Why You Should Take a Screenshot When You Apply for New Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Jack, commented:

My wife applied for the Citi AAdvantage Platinum Select World Elite Mastercard. She was approved and completed the minimum spending requirements to earn the sign-up bonus. But after inquiring with Citi, the bank claims there is no record of her applying for an offer with a sign-up bonus. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.They want proof of the offer and we do not have any. Any suggestions?

Jack’s wife’s situation is one of the most frustrating situations readers ask about.

Folks see an offer to earn a terrific sign-up bonus, like 50,000 airline miles or free hotel nights. Then, they apply to find out they used an outdated link. Or the bank can’t find records of the offer.

Everyone makes mistakes, including the banks. That’s why it’s important to keep records and take screenshots of credit card offers during the application process.

I’ll show you simple ways you can screenshot an offer page.

Why Take Screenshots of Credit Card Offers

Link: Credit Card Resources

Banks constantly update credit card offers. This includes:

- Limited-time sign-up bonuses

- Targeted offers

- Adding or removing card benefits

- Updating specific terms and conditions

With deals changing so frequently, it’s easy to see how banks might not always have their application records correct 100% of the time. We’re all human! But if you’re approved for an offer, the bank should honor the terms under which you applied.

That’s why it’s important to keep your own records.

My simple suggestion is to take a screenshot of the credit card application landing page. It’s easy to capture the information on your screen. And it only takes a few seconds.

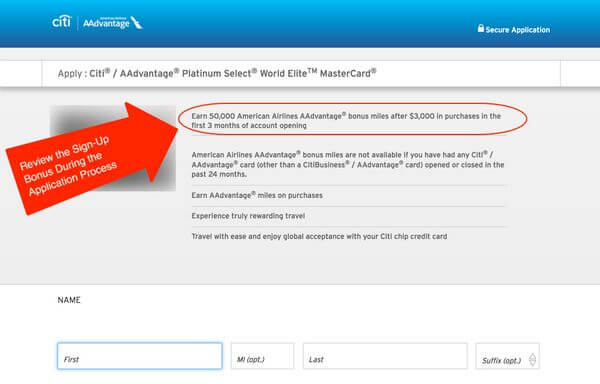

For example, Jack’s wife applied for the Citi® / AAdvantage® Platinum Select World Elite™ Mastercard® .

The current card application page shows you can earn 50,000 American Airlines miles after spending $3,000 on purchases within the first 3 months of account opening. Take a screenshot of this page the moment you apply.

Besides the sign-up bonus, you can also use screenshots to capture other information like:

- Restrictions on sign-up bonuses for previous cardholders

- Special conditions (i.e. tiered minimum spending requirements)

And saved screenshot files will have the date and time. This means you can use it as a reference for the time you have to complete minimum spending requirements.

How to Take a Screenshot

If you’re using a Mac, hit Command + Shift + 3 on your keyboard at the same time. This will automatically save a picture of the current screen to your desktop.

If you have Windows, hit the Print Screen key on your keyboard. This will capture whatever is on your entire screen. But there’s one more step.

Open a program like Paint and paste in the picture. Then, save the image for your records.

If you’re using a Mac or Windows, you can also use browser add-ins to capture what’s on the screen. For example, there’s a free program called Awesome Screenshot that works with Google Chrome.

Screenshots are the easiest way to record the terms of an offer. But you can also consider printing the offer page. Or even take a photo of the screen with your phone to keep for your records. Anything is better than nothing.

Most of the time, you’ll forget you have screenshot images saved on your computer. That’s fine!

But if and when the time comes for you to produce a copy of an offer to the bank, you’ll be ready!

Bottom Line

As part of the credit card application process, I always recommend taking a screenshot of the application page.

Because you’ll have important information saved for your records, like the sign-up bonus offer, minimum spending requirements, and special terms and conditions.

Although unlikely, it’s possible you might need to send the bank the offer page in the future to make sure you get the rewards you applied for. So it’s worth the few seconds it takes to take a screenshot.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!