Warning: Some Plastiq Payments Coding as a Cash Advance!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Via Doctor of Credit and folks on Reddit, certain Plastiq payments are coding as a cash advance when you use a Visa credit card.

This is not good! Because cash advances do NOT count toward minimum spending requirements. And they usually come with high fees and interest charges.

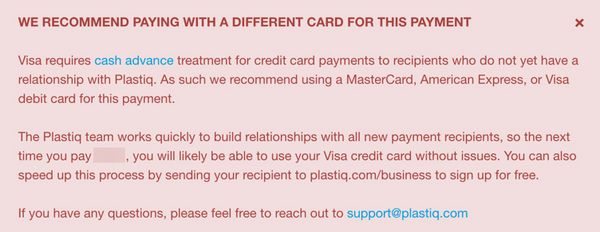

But Plastiq is notifying folks of the potential issue before you confirm your payment method. If you see the warning, I’d recommend using a different card or an alternative service.

I’ll explain how you can avoid cash advances and how you can still use Plastiq!

Cash Advance Issues With Plastiq

Link: Doctor of Credit

Link: Reddit

Folks use Plastiq to pay rent, mortgages, and bills with a credit card. These charges usually code as a regular purchase.

Depending on the fees, Plastiq can be a good way to meet minimum spending requirements or earn extra miles, points, or cash back.

But now Plastiq is warning folks that certain payments could code as a cash advance on Visa credit cards. And some folks on Reddit have already seen cash advance charges with cards like the Chase Sapphire Reserve.

I always recommend calling your credit card company and requesting your cash advance limit be set to zero (or close to zero). This way any potential cash advance transactions will get declined.

If you’d like to continue using Plastiq, it’s probably best to use a MasterCard or AMEX card. Plus, Plastiq is offering a limited-time promotion with lower credit card fees when you use these cards.

Or folks who pay rent with Plastiq might hold off until Cozy Pay launches. But this new service might have higher fees.

Bottom Line

Certain Plastiq payments are coding as a cash advance when you use a Visa credit card.These transactions do NOT earn miles and points or count toward minimum spending requirements. And they also come with fees and interest charges.

I’d recommend contacting your credit card company to set your cash advance limit to zero. This should avoid any potential issues.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!