New 60,000 Point Bonus ($750+ of Big Travel) on Chase Ink Plus!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers.Good news! Via Frequent Miler, if you missed the better sign-up bonus on the Chase Ink Plus business card earlier this year, the increased 60,000 Chase Ultimate Rewards point bonus is back!

Normally, the bonus is 50,000 points after meeting minimum spending requirements. So this is a great deal!

Redeemed for travel through the Chase Ultimate Rewards travel portal, 60,000 points is worth $750! And you could get even more value, like expensive hotel stays or airline award tickets by transferring points to Chase Ultimate Rewards travel partners!

Emily and I don’t earn a commission from this card, but we’ll always tell you about the best offers!

What’s the Deal?

Link: Chase Ink Plus

Link: My Review of the Chase Ink Plus

Link: How to Fill Out a Chase Business Credit Card Application

You’ll earn 60,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the 1st 3 months of opening your account. And you’ll get:

- 5 points for every $1 you spend at office supply stores and cellular phone, landline, internet and cable TV (to a maximum of $50,000 in combined purchases per account anniversary year)

- 2 points for every $1 you spend at gas stations and on rooms booked directly with hotels

- No foreign transaction fees

- Chase Ultimate Rewards points (that never expire) and can be transferred to partner airlines and hotels or used for cash back

The annual fee of $95 is NOT waived for the 1st year. But it’s worth paying $95 for 60,000 Chase Ultimate Rewards points! I’ll explain!

Insider Tips for Applying for This Business Card

The Chase Ink Plus is a business card. But even if you don’t think you have a business, you can still apply. Many folks qualify for business cards even though they don’t realize it!

If you sell items online, teach lessons or provide childcare for others, have a blog, or have just started your business, you could be eligible.

You can apply as a sole proprietor using your Social Security Number. You’re NOT required to have a business EIN (Employer Identification Number) to qualify for the card.However, it can be tricky to apply for a Chase personal and business card on the same day. Business cards are harder to get, so I’d apply for the personal card 1st, then the Chase Ink Plus.

Note: If it’s been more than 24 months since you last received the sign-up bonus on the Chase Ink Plus card, you can get the bonus again.And you’ll get additional discounts through the Visa Savings Edge program.

What Can You Do With 60,000 Points?

Link: Chase Ultimate Rewards Transfer Partners

I love Chase Ultimate Rewards points because they’re easy to use and you can get LOTS of Big Travel with Small Money! Emily and I have used our Chase Ultimate Rewards points for trips to Paris, Maui, Kauai, Switzerland, Italy, and many more.

Chase Ultimate Rewards points are worth 1.25 cents each when redeemed for travel on the Chase Ultimate Rewards travel portal. So with 60,000 points, you could get $750 in travel!

It’s very easy to book flights this way because there are no blackout dates.

But in my experience, you’ll usually get more value from Chase Ultimate Rewards points when you transfer them to airline, hotel, and rail partners, like Hyatt, United Airlines, or Southwest.

For example, 60,000 Chase Ultimate Rewards points could get you:

- 2 coach round-trip award tickets to anywhere in the Mainland US and Canada on United Airlines (with 10,000 miles left over)

- A 1-way award ticket in Singapore Airlines First Class suites between New York and Frankfurt

- 2 nights at a top-tier Hyatt, like the Park Hyatt Paris – Vendome

That’s an amazing deal from just 1 credit card sign-up bonus!

And the Chase Ink Plus is of 1 of the 3 cards (Chase Sapphire Preferred and Chase Ink Bold are the others) that allow you to combine all your Chase Ultimate Rewards points together to transfer to partner airlines and hotels. Even points earned from the Chase Freedom and Chase Ink Business Cash Credit Card!

That makes the points you earn with the Chase Freedom and Chase Ink Cash card more valuable!

Is It Worth Paying the $95 Annual Fee?

The regular offer on this card is 50,000 Chase Ultimate Rewards points after meeting minimum spending requirements, with the $95 annual fee waived for the 1st year. With the 60,000 point increased bonus, the annual fee is NOT waived.

But I’d happily pay $95 for an additional 10,000 Chase Ultimate Rewards points. That’s because 10,000 points is worth at least $125 (at 1.25 cents per point) when redeemed for travel, and potentially more when transferred to airline and hotel partners!

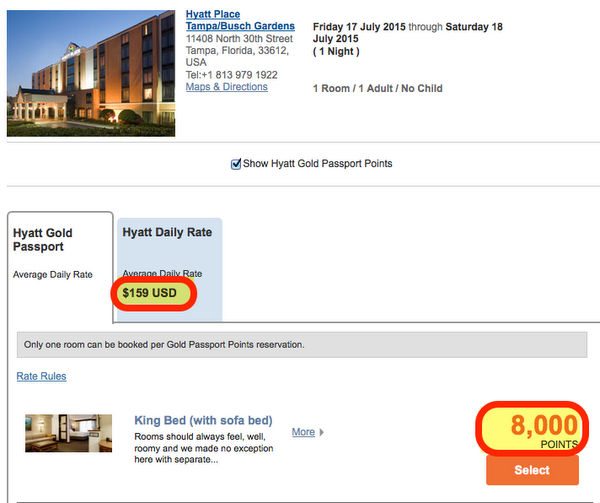

For example, you could get a night at the Hyatt Place Tampa/Busch Gardens for 8,000 Hyatt points per night (transferred from Chase Ultimate Rewards). A paid stay could cost $159 plus taxes (~$178).

Or you could transfer 9,000 Chase Ultimate Rewards points to British Airways and have enough British Airways Avios points for a short-haul, round-trip coach ticket on American Airlines or Alaska Airlines. Sometimes these tickets are worth $300 or more!

That said, some folks report the annual fee IS waived for the 1st year when you apply for the card in person at a Chase branch.

Bottom Line

For a limited time, the sign-up bonus on the Chase Ink Plus card has increased to 60,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the 1st 3 months of opening your account.

The points are worth $600 for cash back, $750 in travel through the Chase Ultimate Rewards travel portal, or even more when you transfer them to airline, hotel, and rail partners for flights and luxury hotel rooms.

We don’t earn a commission on this card offer, but we’ll always tell you about the best deals!

What’s your favorite way to use Chase Ultimate Rewards points?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!