Targeted: Earn Bonus Miles and Points With Your Barclaycard Credit Cards!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Have a Barclaycard credit card like the Arrival Plus, American Airlines Aviator, or JetBlue Plus card? Check your email, spam, and snail mail!

Via Doctor of Credit, folks have reported getting targeted spending bonuses, in categories like gas stations, restaurants, home improvement stores, and more. Two Million Mile Secrets team members received offers too!

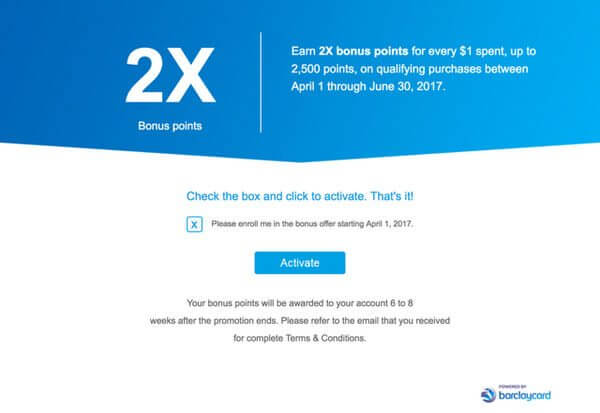

To qualify, you must activate the bonus by May 31, 2017. Spending between April 1, 2017, and June 30, 2017, will count towards the bonus. And you can earn a maximum of 2,500 points or miles with the deal.

I’ll share more about these targeted offers. And help you decide whether they make sense for you!

Barclaycard Spending Bonus

Some folks can earn a spending bonus for using Barclaycard cards, like the JetBlue Plus and Arrival Plus, for purchases in certain bonus categories, between April 1, 2017, and June 30, 2017. So check your email and snail mail to see if you’ve been targeted!

To qualify, you must register your targeted card by May 31, 2017. The maximum number of points or miles you can earn is 2,500.

Million Mile Secrets team member Keith was targeted to earn 2X JetBlue points for every $1 spent at gas stations, home improvement stores, and department stores, with his Barclaycard JetBlue Plus card.

And Jasmin was offered 2X Choice points for ever $1 spent with her Barclaycard Choice Privileges card at grocery stores, home improvement stores, and restaurants.

Other folks have reported getting targeted offers like:

- 2X bonus Barclaycard Arrival miles for spending at gas stations, department stores, and home improvement stores with the Barclaycard Arrival Plus World Elite Mastercard

- 2X bonus Hawaiian Airlines miles on purchases at restaurants, grocery stores, and home improvement stores with the Barclaycard Hawaiian Airlines card

- 2X bonus Wyndham points at grocery stores, home improvement stores, and restaurants with the Barclaycard Wyndham Rewards card

- …and more!

Is It Worth It?

This isn’t a very exciting deal, because the maximum number of points or miles you can earn is 2,500. But if you don’t have other cards that earn more, and you’re spending in those bonus categories anyway, it’s worth registering. Because activating the bonus only takes a few seconds, and a small bonus is better than nothing!But don’t forget, cards like the Chase Freedom also offer bonuses on rotating categories, that are a better deal than these Barclaycard offers. And cards like the Chase Sapphire Reserve offer 3X Chase Ultimate Rewards points at restaurants year-round.

For example, between April 1, 2017, and June 30, 2017, you can earn 5X Chase Ultimate Rewards points (5% cash back) when you register and use your Chase Freedom card at grocery stores (and drug stores!) on up to $1,500 in combined spending.

If you spend the $1,500 maximum in bonus categories, you’ll earn 7,500 Chase Ultimate Rewards points ($75).

I’d much rather earn bonus Ultimate Rewards points than Choice hotel points! But it’s up to you to decide what’s best for your particular travel goals.Bottom Line

Check your email to see if you’ve been targeted for a bonus spending offer from Barclaycard, with cards like the Arrival Plus, JetBlue Plus, Choice Privileges, and more.

If so, you can earn bonus points or miles for purchases in certain bonus categories between April 1, 2017, and June 30, 2017. But you must activate the bonus by May 31, 2017.

Were you targeted? Tell me about your offer in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!