How to Check If You Can Spend Above Your Credit Limit With Your AMEX Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Did you know you may be able to spend above your credit limit on your American Express card?

It’s useful for folks who want to make a large purchase that exceeds their credit limit.

Also, if you’re using a card that earns rewards (like cash back, miles, or points), you’ll earn rewards on the entire purchase amount too. And you will NOT be charged any fees for exceeding your credit limit.

Check the Spending Power of Your AMEX Card

Want to make a purchase that exceeds the credit limit on your AMEX card? Check your spending power to avoid the embarrassment of having your card declined!

For example, say you have 3 or 4 AMEX cards and one of them has a relatively small $3,000 credit line. But that’s the card you want to use to earn rewards for a particular purchase.

If you’re approved for more spending power on your rewards earning card, you will not need to split transactions between cards. Plus you’ll earn rewards for your entire purchase!

Just check your AMEX card’s spending power to see if your charge would be approved.

Here’s how:

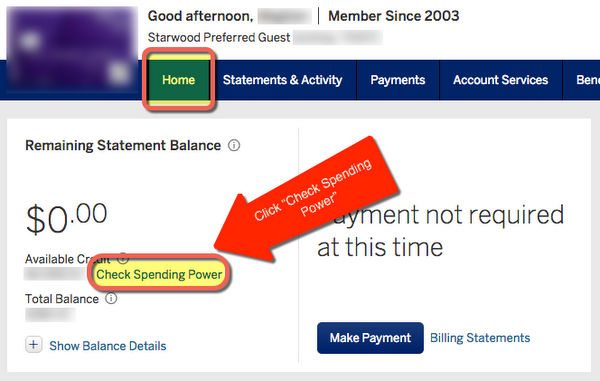

Log-in to your AMEX account and click “Check Spending Power”, located on the home page next to your available credit amount.

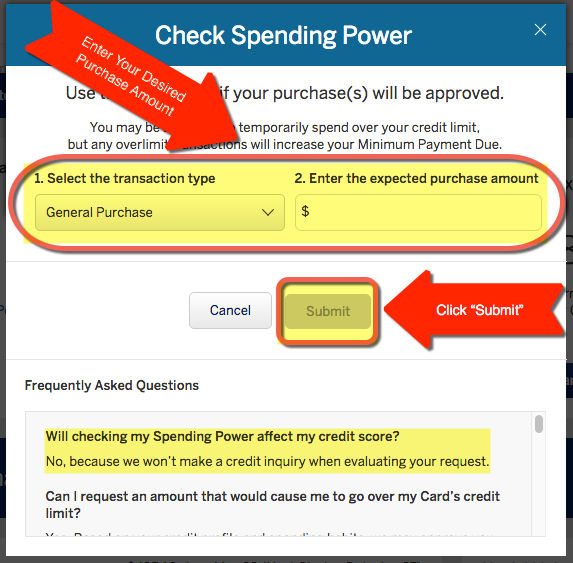

Then enter your expected purchase amount and select the transaction type, either a “general purchase” or “cash.”

A “cash” purchase refers to a cash advance. So most of the time you’ll likely be considering a “general purchase.”

Once you click the “Submit” button, you’ll see a new screen showing how much (if any) above you’re credit limit you’ve been approved for.

A friend of mine checked her Starwood Preferred Guest Credit Card from American Express and was approved to spend ~$4,000 over her existing credit limit.

It’s also worth noting that checking your spending power will NOT affect your credit score. But you can only check it 3 times per day.

Just remember, if you spend any amount over your credit limit, the minimum payment due on your card WILL go up.

However, I always suggest paying your credit card off in full each billing cycle. Because interest charges will likely negate any rewards you’re earning.

And with AMEX charge cards like The Platinum Card® from American Express Exclusively for Mercedes-Benz, AMEX Platinum, and Premier Rewards Gold Card from American Express, you have to pay your balance in full each month.

Who Should NOT Use the Check Spending Power Tool

The Check Spending Power tool is NOT for folks who don’t have the money to pay for their purchases. Or anyone who isn’t absolutely certain they can pay their credit card bills on time. Taking on more bills than you can afford will hurt your credit. And we want you to improve your credit so you can get more Big Travel with Small Money!Small Businesses

If you qualify for a small business card, you can use the SimplyCash® Plus Business Credit Card from American Express card to grow your business using the Check Spending Power tool. You can read my full review of the card here.

Bottom Line

To make a purchase with your AMEX card that exceeds your credit limit, you can use the “Check Spending Power” tool.

And if you’re using a card that earns cash back, miles, or points, you’ll earn rewards on your entire purchase amount!

You will NOT be charged for exceeding your credit limit. But remember, your minimum payment WILL go up.

With AMEX charge cards, like the AMEX Platinum or AMEX Premier Rewards Gold, you must pay your balance in full each month.

But I always recommend paying your credit cards off in full every month! Because any interest that accrues will negate the rewards you’re earning.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!