Are You Missing Out on Free Travel? 5 Reasons to Start a Small Business Right Now

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Several of our team members know a powerful way to earn tons more points for award travel. We started our own small businesses. And you can, too!

It’s fast and easy. As long as you aim to earn a profit, even a small one, you can qualify to earn 1,000s of extra miles and points with the best business credit cards, like the Ink Business Preferred Credit Card. It’s got an intro bonus worth at least $1,000 in travel after meeting minimum spending requirements!

And you can apply with your social security number as a sole proprietor. There are no forms or registration to deal with.

Simply pick a skill and start doing it. Why wait?

I’ll share why you should start a small business immediately!

5 Ways You Can Benefit From Starting a Small Business

I’ve done it with freelance writing and opening Airbnb locations. Joseph started a resume service. Jasmin and Keith resell products. And Meghan is busy building rental properties.

All of these activities qualify us for small business cards, because we earn profits. Some folks call these “side hustles.”

Other qualifying activities include tutoring, coaching, taking photographs, selling real estate, and so much more. Anything you do that earns extra cash is enough to submit an application.

If you have a skill you can monetize, you can make a small business out of it. Do you sell soaps and hand knits online? Drive for a rideshare? Deliver groceries? Those are small businesses, too!

You don’t need to make millions in revenue. But banks do want you to try to turn profits.

You can apply using your social security number as a sole proprietor, so you don’t have to be part of a huge corporation.

Here are 5 good reasons to make a business out your skills.

1. Earn More Welcome Bonuses

Link: Best Business Credit Cards

How does $1,000 toward travel sound? That’s exactly what the 80,000 Chase Ultimate Rewards points you’ll earn with the Ink Business Preferred℠ Credit Card bonus are worth, after you meet the minimum spending requirements.

Lots of small business cards have excellent welcome offers including:

- Ink Business Preferred℠ Credit Card – 80,000 Chase Ultimate Rewards points (worth $1,000 toward travel) after you spend $5,000 on purchases in the first 3 months from account opening

- Ink Business Unlimited℠ Credit Card – 50,000 Chase Ultimate Rewards points (worth $500 cash) after you spend $3,000 on purchases in the first 3 months

- CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® – 70,000 American Airlines miles after making $4,000 in purchases within the first 4 months of account opening

- The Hilton Honors American Express Business Card – 125,000 Hilton points after spending $3,000 in purchases in the first 3 months

The information for the CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Even better, small business cards issued by AMEX, Bank of America, Barclays, Chase, and Citi do NOT appear on your personal credit report. That means they won’t count against Chase’s stricter application rules! Focusing on small business cards is a strategy many of us adopted to open more Chase cards.

But to open any small business card, you need a small business (of course).

Being able to earn more welcome bonuses is a huge reason to start one!

2. Make the Most of Excellent Bonus Categories

Many small business cards have expanded bonus categories outside of what you’ll find on personal credit cards.

For example, the Ink Business Preferred℠ Credit Card earns 3X Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year). Aside from travel, you won’t find bonus points for these categories on personal cards!

And the Ink Business Cash℠ Credit Card earns 5X Chase Ultimate Rewards points (5% cash back) on the first $25,000 spent on combined purchases at office supply stores and on cellular phone, landline, internet, and cable TV services each account anniversary. All of these categories are unique to small business cards.

And they’re tailored for small business spending. So if you ship a lot for your reselling, for example, you might go for a card with shipping as a bonus category.

Or if you advertise on social media, a card with advertising as a bonus category would be appropriate. And so on.

In this way, you can rack up extra points for spending where you wouldn’t ordinarily earn bonus points. That’s another cool perk about small business cards!

3. Get Additional Discounts on Spending

Link: Visa SavingsEdge

Link: Mastercard Easy Savings

If you open a Visa or MasterCard small business card, you can sign-up for Visa SavingsEdge or Mastercard Easy Savings. These programs give you automatic statement credits after you register your card and spend at certain merchants.

And if you open an AMEX card, be sure to check your AMEX Offers. Sometimes these offers are unique to small business cards, like statement credits for advertising, or discounts on shipping.

Having access to more ways to save is another great benefit to opening a small business credit card.

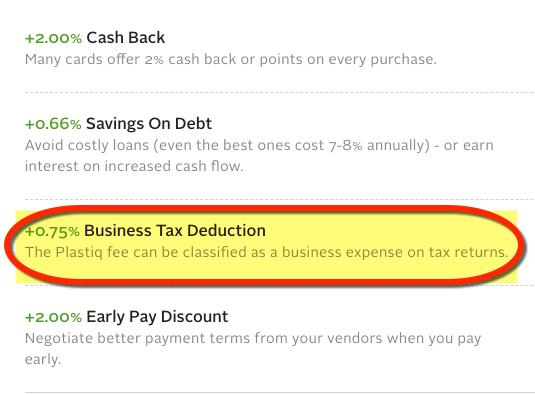

4. Tax Write-Offs for Business Service Fees

If you use your small business card to pay bills, and find there’s a service fee, be sure to write it off on your taxes!

For example, Plastiq has a 2.5% fee when you pay ordinary bills like taxes, contractors, insurance, and much more. But when you use a small business card, you can itemize the expense on your taxes.

Plus, you’ll earn points on your payments. And because these transactions count as a purchase, they’ll also count toward your minimum spending requirements. That’s a win-win-win!

5. Easy Way to Keep Points Flowing

This is perhaps the biggest reason to get a small business card. If you have legitimate business spending, you can easily earn 1,000s of extra miles or points each month. Over the course of a year, that can add up big time!

I use Plastiq to pay rent for my Airbnb properties, which are a few $1,000 per month. All that spending nets me an extra award trip once or twice a year!

Plus, small businesses can grow – and that can mean extra cash in your pocket! As you scale your business, you’ll spend and make more.

More money and points. What’s not to love?

Bottom Line

Lots of us on the Million Mile Secrets team use small business cards to:

- Earn huge welcome bonuses, like 80,000 Chase Ultimate Rewards points after meeting the minimum spending on the Ink Business Preferred℠ Credit Card (worth $1,000 toward travel)

- Access more bonus categories, like shipping, advertising, and cell & internet service

- Get more discounts on everyday spending

- Claim tax write-offs for small business service fees, like those made with Plastiq

- Keep points rolling in throughout the year!

Even better, certain activities you might already do can qualify you to apply for small business cards. If you apply as a sole proprietor, you can use your social security number on your application. And that can be your ticket to lots of extra miles & points!

Don’t have a small business yet? Why not start one today?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!