Up to $1,000 in Flights With This No Annual Fee Card!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.There’s a no-annual-fee credit card with a generous sign-up bonus. And it’s not getting much attention!

Via Doctor of Credit, the Merrill Lynch Merrill+ Visa is offering a sign-up bonus of 50,000 Merrill points. That’s worth between $500 and $1,000, depending on how you use them!

Emily and I don’t earn commission on this card, but we’ll always tell you about the best deals we’re aware of!

I’ll tell you about this card, and show you how to maximize its rewards!

Merrill+ Visa Signature Card

Link: Merrill+ Visa Signature Card

Link: Merrill+ Benefits Guide

The Merrill+ Visa has been flying under the radar for a while now. And it’s worth a look!

With this card, you’ll get:

- 50,000 points when you spend $3,000 on purchases within the first 90 days of account opening (up to $1,000 in travel!)

- 1 point per $1 on all purchases

- Points never expire

- Your choice of free Delta Sky Club lounge membership or $200 credit for travel incidentals (including Global Entry) after spending $50,000+ in 1 year

- No foreign transaction fees

- No annual fee

In the past, it’s been hard to get approved for Merrill Lynch cards if you don’t already have a banking relationship with them. But that’s changed!

Most folks seem to get the “Unable to give you a decision at this time” message when they apply, but are approved later. There are other data points of folks approved without being previous Merrill Lynch customers on Doctor of Credit’s site.

Also, the Terms & Conditions say:

Limit one (1) bonus points offer per new account. This one-time promotion is limited to new customers opening an account in response to this offer.

So if you’ve had this card in the past, you might not get the sign-up bonus again. Let me know in the comments if you do!

Here’s why you should consider signing-up for this card:

1. You Can Receive Huge Value From the Sign-Up Bonus

The value of your points depends on what you redeem them for. You’ll get:

- 2 cents per point when booking flights on American Airlines, British Airways, Delta, and United Airlines. But there are conditions (I’ll explain!)

- 1.67 cents per point on all other airlines (conditions here, too)

- 1 cent per point when you redeem for cash back

- Generally 1 cent per point when you redeem for gift cards (redemption value varies)

If you want to use your points for flights, you’ll need to redeem at least 25,000 points. For 25,000 points, you can buy any ticket between $0 and $500. So to get maximum value, you’d need to find a ticket that’s EXACTLY $500.

If the ticket is over $500, you’ll get a value of 1 cent per point (in increments of 2,500) towards your ticket. So:

- If your ticket costs $150 you will pay 25,000 points

- If your ticket costs $500 you will pay 25,000 points

- If your ticket costs $501 you will pay 27,500 points

- If your ticket costs $525 you will pay 27,500 points

When you run out of points, you’ll pay the remainder of your bill with your card.

So if you have a $1,000 round-trip ticket, consider buying 2 one-way tickets to get more value for your points.

With other airlines, you can redeem 30,000 points for up to $500 in flights.

2. You Don’t Have to Search for Award Flights to Use Points

You’ll usually get the most value from miles & points by booking award flights. The downside is you’re restricted by available award seats!

When you book flights with Merrill points, you can book any seat available on any plane at any time. Because redeeming your points counts as a paid ticket, not an award flight.

You’ll even earn award miles for your flight!

3. Everyone Should Have a No-Annual-Fee Credit Card

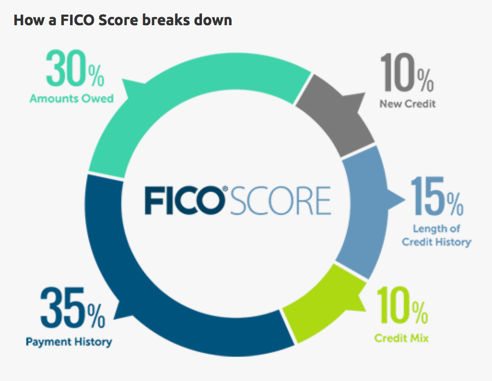

Everyone should have a no-annual-fee credit card. That’s because 15% of your credit score is determined by the Length of Credit History.

So it helps to have a credit card with no-annual fee which you keep for a very long time, because it helps increase the average age of your credit accounts. This is especially important if you apply for & cancel cards frequently.

4. Folks Who Have Exceeded Strict Bank Application Rules Can Get This Card!

The Merrill+ card is issued by Bank of America. And that’s good news for most of us in the miles & points hobby!

Most of us have a lot of credit cards issued by Chase, Citi, and AMEX. So when I see a good travel card issued by another bank, I get very excited!

That’s because Chase has strict application rules. If you’ve opened 5 or more credit card accounts (from any bank) in the past 24 months, it’s VERY UNLIKELY Chase will approve you for some of their cards.

American Express restricts sign-up bonuses on all cards to once per lifetime. So if you’ve had a certain AMEX card’s sign-up bonus before, you’ll never get it again!

And Citi is tightening their rules, too! They are now restricting folks from earning the sign-up bonus from more than one card of the same “brand” within 24 months.

Mostly a Sock Drawer Card

While you can get a solid value from the Merrill+ sign-up bonus, it’s not really worth using afterwards.

That’s because the maximum value you’ll get from each point is 2 cents. There are other no-annual-fee credit cards that give you an equal or better return for everyday spending.

For example, the Citi Double Cash Card earns earn 1% cash back on all your purchases AND another 1% cash back on payments, as long as you meet the minimum spending each month.

That return is as good as the maximum possible value you’ll earn for spending on the Merrill+ card. And the Citi Double Cash earns cash, so you can use the rewards for things other than travel!

Bottom Line

The Merrill+ card is an excellent no-annual-fee credit card option! With a sign-up bonus worth between $500 and $1,000, and no foreign transaction fees, this card is worth a look!

You’ll receive:

- 2 cents per point when booking flights on American Airlines, British Airways, Delta, and United Airlines (conditions apply!)

- 1.67 cents per point on all other airlines (conditions apply!)

- 1 cent per point when you redeem for cash back

- Generally 1 cent per point when you redeem for gift cards (redemption value varies)

You do not need to have a banking relationship with Merrill Lynch to get this card.

Emily and I don’t get a commission for this credit card, but we’ll ALWAYS tell you the best deals!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!