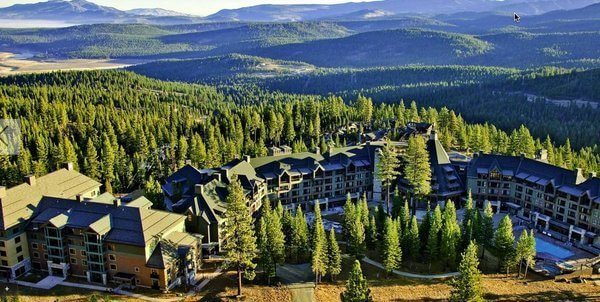

Many folks are excited about the perks of the new Chase Ritz-Carlton card offer. Like earning 3 complimentary nights after meeting minimum spending requirements to use for luxury stays at hotels in the US, Caribbean & Mexico, Europe, or Asia.

Because this card is issued by Chase, many are wondering if the bank’s stricter application rules apply.

Based on several sources, even if you’ve had lots of new cards in the past 2 years, you CAN still get approved for the Chase Ritz-Carlton card. But this doesn’t mean it’s automatic.

I’ll explain more about this exciting news!

What We Know About Ritz-Carlton Card Approvals

Link: Ritz-Carlton Rewards® Credit Card

Link: My Review of the Ritz-Carlton Card

According to several sources, it appears you can get approved for the Ritz-Carlton card, even if you’ve opened more than 5 new credit cards in the last 24 months.

For example, Doctor of Credit reports the new Ritz-Carlton card is NOT affected by Chase’s tougher application rules.

And, a user on Reddit, stated he was approved for the card despite having more than 5 new credit cards this year.

Folks on FlyerTalk with lots of recent new credit cards were also successful getting approved for the card.

These reports are great! But remember Chase can still deny your application if they feel like you’ve had too many recent credit cards.

Application Requirements

There are no official requirements released by Chase that will guarantee approval for the card. But because the card is part of the Visa Infinite platform, there are likely minimum income requirements.

For example, in other countries that issue Visa Infinite cards, you’ll need to have an income of $60,000 per year to be considered for approval.

Chase will also likely want you to have a strong credit score. Because this will show Chase a measure based on your payment history, length of credit history, and new credit accounts.

Ultimately, Chase will review the facts of your credit application to determine whether or not you should be approved. So be honest on your application. And only apply if you think the card will help your travel goals!

Automatic Upgrades for Existing Chase Ritz-Carlton Cardholders

Existing Chase Ritz-Carlton cardholders will be upgraded to the new cards that are now part of the Visa Infinite program.

This is great news because you’ll have new benefits like:

- $100 discount on multi-passenger, domestic round-trip itineraries purchased through the Visa Infinite Discount Air Benefit – with no limit on the number of times you can use the discount

Folks report you can use your existing Chase Ritz-Carlton card number to use the $100 discount right away. You do NOT have to wait for a new card.

The best part is existing cardholders will continue to pay an annual fee of $395, which is lower than the new $450 annual fee.

If you’ve had this card previously and want to reapply to get the new bonus, you’ll have to wait 24 months from the date you originally received the bonus to be eligible.

Bottom Line

If you’ve had lots of new cards in the last 2 years, you may be eligible to get approved for the Chase Ritz-Carlton card. Because several sources report the card is not impacted by Chase’s stricter application rules.

Ultimately, Chase has the final say on your application. So I can’t promise you’ll automatically get approved.

Existing Chase Ritz-Carlton cardholders will be automatically upgraded to the new card on the Visa Infinite program. And you can begin using the Visa Infinite discounts right away.

I’d love to hear your experience applying for this card in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!