How Chase Private Client Helps Get the Sapphire Reserve

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Have I mentioned how excited I am about the amazing 100,000 point sign-up bonus on the Chase Sapphire Reserve card? 🙂

But I know some folks are disappointed this card is impacted by Chase’s “5/24 rule.” Because many people in the miles and points hobby apply for new credit cards every few months. So they’re not able to take advantage of this new offer.

That’s why I wanted to tell you how becoming a Chase Private Client could help you bypass Chase’s tougher application rules. Million Mile Secrets team member Keith used this method to get approved for the Sapphire Reserve because he’s had more than 10 new cards in the past 24 months.

The Chase Private Client program might not be for everybody, but I’ll explain how it works!

What Is the Chase Private Client Program?

Link: Chase Private Client

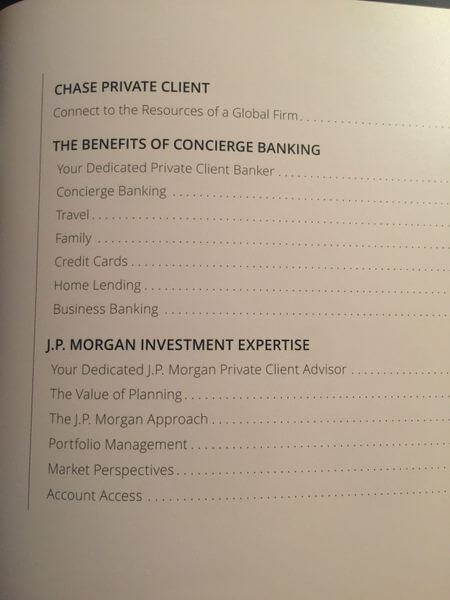

Chase Private Clients have access to special perks with Chase like:

- Competitive mortgage rates when you buy a home

- Higher ATM withdrawal limits

- Investment and financial planning advice through J.P. Morgan

- No fees for certain banking services like checking and savings accounts, money orders, or stop payments

- Travel benefits like no ATM fees when traveling abroad

To become a Private Client you’ll usually need to bring a total of $250,000 in assets to Chase. This can include checking, savings, investment, and retirement accounts.

Upgrade Your Chase Account

I talked with a Chase banker who said existing Chase customers can upgrade their accounts to Private Client status if they have $100,000 in deposits at Chase. There’s no promise this works at every branch. But it might be worth asking your banker if you’re already an existing customer.

There are no monthly or annual account fees if you just use the Chase Private Client banking program and maintain certain account balances. You’ll just get a designation on your account and a special ATM card.

To find out if you qualify for the Private Client program, you can contact Chase or visit a local Chase branch.

Bypass Chase’s Tougher Application Rules With Private Client Designation

Doctor of Credit and folks on Reddit have discussed how being a Chase Private Client can help folks get approved for Chase cards even if they’ve had lots of new credit cards in the past 24 months.Million Mile Secrets team member Keith is a Chase Private Client. And this week it helped him get approved for the Chase Sapphire Reserve.

He applied for the card in a local Chase branch and the application was declined. His Chase banker called the Chase reconsideration line who said his application was declined because he’s had too many new credit cards in the past 24 months. According to Keith, he’s had more than 10 new cards.

It’s been tougher to be approved for most Chase cards, including the new Sapphire Reserve card if you’ve opened ~5+ cards from any bank (except these business cards) in the past 24 months. Chase hasn’t announced an official rule. But many refer to it as the “5/24 rule.”

But the Chase banker told the reconsideration representative that Keith is a Private Client with Chase. After Keith agreed to move credit limits from existing Chase cards, he was approved!

Keep in mind, being a Chase Private Client doesn’t guarantee automatic approval for every Chase card.

Chase Private Client Sapphire Reserve – Worth it?

I don’t offer financial or investment advice, so you’ll have to see if the benefits of the Chase Private Client program make sense for your personal situation.

But if you’re already an existing Chase customer, you might want to inquire to see if you qualify. Because there are no fees for certain parts of the program. And the special Private Client designation might help you get the 100,000 Chase Ultimate Rewards point sign-up bonus with the Chase Sapphire Reserve card!

Bottom Line

It’s possible to bypass the Chase “5/24 rule” if you’re a Chase Private Client. To be eligible for the program, you’ll need $250,000 in combined assets at Chase, which can include savings, checking, investment, and retirement accounts.

Being a Chase Private Client could make it easier to get the incredible 100,000 point sign-up bonus on the Chase Sapphire Reserve card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!